Get the free NYC-6.1 - nyc

Show details

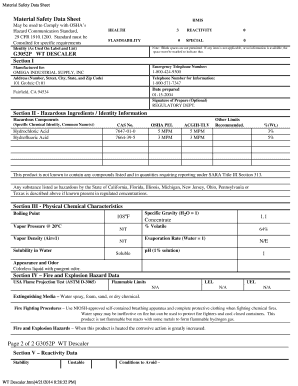

This document is used to request an additional three-month extension of time for corporations to file their general corporation tax returns in New York City.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign nyc-61 - nyc

Edit your nyc-61 - nyc form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your nyc-61 - nyc form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing nyc-61 - nyc online

Use the instructions below to start using our professional PDF editor:

1

Log in to your account. Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit nyc-61 - nyc. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out nyc-61 - nyc

How to fill out NYC-6.1

01

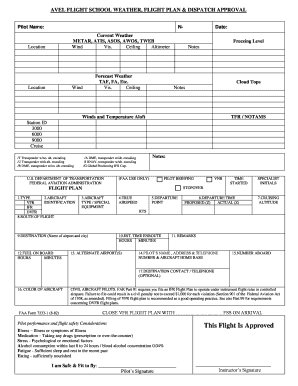

Download the NYC-6.1 form from the NYC Department of Finance website.

02

Fill in your name and address in the designated fields at the top of the form.

03

Provide your identification number, if applicable, such as a Social Security number or Employer Identification Number.

04

Enter the details of the property or business related to the form, including the address and type of ownership.

05

Complete any financial information required in the respective sections, like income and expenses.

06

Review the form for accuracy and completeness before submitting.

07

Submit the form by the deadline indicated, either online or by mailing it to the appropriate department.

Who needs NYC-6.1?

01

Individuals or businesses filing for specific tax benefits or exemptions in New York City, particularly related to property ownership.

Fill

form

: Try Risk Free

People Also Ask about

What is the probationary period for employees in NY?

(a) Every appointment and promotion to a position in the competitive or labor class shall be for a probationary period of one year unless otherwise set forth in the terms and conditions of the certification for appointment or promotion as determined by the commissioner of citywide administrative services.

How many English people live in NYC?

###Did you know that there are 34,134 people living in New York who were born in the UK? That's 5% of all Brits in the US!

What is the probation period when starting a new job?

A probation period is a trial period of employment, which often takes place when a new hire first joins the company. During this period, it's generally much easier for either the organisation or the employee to terminate the contract. In some cases, they can also be used with existing employees.

What is the probationary period for NYU?

What Is a Probationary Period? The probationary period for covered employees spans six months from the date of hire.

What is probationary period?

It is the fixed duration during which a new employee's performance and suitability for a job are assessed. During the probation period, new employees are considered probationary employees. A probationary period can vary, but commonly, it lasts for 3 to 6 months.

What is 6.1 9 of the personnel rules and regulations of the city of New York?

6.1. 9 of this section, an employee shall not be transferred to a position for which there is required an examination involving essential tests or qualifications different from or higher than those required for the position held by such employee.

What is the probationary period in NYC?

(a) Every appointment and promotion to a position in the competitive or labor class shall be for a probationary period of one year unless otherwise set forth in the terms and conditions of the certification for appointment or promotion as determined by the commissioner of citywide administrative services.

How long does a NYC civil service list last?

➢All applicants receive a notification in the mail from DCAS showing their results and list number, if applicable. ➢DCAS then establishes an eligible list. An eligible list can last for up to (4) years.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is NYC-6.1?

NYC-6.1 is a form used by businesses and individuals to report certain information relating to their New York City taxes, specifically aimed at filing their business income or certain tax liabilities.

Who is required to file NYC-6.1?

Businesses and individuals who have income or credits that need to be reported for New York City tax purposes are required to file NYC-6.1.

How to fill out NYC-6.1?

To fill out NYC-6.1, you will need to provide your business identification information, report your income, deductions, and any applicable credits, and ensure all required fields are completed accurately before submitting the form.

What is the purpose of NYC-6.1?

The purpose of NYC-6.1 is to ensure that businesses and individuals accurately report their financial activities and fulfill their tax obligations to New York City.

What information must be reported on NYC-6.1?

NYC-6.1 requires reporting of business identification information, total income, deductions, credits claimed, and any other relevant tax information that pertains to New York City tax regulations.

Fill out your nyc-61 - nyc online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Nyc-61 - Nyc is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.