Get the free employer form - dol wa

Show details

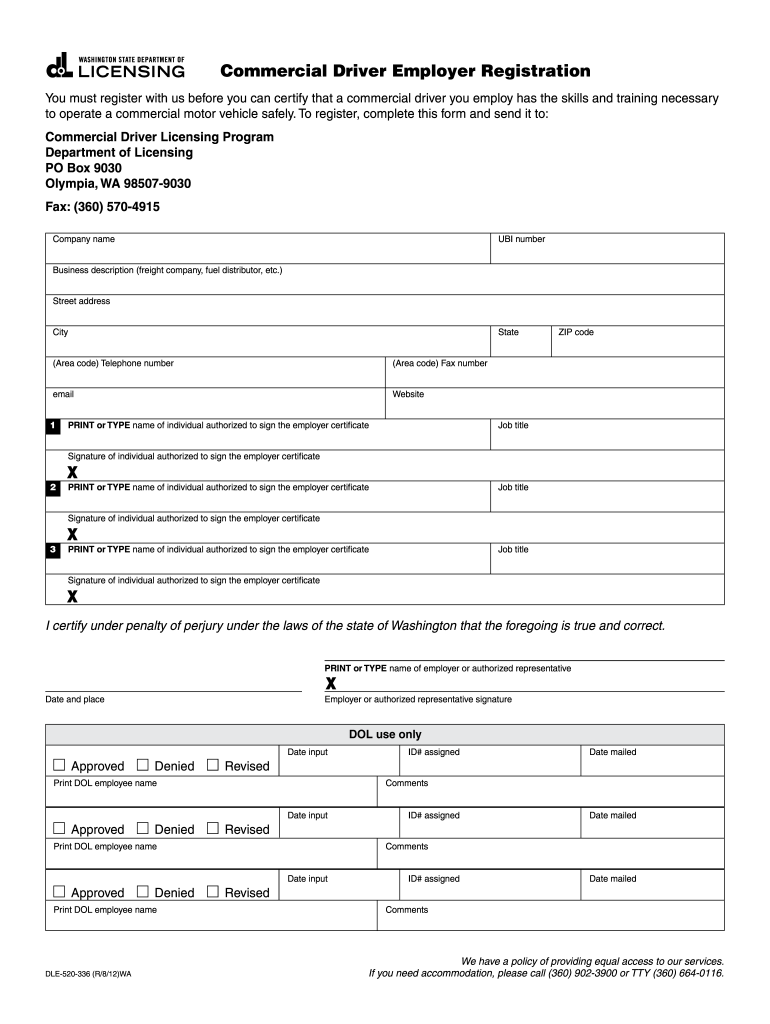

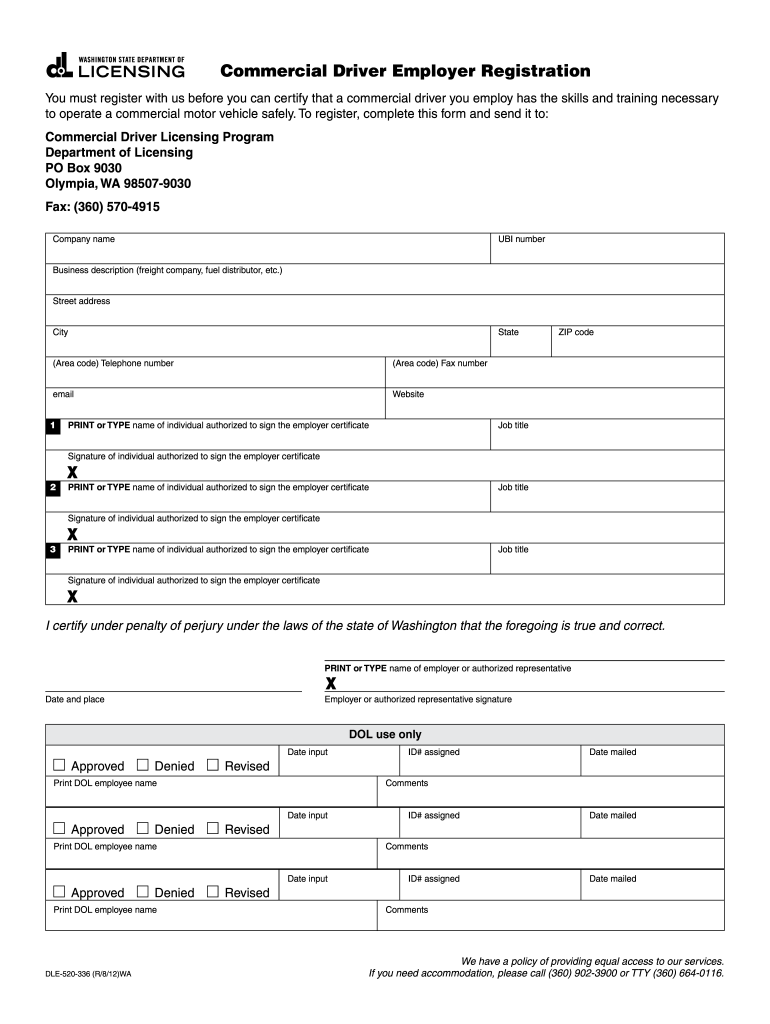

Click here to START or CLEAR then hit the TAB button Commercial Driver Employer Registration You must register with us before you can certify that a commercial driver you employ has the skills and training necessary to operate a commercial motor vehicle safely. To register complete this form and send it to Department of Licensing PO Box 9030 Olympia WA 98507-9030 Fax 360 570-4915 Company name UBI number Business description freight company fuel distributor etc. Street address City State Area...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign employer form - dol

Edit your employer form - dol form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your employer form - dol form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing employer form - dol online

Follow the steps down below to use a professional PDF editor:

1

Sign into your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit employer form - dol. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Instructions and Help about employer form - dol

Fill

form

: Try Risk Free

People Also Ask about

What is a W-2 form employer?

Form W-2 is completed by an employer and contains important information that you need to complete your tax return. It reports your total wages for the year and the amount of federal, state, and other taxes withheld from your paycheck. It may also contain information about: Tips. Contributions to a 401(k)

What is a w9 form for employees?

Use Form W-9 to provide your correct Taxpayer Identification Number (TIN) to the person who is required to file an information return with the IRS to report, for example: Income paid to you. Real estate transactions. Mortgage interest you paid.

Who is considered a W-2 employee?

A W2 employee is a worker who receives a W2 tax form from their employer. W2 employees are generally considered to be the most traditional form of employment. Workers who are classified under other forms of employment use other tax forms (like 1099 employees) to file their taxes. Hence the name, "W2 employee."

What does a W-2 employer pay?

Social Security and Medicare taxes The total due every pay period is 15.3% of an individual's wages – half of which is paid by the employee and the other half by the employer. This means that each party pays 6.2% for Social Security up to a wage base limit of $160,200 and 1.45% for Medicare with no limit.

Which form is your employer?

Your Form W-2 tells you how much you earned from your employer in the past year and how much withholding tax you've already paid on those earnings.

What is an employer W 5 form?

What Is a W-5 Tax Form? The W-5 form, or Earned Income Credit Advance Payment Certificate, was a form submitted by an employee in order to receive a portion of the Earned Income Credit (EIC) in advance with their pay.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute employer form - dol online?

pdfFiller has made filling out and eSigning employer form - dol easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

How do I make edits in employer form - dol without leaving Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your employer form - dol, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

How can I fill out employer form - dol on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your employer form - dol, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

What is employer form?

The employer form refers to the form that employers use to report employee wages and tax withholdings to the tax authorities.

Who is required to file employer form?

Employers are required to file the employer form if they have employees and withhold federal income taxes, Social Security taxes, or Medicare taxes.

How to fill out employer form?

Employers can fill out the employer form by providing accurate information about their employees' wages and tax withholdings. They can use electronic filing or paper filing methods to submit the form.

What is the purpose of employer form?

The purpose of the employer form is to ensure that employers accurately report employee wages and tax withholdings, and to calculate and reconcile their employment tax liabilities.

What information must be reported on employer form?

Employers must report information such as employee wages, tips, federal income tax withholdings, Social Security tax withholdings, Medicare tax withholdings, and other applicable employment tax information on the employer form.

Fill out your employer form - dol online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Employer Form - Dol is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.