Get the free IDBI Tax Saving Fund - sebi gov

Show details

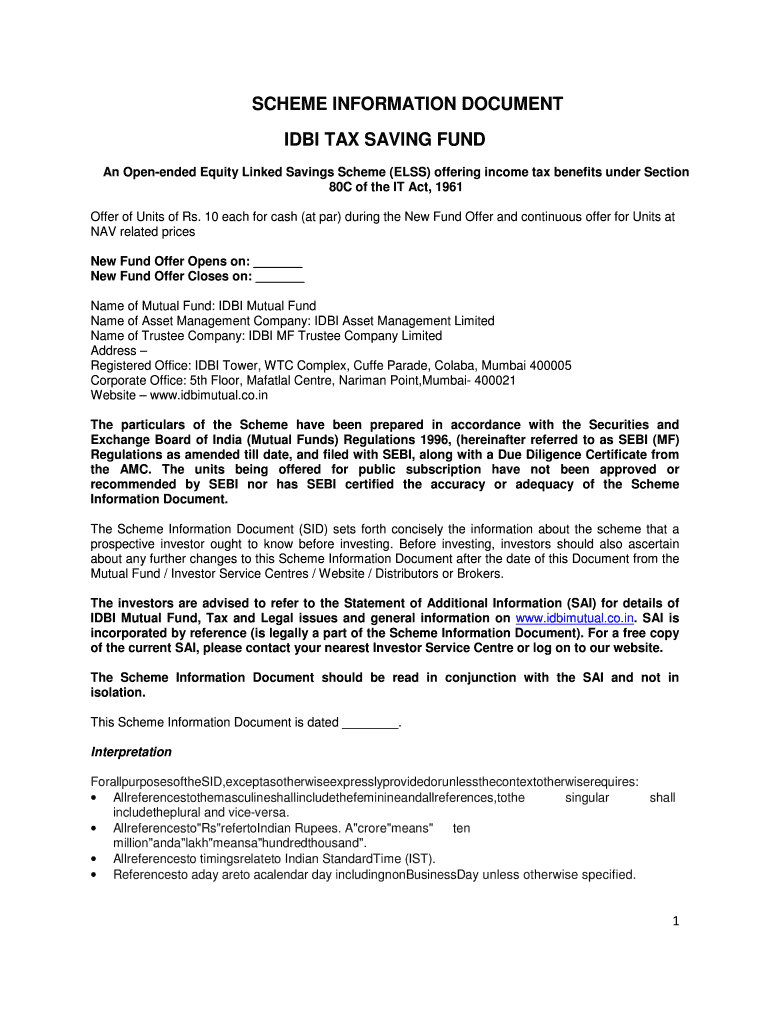

Document providing details about the IDBI Tax Saving Fund, an open-ended Equity Linked Savings Scheme (ELSS) offering income tax benefits under Section 80C of the IT Act, 1961.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign idbi tax saving fund

Edit your idbi tax saving fund form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your idbi tax saving fund form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit idbi tax saving fund online

To use our professional PDF editor, follow these steps:

1

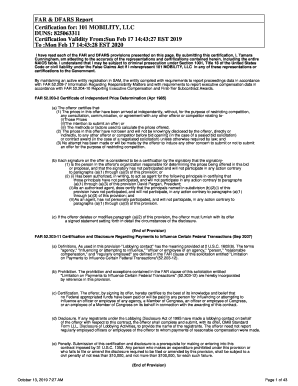

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit idbi tax saving fund. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out idbi tax saving fund

How to fill out IDBI Tax Saving Fund

01

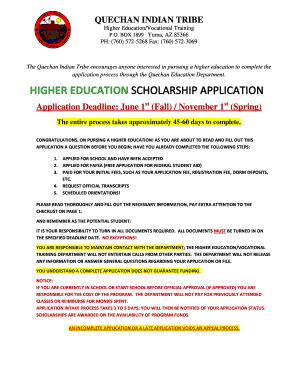

Visit the IDBI Mutual Fund website or a registered financial advisor.

02

Select the IDBI Tax Saving Fund from the list of available funds.

03

Read the fund details, including its investment objectives and risk factors.

04

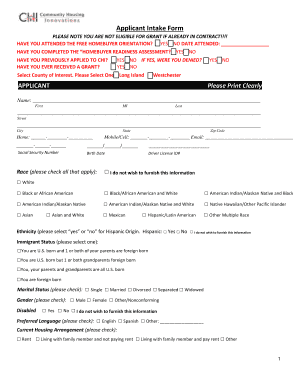

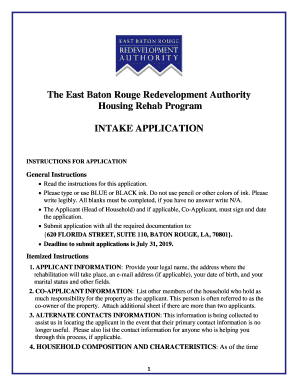

Fill out the online application form or use a physical form if preferred.

05

Provide necessary personal information, including PAN, Aadhaar details, and bank account information.

06

Choose your investment amount within the prescribed limits for tax-saving.

07

Submit the application form along with the necessary documents for KYC verification.

08

Complete the payment process through online transfer, cheque, or demand draft.

09

Receive confirmation of your investment and keep track of your portfolio.

Who needs IDBI Tax Saving Fund?

01

Individuals looking for tax-saving investment options under Section 80C of the Income Tax Act.

02

Investors seeking long-term capital appreciation along with tax benefits.

03

Taxpayers with a taxable income who want to reduce their tax liability.

04

People aiming to invest in equity markets with a lock-in period of three years.

Fill

form

: Try Risk Free

People Also Ask about

What is the interest rate for SCSS for senior citizens in 2025?

Senior Citizen Savings Scheme offers 8.2% interest rate in 2025, tax benefits, flexible withdrawals, and a 5-year tenure, ensuring secure returns. The Senior Citizen Savings Scheme (SCSS) is primarily for the senior citizens of India.

What is the interest rate of SCSS in IDBI Bank?

IDBI Bank's Senior Citizens Savings Scheme (SCSS) offers a competitive interest rate of 8.20% per annum. This scheme is available to individuals aged 60 and above, retirees between 55 and 60 who have opted for the Voluntary Retirement Scheme (VRS), and retired defence personnel aged 50 and above.

What is a tax saving fund?

What are ELSS Funds. ELSS funds are equity funds that invest a major portion of their corpus into equity or equity-related instruments. ELSS funds are also called tax saving schemes since they offer tax exemption of up to Rs. 150,000 from your annual taxable income under Section 80C of the Income Tax Act.

What is the interest rate for IDBI tax saver FD?

IDBI Bank offers FD interest rates of 3.00-6.75% p.a. to the general public and 3.50-7.25% p.a. to senior citizens on tenures ranging from 7 days to 20 years. The interest rate on IDBI Bank Tax Saving FDs is 6.25% p.a. for the general public and 6.75% p.a. for senior citizen depositors for tenures of 5 years.

What is the current IDBI savings account interest rate?

IDBI Saving Account Interest Rate BalancesIDBI Bank Savings Account Interest Rate Up to Rs. 5 crores 3.00% p.a. More than Rs. 5 crores and less than Rs. 100 crores 3.25% p.a. More than Rs. 100 crores 3.50% p.a.

What is the interest rate for SCSS in IDBI Bank?

Senior Citizens Savings Scheme (SCSS) Rate of Interest 8.20% per annum#* or Retirees who have opted for the Voluntary Retirement Scheme (VRS) or Superannuation aged between 55-60.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is IDBI Tax Saving Fund?

IDBI Tax Saving Fund is an equity-linked savings scheme (ELSS) offered by IDBI Asset Management. It provides investors with the opportunity to save on taxes while investing in a diversified portfolio of equity and equity-related instruments.

Who is required to file IDBI Tax Saving Fund?

Individuals and Hindu Undivided Families (HUFs) who wish to claim tax deductions under Section 80C of the Income Tax Act are required to file IDBI Tax Saving Fund investments when filing their income tax returns.

How to fill out IDBI Tax Saving Fund?

To fill out IDBI Tax Saving Fund, investors must complete the application form provided by IDBI, provide necessary KYC documents, and submit it along with the investment amount. They can also invest online through the IDBI website or through authorized agents.

What is the purpose of IDBI Tax Saving Fund?

The purpose of IDBI Tax Saving Fund is to provide tax benefits to investors while allowing them to grow their wealth through exposure to the equity markets, thus encouraging long-term savings and investments.

What information must be reported on IDBI Tax Saving Fund?

Investors must report details such as the amount invested, the fund's name, the investment date, and documentation that proves the date of investment to avail tax deductions under Section 80C.

Fill out your idbi tax saving fund online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Idbi Tax Saving Fund is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.