Get the free Stretch Your Dollars: Budgeting Basics - Community Credit Union - communitycredituni...

Show details

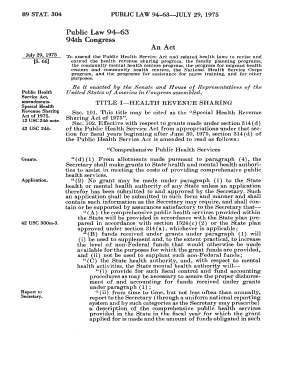

Stretch Your Dollars budgeting basics Stretch Your Dollars budgeting basics Money is a big part of our lives. How we earn money and how we spend money has changed a lot over the past decade. How can

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign stretch your dollars budgeting

Edit your stretch your dollars budgeting form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your stretch your dollars budgeting form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit stretch your dollars budgeting online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit stretch your dollars budgeting. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

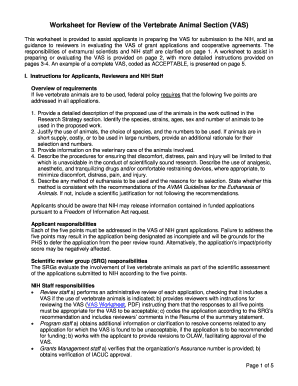

How to fill out stretch your dollars budgeting

How to fill out stretch your dollars budgeting:

01

Start by assessing your current financial situation. Take note of your income, expenses, debts, and savings. This will give you a clear understanding of where your money is going and how much you have left to work with.

02

Identify areas where you can cut back on expenses. Look for unnecessary expenses that can be eliminated or reduced. For example, you could cancel unused subscriptions, negotiate lower insurance rates, or find ways to save on utilities.

03

Create a realistic budget that aligns with your financial goals. Determine how much you want to save, how much you need for essential expenses, and allocate the remaining funds for discretionary spending. Be sure to prioritize your necessities and savings before discretionary expenses.

04

Track your expenses diligently. Keep a record of every expense, no matter how small. This will help you identify any areas where you may be overspending and allow you to make necessary adjustments.

05

Look for ways to increase your income. Consider taking up a side job or freelance work to supplement your primary income. This additional income can help you reach your financial goals faster and provide more flexibility in your budget.

06

Set aside money for emergency savings. It's important to have a financial cushion to fall back on in case of unexpected expenses or emergencies. Aim to save at least 3-6 months' worth of living expenses in a separate savings account.

07

Stick to your budget and constantly reassess it. Review your budget regularly to ensure you're staying on track and making progress towards your financial goals. Make adjustments as necessary, taking into account any changes in income or expenses.

Who needs stretch your dollars budgeting:

01

Individuals with limited income: If you have a fixed or limited income, it's crucial to make the most of every dollar you have. Stretching your dollars through budgeting can help you make ends meet and achieve financial stability.

02

People looking to save money: Whether you have specific financial goals in mind or simply want to build up your savings, budgeting can help you make better use of your money and save more efficiently.

03

Those with debt: Stretch your dollars budgeting can be especially helpful for individuals with debt. By properly allocating your funds and prioritizing debt repayment, you can pay off your debts faster and become debt-free sooner.

04

Individuals experiencing financial hardships: If you're going through a difficult financial period, such as a job loss or medical expenses, stretch your dollars budgeting can provide a structured approach to managing your finances and finding ways to make ends meet.

05

Anyone looking for financial stability: Regardless of your income level or financial situation, budgeting can help you gain control over your finances and achieve long-term stability. Stretching your dollars through budgeting allows you to be mindful of your spending and make better financial decisions.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute stretch your dollars budgeting online?

With pdfFiller, you may easily complete and sign stretch your dollars budgeting online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

Can I create an eSignature for the stretch your dollars budgeting in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your stretch your dollars budgeting and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

How can I fill out stretch your dollars budgeting on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your stretch your dollars budgeting, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

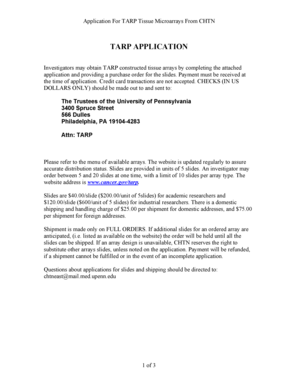

What is stretch your dollars budgeting?

Stretch your dollars budgeting is a financial planning method that focuses on maximizing the value of each dollar spent.

Who is required to file stretch your dollars budgeting?

Anyone who wants to effectively manage their finances and make the most of their income can benefit from stretch your dollars budgeting.

How to fill out stretch your dollars budgeting?

To fill out stretch your dollars budgeting, you need to assess your income and expenses, set financial goals, create a budget plan, track your spending, and adjust your budget as needed.

What is the purpose of stretch your dollars budgeting?

The purpose of stretch your dollars budgeting is to help individuals and families make informed financial decisions, save money, and reach their financial goals.

What information must be reported on stretch your dollars budgeting?

Information such as income sources, expenses, savings goals, and spending patterns must be reported on stretch your dollars budgeting.

Fill out your stretch your dollars budgeting online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Stretch Your Dollars Budgeting is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

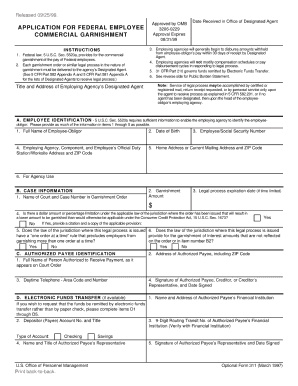

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.