Get the free Principal Pnb Fixed Maturity Plan 367 Days - Series I - sebi gov

Show details

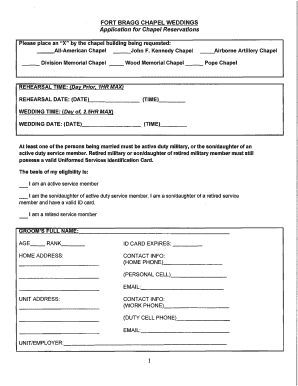

This document outlines the essential details and instructions for investing in Principal Pnb Fixed Maturity Plan, a close-ended debt scheme offering fixed maturity.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign principal pnb fixed maturity

Edit your principal pnb fixed maturity form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your principal pnb fixed maturity form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit principal pnb fixed maturity online

To use our professional PDF editor, follow these steps:

1

Log in to account. Click Start Free Trial and register a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit principal pnb fixed maturity. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out principal pnb fixed maturity

How to fill out Principal Pnb Fixed Maturity Plan 367 Days - Series I

01

Obtain the Principal Pnb Fixed Maturity Plan 367 Days - Series I application form from a financial advisor or the official website.

02

Fill in your personal details, such as name, address, and contact information, in the designated sections.

03

Provide your investment amount that you wish to invest in the plan.

04

Select the preferred payment method for your investment (e.g., bank transfer, cheque).

05

Confirm your understanding of the terms and conditions of the plan by reading through the document.

06

Sign and date the form to validate your application.

07

Submit the completed form along with necessary documents to the respective financial institution or advisor.

Who needs Principal Pnb Fixed Maturity Plan 367 Days - Series I?

01

Investors looking for a fixed-income investment option with a defined maturity period.

02

Individuals seeking a stable and low-risk investment avenue for short-term financial goals.

03

Clients of banks or financial institutions who prefer guaranteed returns without the volatility of equity markets.

04

People who want to diversify their investment portfolio with fixed maturity plans.

Fill

form

: Try Risk Free

People Also Ask about

What is the principal PNB mutual fund?

Principal Mutual Fund originally known as Principal PNB Mutual Fund or PNB Mutual Fund initially operated as a joint venture between US-based investment management company Principal Financial and Punjab National Bank (PNB), one of India's largest public sector banks.

What is the new name for PNB mutual fund?

Principal Mutual Fund is one of the leading mutual fund in India. The investment manager to Principal Mutual Fund is Principal Pnb Asset Management Company.

What is the difference between FD and FMP?

FMPs: Returns can exceed FD rates when interest rates are favourable. However, returns are not fixed or guaranteed. Debt funds: Similar to FMPs, debt funds can offer better potential returns than savings accounts or FDs of similar tenures. Short-term debt funds typically have lower return potential than long-term ones.

What is a fixed maturity plan?

Fixed Maturity Plan (FMP) is a tenure-specific mutual fund scheme that aligns its investments in debt instruments with the scheme's duration. Spanning from months to years, FMPs suit investors seeking predictable returns over a defined investment horizon.

Is a fixed deposit better at maturity or monthly?

Generally speaking, if you choose more frequent payouts (like monthly or quarterly) term deposits with more regular payment frequencies may come with slightly lower interest rates, while receiving your interest annually or at maturity often comes with a higher interest rate.

What is the difference between fixed deposit and fixed maturity plan?

FD: The fixed deposit interest rate is predetermined and guaranteed. FMP: The returns are not guaranteed and vary depending on market fluctuations. DF: There is no guarantee of the returns as it depends on market fluctuations. In fact, in some instances, the principal amount can also be eroded.

Is a fixed maturity plan the same as a fixed deposit?

FD: The fixed deposit interest rate is predetermined and guaranteed. FMP: The returns are not guaranteed and vary depending on market fluctuations. DF: There is no guarantee of the returns as it depends on market fluctuations. In fact, in some instances, the principal amount can also be eroded.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Principal Pnb Fixed Maturity Plan 367 Days - Series I?

Principal Pnb Fixed Maturity Plan 367 Days - Series I is a fixed income investment scheme that aims to provide regular returns over a fixed tenure of 367 days.

Who is required to file Principal Pnb Fixed Maturity Plan 367 Days - Series I?

Investors looking for a defined maturity period with a fixed return should consider filing for Principal Pnb Fixed Maturity Plan 367 Days - Series I.

How to fill out Principal Pnb Fixed Maturity Plan 367 Days - Series I?

To fill out the application for Principal Pnb Fixed Maturity Plan 367 Days - Series I, investors need to provide personal details, select the investment amount, and choose the plan options as required.

What is the purpose of Principal Pnb Fixed Maturity Plan 367 Days - Series I?

The purpose of Principal Pnb Fixed Maturity Plan 367 Days - Series I is to offer investors a low-risk investment option with predictable returns over a specified duration.

What information must be reported on Principal Pnb Fixed Maturity Plan 367 Days - Series I?

The information that must be reported includes the investor's personal details, investment amount, expected returns, and the duration of the investment.

Fill out your principal pnb fixed maturity online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Principal Pnb Fixed Maturity is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.