Get the free Form 4800-DCC - fincen

Show details

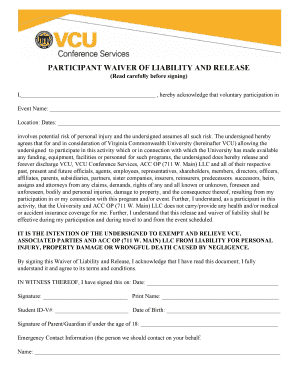

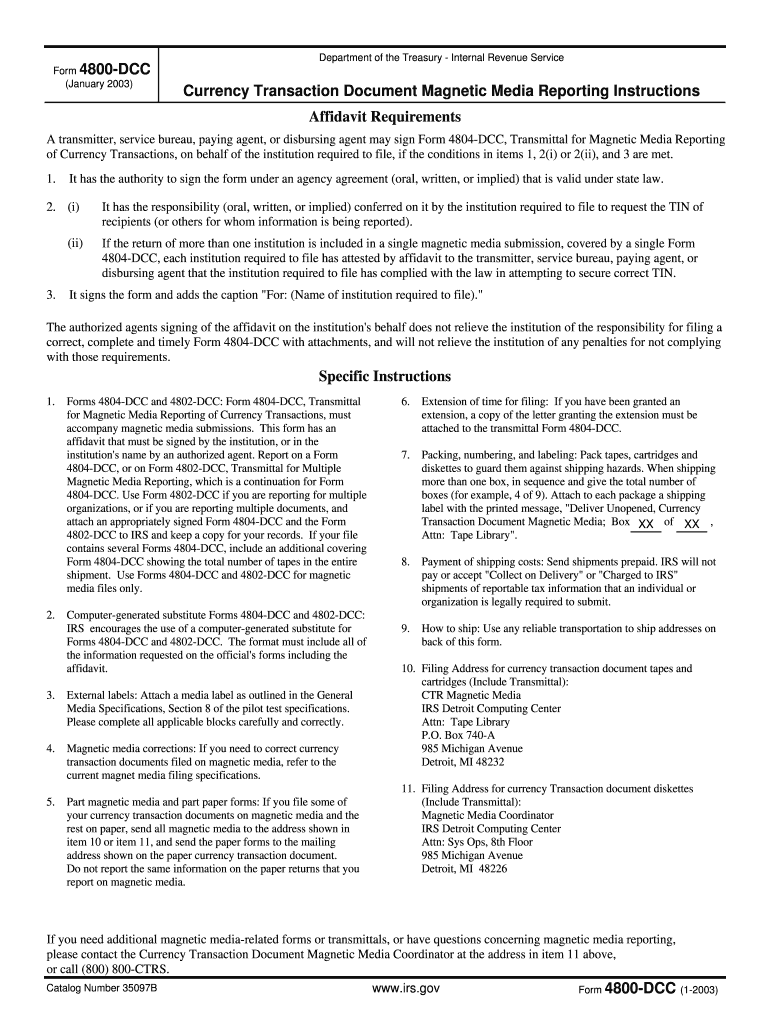

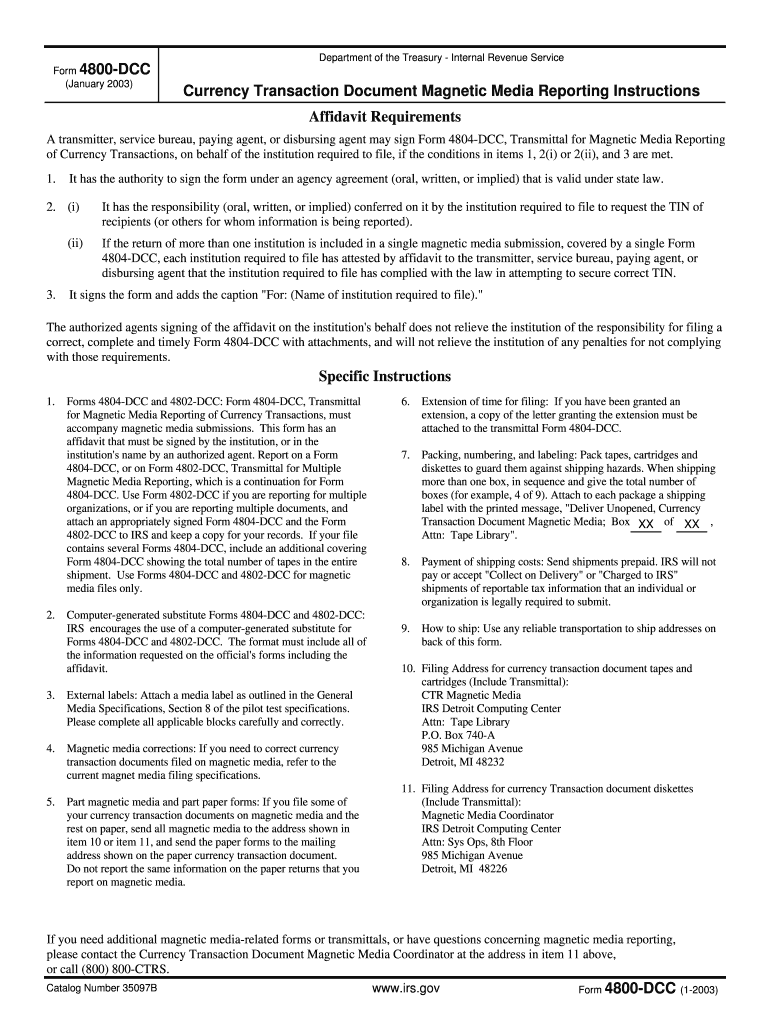

Este documento proporciona instrucciones sobre cómo completar el Formulario 4800-DCC para el envío de documentos de transacciones de moneda a través de medios magnéticos, incluyendo requisitos

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form 4800-dcc - fincen

Edit your form 4800-dcc - fincen form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 4800-dcc - fincen form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form 4800-dcc - fincen online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit form 4800-dcc - fincen. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form 4800-dcc - fincen

How to fill out Form 4800-DCC

01

Gather necessary personal information, including your name, address, and identification details.

02

Review the instructions provided with Form 4800-DCC to understand the sections.

03

Begin filling out the form by entering your information in the designated fields.

04

Complete any required declarations or attestations as outlined on the form.

05

Double-check all entries for accuracy and completeness.

06

Sign and date the form where indicated.

07

Submit the completed form as directed in the instructions, whether online or via mail.

Who needs Form 4800-DCC?

01

Individuals or businesses engaging in specific transactions requiring regulatory reporting.

02

Taxpayers who are mandated to report certain types of income or deductions.

03

Entities involved in activities that require compliance with local or federal regulations.

Fill

form

: Try Risk Free

People Also Ask about

What is the CA 540 tax form?

The most common California income tax form is the CA 540. This form is used by California residents who file an individual income tax return. This form should be completed after filing your federal taxes, using Form 1040.

What is CA form 3893?

Use form FTB 3893 to pay an elective tax for taxable years beginning on or after January 1, 2022, and before January 1, 2026.

What is CA form 3800?

Use form FTB 3800, Tax Computation for Certain Children with Unearned Income, to figure the child's tax. Complete form FTB 3800 if all of the following conditions apply: The child is age 18 and under or a student under age 24 at the end of 2023.

Can CA Form 109 be filed electronically?

e-file Form 109 – For taxable years beginning on or after January 1, 2023, the FTB offers e-file for exempt organizations filing Form 109, California Exempt Organization Business Income Tax Return. Check with your software provider to see if they support exempt organization e-file.

Who must file a California corporate tax return?

You will also need to file a California Corporation Franchise or Income Tax Return (Form 100) annually if your corporation is incorporated in, doing business in, or registered to do business in California, or receives California source income.

Who must file California Form 100?

Who is Required to File Form 100 ? Corporations organized in California or doing business in the state must file Form 100. This includes California-based corporations and out-of-state corporations conducting business within California.

What is the California corporate tax return form?

What Is CA Form 100? The California Corporation Franchise or Income Tax Return serves as a tax document for corporations functioning in California. Its purpose is to declare income, compute tax liability, and meet tax responsibilities to the state.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Form 4800-DCC?

Form 4800-DCC is a document used for reporting specific financial or regulatory information to the appropriate authorities.

Who is required to file Form 4800-DCC?

Generally, entities that are subject to the regulatory requirements pertaining to the information reported on Form 4800-DCC are required to file it.

How to fill out Form 4800-DCC?

Form 4800-DCC should be filled out by providing accurate information in the designated fields, ensuring compliance with the instructions provided for the form.

What is the purpose of Form 4800-DCC?

The purpose of Form 4800-DCC is to collect necessary data for regulatory oversight and to ensure compliance with applicable laws.

What information must be reported on Form 4800-DCC?

Form 4800-DCC typically requires detailed financial data, identification of the reporting entity, and any other relevant information as specified by the filing instructions.

Fill out your form 4800-dcc - fincen online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 4800-Dcc - Fincen is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.