Get the free IRREVOCABLE LETTER OF CREDIT - aldoi

Show details

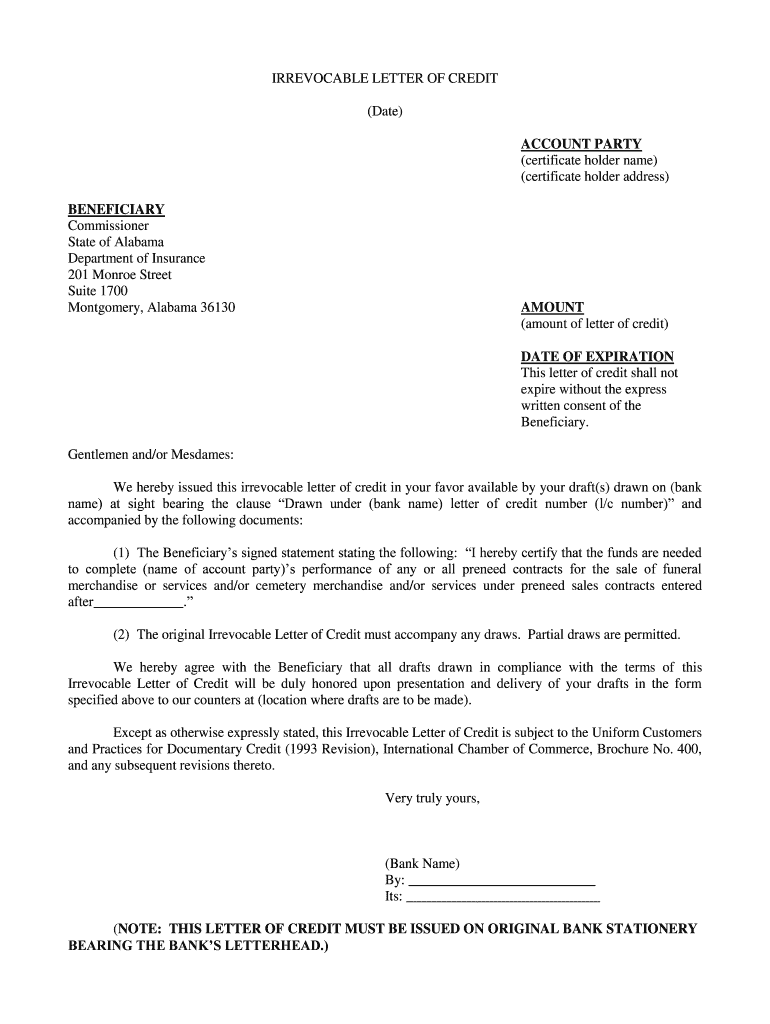

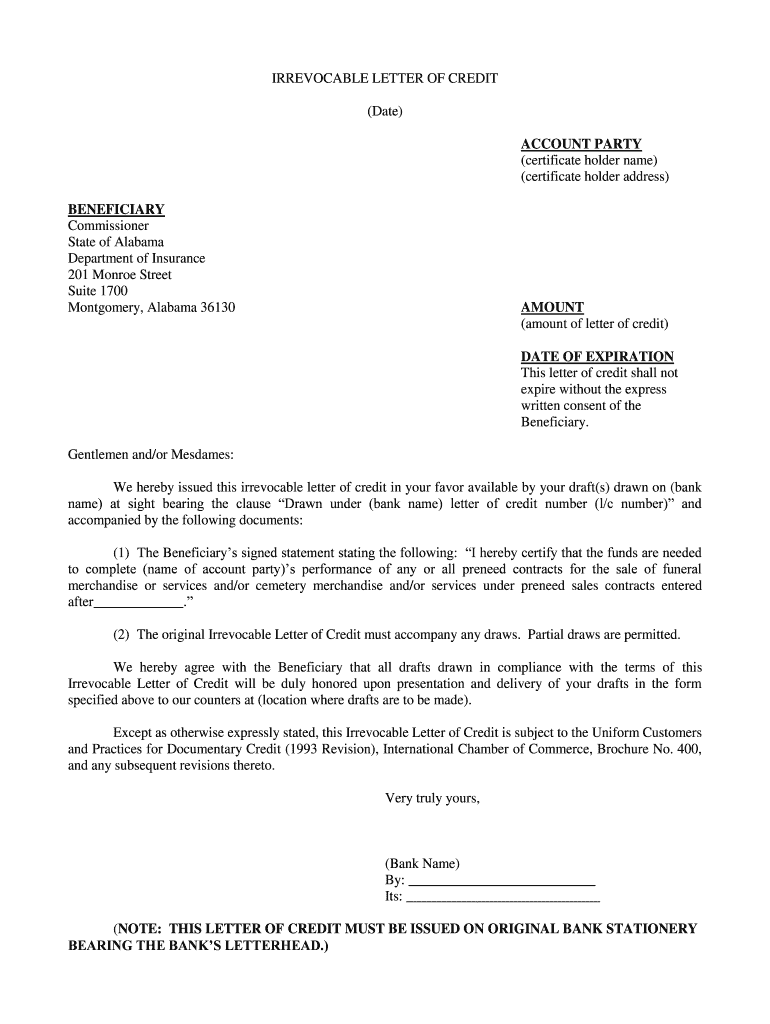

This document serves as an irrevocable letter of credit issued in favor of the Commissioner of the State of Alabama, Department of Insurance, ensuring funds for preneed contracts related to funeral

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign irrevocable letter of credit

Edit your irrevocable letter of credit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your irrevocable letter of credit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing irrevocable letter of credit online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit irrevocable letter of credit. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

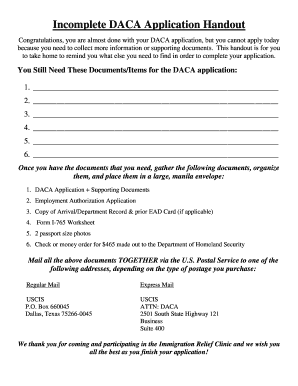

How to fill out irrevocable letter of credit

How to fill out IRREVOCABLE LETTER OF CREDIT

01

Start with the title 'Irrevocable Letter of Credit' at the top of the document.

02

Specify the date of issuance and the identification number of the letter of credit.

03

Clearly name the issuing bank and provide their contact details.

04

Identify the beneficiary, including their name and address.

05

Include the applicant's information, which is the party requesting the letter of credit.

06

State the amount of credit in words and figures.

07

Specify the currency of the letter of credit.

08

Outline the terms and conditions under which the credit can be drawn.

09

Include a description of the documents required for payment, such as shipping documents, invoices, etc.

10

State the expiry date and place for the letter of credit.

11

Provide any additional instructions or clauses necessary for the letter of credit.

12

Ensure that the letter is signed by the authorized representative of the issuing bank.

Who needs IRREVOCABLE LETTER OF CREDIT?

01

Exporters who require payment assurance from buyers.

02

Importers looking to guarantee payment to their suppliers.

03

Banks that issue letters of credit as part of international trade finance solutions.

04

Businesses engaged in large transactions that require secure payment methods.

Fill

form

: Try Risk Free

People Also Ask about

How do I get an irrevocable letter of credit?

Irrevocable Letter of Credit Costs are determined by the lender based on the credit and financial strength of the borrower. Generally, these guarantees cost between 0.5% – 3% depending on the market conditions. Under current market conditions, Surety Bond may be cheaper than ILOCs.

How much does an irrevocable letter of credit cost?

Irrevocable letters of credit can also be referred to as standby letters of credit. Once an irrevocable letter of credit is issued, all parties are contractually bound by it. This means that even if the buyer in a transaction doesn't pay, the bank is obligated to make payment to the seller to satisfy the agreement.

Where can I get an irrevocable letter of credit?

A revocable letter of credit is uncommon because it can be changed or cancelled by the bank that issued it at any time and for any reason. An irrevocable letter of credit cannot be changed or cancelled unless everyone involved agrees.

What is an irrevocable letter of credit?

How to get an Irrevocable Letter of Credit? To obtain an ILOC, you need to reach out to your bank who will provide you with a representative. Don't try to draft an LC on your own or attempt to copy someone else's. Writing your ILOC may seem right in the short run to save money.

What is the difference between a letter of credit and an irrevocable letter of credit?

Irrevocable Letter of Credit Costs are determined by the lender based on the credit and financial strength of the borrower. Generally, these guarantees cost between 0.5% – 3% depending on the market conditions. Under current market conditions, Surety Bond may be cheaper than ILOCs.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is IRREVOCABLE LETTER OF CREDIT?

An Irrevocable Letter of Credit (ILC) is a financial document issued by a bank guaranteeing payment to a seller on behalf of a buyer, provided that the seller meets certain conditions outlined in the letter. Unlike a revocable letter of credit, it cannot be modified or canceled without the consent of all parties involved.

Who is required to file IRREVOCABLE LETTER OF CREDIT?

Typically, the buyer (importer) is required to file an Irrevocable Letter of Credit to ensure that the seller (exporter) is guaranteed payment once they fulfill their part of the agreement. The bank, on behalf of the buyer, issues the letter.

How to fill out IRREVOCABLE LETTER OF CREDIT?

To fill out an Irrevocable Letter of Credit, the applicant (buyer) must provide complete details about the transaction, including the beneficiary's information, the amount to be credited, terms of payment, shipping instructions, documents required for payment, and validity period. It's essential to accurately complete each section to avoid discrepancies.

What is the purpose of IRREVOCABLE LETTER OF CREDIT?

The purpose of an Irrevocable Letter of Credit is to provide a secure method of payment in international trade, protecting both buyers and sellers. It ensures that the seller receives payment upon fulfilling the specified terms and reduces the risk of non-payment for the seller.

What information must be reported on IRREVOCABLE LETTER OF CREDIT?

Information that must be reported on an Irrevocable Letter of Credit includes the name and address of the buyer and seller, the amount of credit, the expiration date, the terms of the transaction, required shipping documents, and any specific conditions for payment.

Fill out your irrevocable letter of credit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Irrevocable Letter Of Credit is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.