Get the free Form NYC-222 - 1996 - nyc

Show details

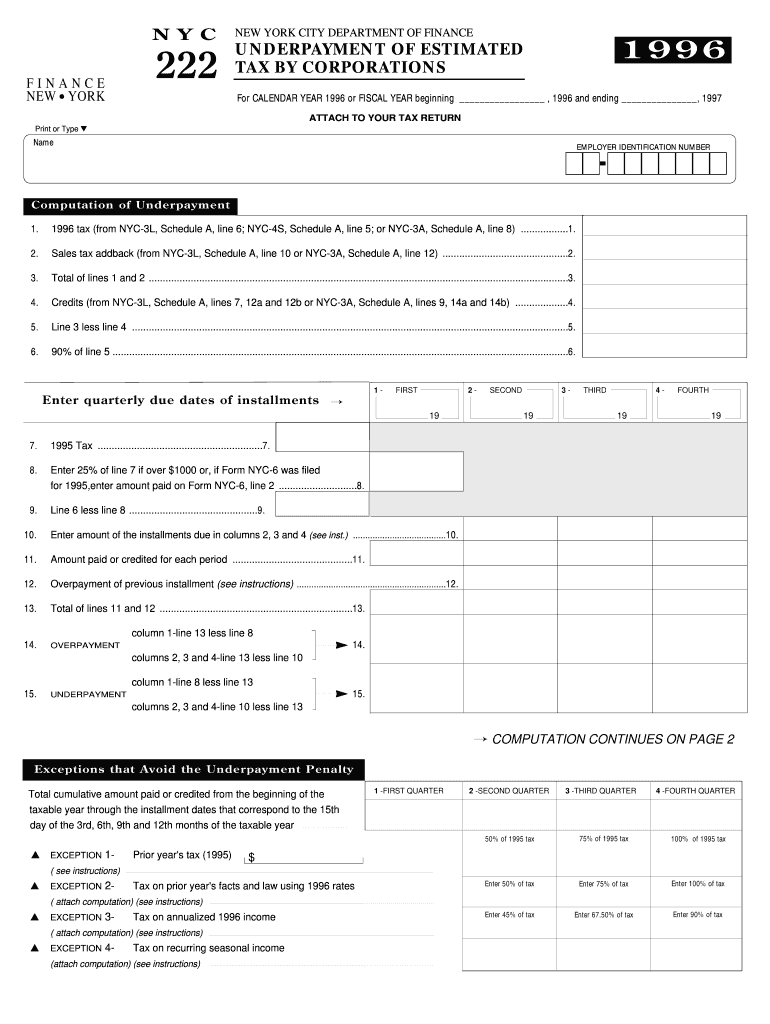

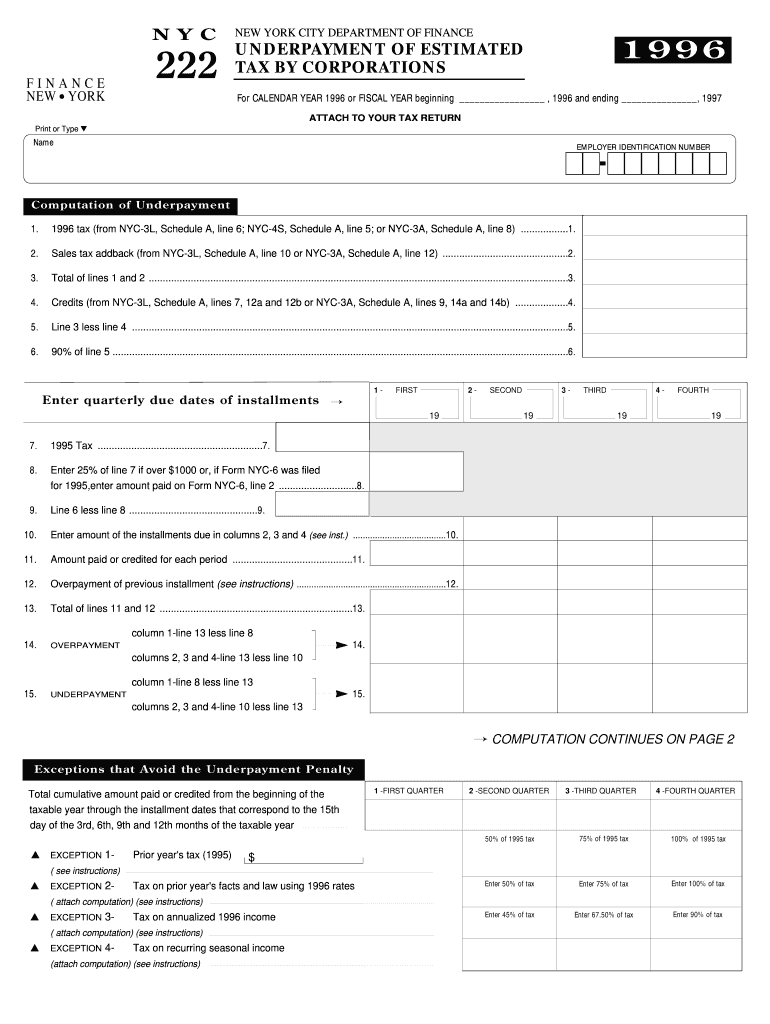

Este formulario permite a las corporaciones determinar si pagaron el monto correcto del impuesto estimado en la fecha de vencimiento adecuada. Si no se pagó el monto mínimo a tiempo, puede imponerse

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form nyc-222 - 1996

Edit your form nyc-222 - 1996 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form nyc-222 - 1996 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form nyc-222 - 1996 online

Use the instructions below to start using our professional PDF editor:

1

Log in to account. Click on Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit form nyc-222 - 1996. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form nyc-222 - 1996

How to fill out Form NYC-222 - 1996

01

Obtain Form NYC-222 - 1996 from the New York City Department of Finance website or local office.

02

Fill in your name, address, and contact information at the top of the form.

03

Indicate your status by checking the appropriate box (individual, business, etc.).

04

Provide details about your income sources and amounts in the specified sections.

05

Complete sections related to deductions or credits applicable to your situation.

06

Review the form for accuracy and completeness.

07

Sign and date the form at the bottom.

08

Submit the completed form to the IRS or New York City Department of Finance by the designated deadline.

Who needs Form NYC-222 - 1996?

01

Individuals or businesses who owe taxes to New York City or are seeking to claim tax credits.

02

Residents or non-residents who have generated income within New York City during the tax year.

Fill

form

: Try Risk Free

People Also Ask about

What is the penalty for estimated taxes in NYC?

Penalties for underpayment of estimated taxes The penalty is the federal short-term interest rate plus 5.5 percentage points. Both the federal interest rate plus the additional percentage rate change quarterly. However, the minimum penalty is 7.5%.

What is a NYC 400 form?

Every corporation subject to the New York City General Corporation Tax or Business Corporation Tax (Title 11, Chapter 6, Subchapter 2 or Subchapter 3-A of the Administrative Code) must file a declaration (NYC-400) if its estimated tax for the current year can reasonably be expected to exceed $1,000.

What is NYC 210?

If you qualify for the NYC school tax credit and are not filing a tax return on Form IT-201 or IT-203 for 2024, use Form NYC-210 to claim your NYC school tax credit. File your Form NYC-210 as soon as you can after January 1, 2025. You must file your 2024 claim no later than April 17, 2028.

What is NYC 222?

Form NYC-222 will enable corpora- tions to determine if they paid the cor- rect amount of estimated tax by the proper due date. If the minimum amount was not paid timely, an under- payment penalty may be imposed for the period underpaid. This form helps you to determine whether or not you are subject to this penalty.

What is NYC sales tax 2025?

New York sales tax details The minimum combined 2025 sales tax rate for New York, New York is 8.0%. This is the total of state, county, and city sales tax rates. The New York sales tax rate is currently 4.0%.

Who needs to file NYC 2?

A C corporation filing federal Form 1120 must file Form NYC-2, Business Corporation Tax Return with the City of New York if the corporation does business, employs capital, owns or leases property, or maintains an office in the city. A corporate partner in a partnership is subject to the same requirement.

What is New York IT 225?

IT-225 is a modification form that is used to report additions or subtractions to federal adjusted gross income and has been updated to include a reason code (S-143) that is specifically used to identify HWB income. The form is available here, and instructions are here.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Form NYC-222 - 1996?

Form NYC-222 is a tax form used for the New York City corporate tax purposes, specifically related to the General Corporation Tax.

Who is required to file Form NYC-222 - 1996?

Corporations that are subject to the New York City General Corporation Tax and meet certain thresholds of income or business activity are required to file Form NYC-222.

How to fill out Form NYC-222 - 1996?

To fill out Form NYC-222, corporations need to provide their basic information, report their income, deductions, and calculate the tax owed based on the information provided. Detailed instructions accompany the form to guide taxpayers through the process.

What is the purpose of Form NYC-222 - 1996?

The purpose of Form NYC-222 is to report a corporation's income and calculate the tax owed to New York City under the General Corporation Tax.

What information must be reported on Form NYC-222 - 1996?

Form NYC-222 requires reporting on corporate income, deductions, credits, and other relevant financial information required to determine the tax liability for the reporting period.

Fill out your form nyc-222 - 1996 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form Nyc-222 - 1996 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.