Get the free RGESS - sebi gov

Show details

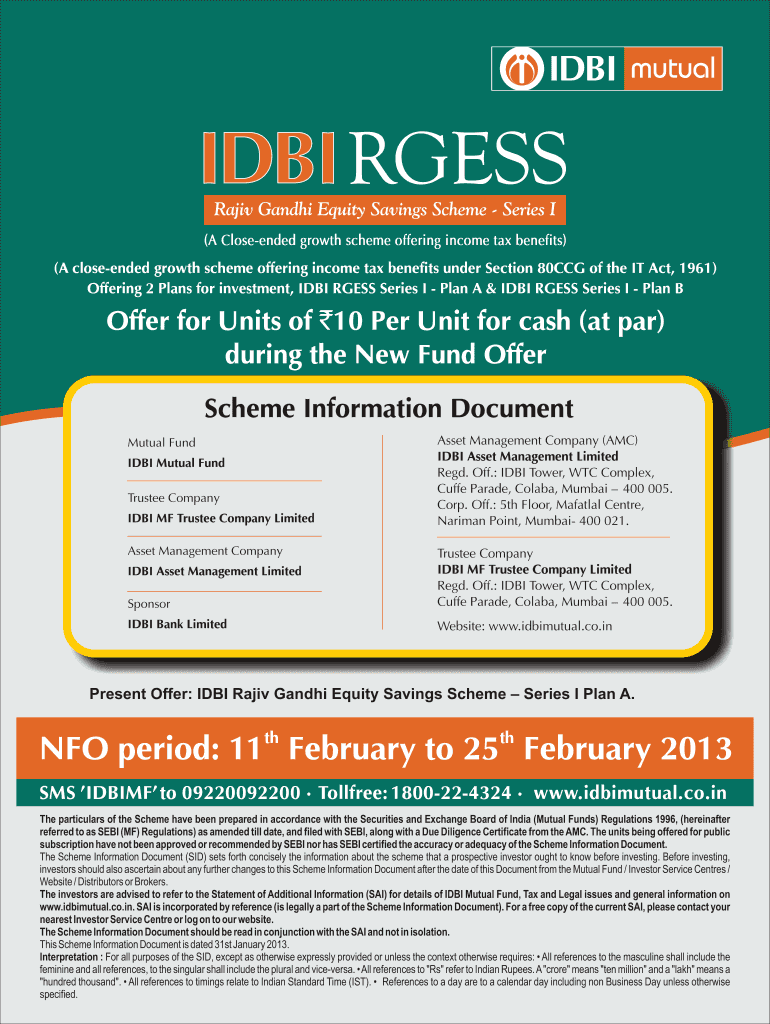

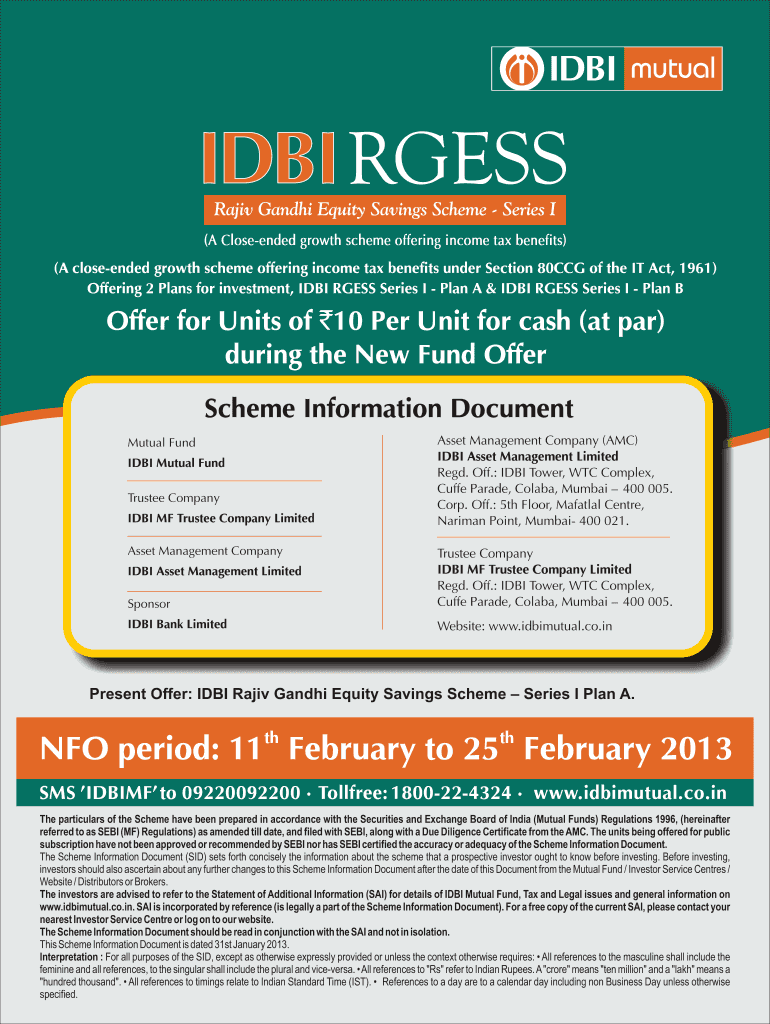

A close-ended growth scheme offering income tax benefits under Section 80CCG of the IT Act, 1961, with two plans for investment: Plan A and Plan B.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign rgess - sebi gov

Edit your rgess - sebi gov form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your rgess - sebi gov form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit rgess - sebi gov online

In order to make advantage of the professional PDF editor, follow these steps:

1

Log in to your account. Click Start Free Trial and sign up a profile if you don't have one yet.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit rgess - sebi gov. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out rgess - sebi gov

How to fill out RGESS

01

Obtain the necessary documents, including your PAN and income proofs.

02

Visit the official website of the RGESS and create an account.

03

Fill out the online application form with accurate personal and financial details.

04

Choose eligible investments that qualify for RGESS.

05

Submit the application and wait for confirmation.

06

Track your application status through the website.

Who needs RGESS?

01

Individuals looking to invest in the stock market for the first time.

02

Income taxpayers with a gross annual income of less than or equal to Rs 12 lakh.

03

Those seeking tax benefits under the RGESS scheme.

Fill

form

: Try Risk Free

People Also Ask about

What is RGESS in a demat account?

With an objective to encourage flow of savings of the small investors in domestic capital market, the Government of India (GOI) announced a scheme named Rajiv Gandhi Equity Savings Scheme, 2012 (RGESS) in the Union Budget 2012-13 and further expanded vide Union Budget 2013-14 (Notification dated December 18, 2013) to

Is RGESS still available?

No, RGESS had been discontinued during the Union Budget 2017 and as such, the tax deduction is no longer applicable to any equity savings scheme.

What is the message of 80CCG?

In the year that the taxpayer is claiming the deduction, their income should not exceed ₹12 lakhs. The investor must be a new entrant to the capital market. Eligible investors can claim a deduction of 50% of the monies invested, subject to a maximum investment limit of ₹50,000, for computing their taxable income.

What is 80CCG?

Popularly known as the Rajeev Gandhi Equity Saving Scheme, Section 80CCG of Income Tax Act in India, is formulated to offer incentives to equity market investors. The objective of this section is to improve savings among individual investors and in turn, boost the country's domestic capital market.

What is 80CCG RGESS?

The investor would get under Section 80CCG of the Income Tax Act, a 50% deduction of the amount invested during the year, upto a maximum investment of Rs. 50,000 per financial year, from his/her taxable income for that year, for three consecutive assessment years.

What are the benefits of Rajiv Gandhi equity saving Scheme?

The investor would get under Section 80CCG of the Income Tax Act, a 50% deduction of the amount invested during the year, upto a maximum investment of Rs. 50,000 per financial year, from his/her taxable income for that year, for three consecutive assessment years.

What is meant by RGESS?

The Rajiv Gandhi Equity Savings Scheme (RGESS) was announced by the Union Budget in 2012-13 and further expanded in 2013-14. It is a tax saving scheme. It is designed exclusively for new investors with little or no experience in the securities market and who have their gross income per year below a certain amount.

What is the 80CCG?

Section 80CCG, also known as the Rajiv Gandhi Equity Savings Scheme (RGESS), was introduced under the Income Tax Act in India to incentivize first-time equity investors. The scheme aimed to encourage individuals to save while fostering growth in India's capital markets.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is RGESS?

RGESS stands for the Rajiv Gandhi Equity Savings Scheme, which is a government initiative in India aimed at encouraging small investors to invest in the stock market.

Who is required to file RGESS?

Individuals who are new retail investors with an annual income of up to Rs. 12 lakh and invest in eligible equity shares under RGESS are required to file RGESS.

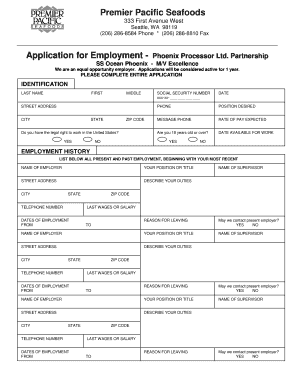

How to fill out RGESS?

To fill out RGESS, eligible investors need to submit a declaration form along with a prescribed application form and ensure that they provide necessary details about their identity, income, and investment.

What is the purpose of RGESS?

The purpose of RGESS is to promote and incentivize long-term equity investments by offering tax benefits to new retail investors in India.

What information must be reported on RGESS?

RGESS requires reporting of information such as investor's name, PAN, income details, the value of the eligible investments, and the duration for which the investments are held.

Fill out your rgess - sebi gov online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Rgess - Sebi Gov is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.