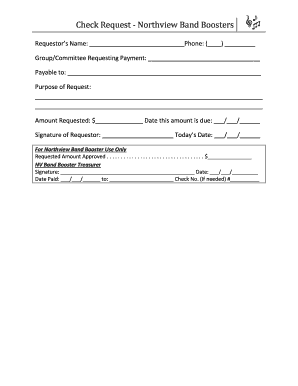

Get the free Form T-4 - gov mb

Show details

This form is used for the Tobacco Tax Return to report sales and tax collected by out-of-province collectors, manufacturers of tobacco products, and wholesale importers treated as manufacturers.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form t-4 - gov

Edit your form t-4 - gov form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form t-4 - gov form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form t-4 - gov online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit form t-4 - gov. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form t-4 - gov

How to fill out Form T-4

01

Gather employee information including their name, address, and Social Insurance Number (SIN).

02

Prepare to report the total income paid to each employee for the year.

03

Calculate the total deductions for Canada Pension Plan (CPP), Employment Insurance (EI), and income tax withheld.

04

Fill in the form sections designated for employer information, including your business number.

05

Enter each employee's income and deductions accurately in the appropriate boxes.

06

Verify that all information is correct before submission.

07

Submit Form T-4 to the Canada Revenue Agency (CRA) by the deadline.

Who needs Form T-4?

01

Employers who pay salaries or wages to employees in Canada.

02

Self-employed individuals who have employees.

03

Businesses that provide taxable benefits to employees.

Fill

form

: Try Risk Free

People Also Ask about

What does T4 do in the body?

Because T4 is converted into another thyroid hormone called T3 (triiodothyronine), free T4 is the more important hormone to measure. Any changes show up in T4 first. T3 and T4 help to control how your body stores and uses energy to do its work (metabolism).

What is the difference between T4 and T4S at Madrid airport?

As a general rule, all Air Shuttle flights and most domestic and Schengen flights depart from T4. Except for any last-minute changes, Schengen, domestic and Air Nostrum flights operate from T4 using boarding gates K (K86 to K93). Non-Schengen international flights depart from the Satellite Building (T4S).

What is the T4 statement?

What is a T4 slip. A T4 slip identifies all of the remuneration paid by an employer to an employee during a calendar year. You can get a Form T4 slip in a PDF or PDF fillable/saveable format to file on paper.

How to save T4 as PDF?

You can collapse the tax form flyout by clicking the right arrow at the far left of the flyout. Click the Print button to open the Print dialog. The application displays the Save as PDF option by default. Click the Save button to save the item as a PDF file.

What is a T4 financial statement?

The T4 slip, officially known as the Statement of Remuneration Paid, is a tax document that summarizes the total amount of income earned and deductions taken for an employee within a calendar year.

What is the difference between T4 and T4s?

T4s are given to employees and the CRA. (You need to create a T4 for each province and territory in which the employee earned income.) T4As are given to independent contractors and the CRA. (Same as a T4, create one for each province and territory in which the contractor was paid.)

What is the T4?

Key Takeaways. A T4 slip, or Statement of Remuneration Paid, is a document that summarizes all of the money paid by an employer to an employee during a calendar year. Most employers send your T4 electronically by February. Using Auto-fill my return you can directly import tax slips from the CRA to TurboTax.

How to download Lyft T4?

You can download your Quarterly Earnings Summary after the end of any quarter you've received earnings. To download your summary: Go to the 'Tax Center' tab in your Dashboard. Under the 'Documents' header, select 'Download' to download your Quarterly Earnings Summary.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Form T-4?

Form T-4 is a Canadian tax form used to report income earned by a resident of Canada from a trust or estate.

Who is required to file Form T-4?

Trustees or executors of estates are required to file Form T-4 if they distribute income to beneficiaries.

How to fill out Form T-4?

To fill out Form T-4, you need to provide the trust or estate’s information, the recipient's details, the amount of income distributed, and any necessary deductions.

What is the purpose of Form T-4?

The purpose of Form T-4 is to report income from a trust or estate to the Canada Revenue Agency (CRA) and to the beneficiaries for tax purposes.

What information must be reported on Form T-4?

Form T-4 must include the trust or estate's name, address, identification number, the beneficiary's name, address, identification number, and the amounts paid to the beneficiaries.

Fill out your form t-4 - gov online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form T-4 - Gov is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.