Get the free CigaretteTax_RefundApplication - nyc

Show details

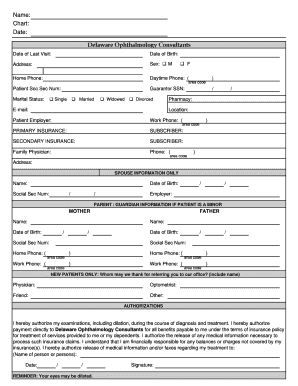

Use this application to claim a refund of the amount paid for stamps affixed to packages of cigarettes with unused or damaged tax stamps.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign cigarettetax_refundapplication - nyc

Edit your cigarettetax_refundapplication - nyc form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your cigarettetax_refundapplication - nyc form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit cigarettetax_refundapplication - nyc online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit cigarettetax_refundapplication - nyc. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out cigarettetax_refundapplication - nyc

How to fill out CigaretteTax_RefundApplication

01

Obtain the Cigarette Tax Refund Application form from the relevant government website or office.

02

Fill out the applicant's personal information, including name, address, and contact details.

03

Provide details of the cigarette purchases, including dates, quantities, and proof of purchase.

04

Indicate the reason for the refund request clearly.

05

Attach any required supporting documentation, such as receipts or tax payment evidence.

06

Review the application to ensure all information is accurate and complete.

07

Sign and date the application.

08

Submit the application to the appropriate tax authority, either by mail or electronically, as specified on the form.

Who needs CigaretteTax_RefundApplication?

01

Individuals or businesses that have purchased cigarettes and paid taxes on them.

02

Residents who have relocated to a different state and have leftover cigarettes.

03

Retailers who have unsold cigarette inventory that has been taxed but not sold.

Fill

form

: Try Risk Free

People Also Ask about

How much do 200 cigarettes cost duty free in the UK?

less than half the price you'd pay in a conventional store. A pack of 20 Marlboro Red is about £12 in "normal" shops, Duty Free is about half that, so a "sleeve" of 200 would be around £60.

What is California's tobacco tax?

9, California — Tobacco Tax: 2025-2026 Cigarette and Tobacco Products Tax Rates Announced, (Apr 25, 2025) Effective July 1, 2025, through June 30, 2026, the California tax rate on: (1) cigarettes remains $0.1435 per cigarette ($2.87 per pack of 20); and (2) tobacco products is 54.27% (formerly, 52.92%) of wholesale cost.

Which country has the highest tax on cigarettes?

Countries That Impose The Highest Tax On Cigarettes RankCountryTaxes as Percentage Of Cigarette Price 1 Bosnia and Herzegovina 86.0 % 2 Israel 85.0 % 3 Slovakia 84.6 % 4 Bulgaria 84.0 %6 more rows

What is the Illinois state tax on cigarettes?

149 mills per cigarette or $2.98 per package of 20 cigarettes. Note: A separate (sales) uses tax of 6.25 percent is also due on the purchase price. collect the following tax amounts from each purchaser monthly: $.

What is the cigarette tax in England?

VAT is applied after tobacco duty, so, for example, the price of a packet of 20 cigarettes currently reflects the pre-tax price plus 16.5 per cent ad valorem plus £6.69 of duty tax plus 20 per cent VAT on both the pre-tax price and the duty.

Why is tobacco tax so high in the UK?

Tobacco tax increases are one of the most effective means of reducing tobacco use1 and consequently the tobacco industry has historically lobbied heavily against tax increases. With standardised packaging of cigarettes now under consideration in the UK, industry lobbying on the illicit tobacco trade has intensified.

How much is cigarette tax in the UK?

Tobacco Duty Tobacco productRate Cigarettes 16.5% of the retail price plus £6.69 on a packet of 20 Cigars £4.17 on a 10g cigar Hand rolling tobacco £14.30 on a 30g packet Other smoking tobacco and chewing tobacco (for example pipe tobacco) £5.50 on a 30g packet1 more row

What is the tax on bidi in India?

The retail price of duty-paid bidis is around INR21/bundle, while the retail price for exempt bidis is around INR16/bundle. Duty paid-bidi sticks are subject to tax of INR4. 6/pack representing 22% of the retail price.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is CigaretteTax_RefundApplication?

CigaretteTax_RefundApplication is a document or form filed to request a refund for cigarette taxes that have been paid, typically in cases where the cigarettes were not sold or were returned.

Who is required to file CigaretteTax_RefundApplication?

Retailers, wholesalers, or distributors of cigarettes who have paid cigarette taxes and are seeking a refund for unsold or returned products are required to file the CigaretteTax_RefundApplication.

How to fill out CigaretteTax_RefundApplication?

To fill out the CigaretteTax_RefundApplication, you typically need to provide your business details, the quantity of cigarettes for which you are seeking a refund, the tax paid, and the reason for the refund. It is important to follow the specific instructions provided on the form.

What is the purpose of CigaretteTax_RefundApplication?

The purpose of the CigaretteTax_RefundApplication is to allow businesses to reclaim taxes paid on cigarettes that were not sold or were returned, ensuring that they are not financially penalized for unsold inventory.

What information must be reported on CigaretteTax_RefundApplication?

Typically, the information that must be reported on the CigaretteTax_RefundApplication includes the applicant's identification details, tax identification number, the amount of tax paid, details of the cigarettes involved, and a justification for the refund claim.

Fill out your cigarettetax_refundapplication - nyc online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Cigarettetax_Refundapplication - Nyc is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.