Get the free BOE-62

Show details

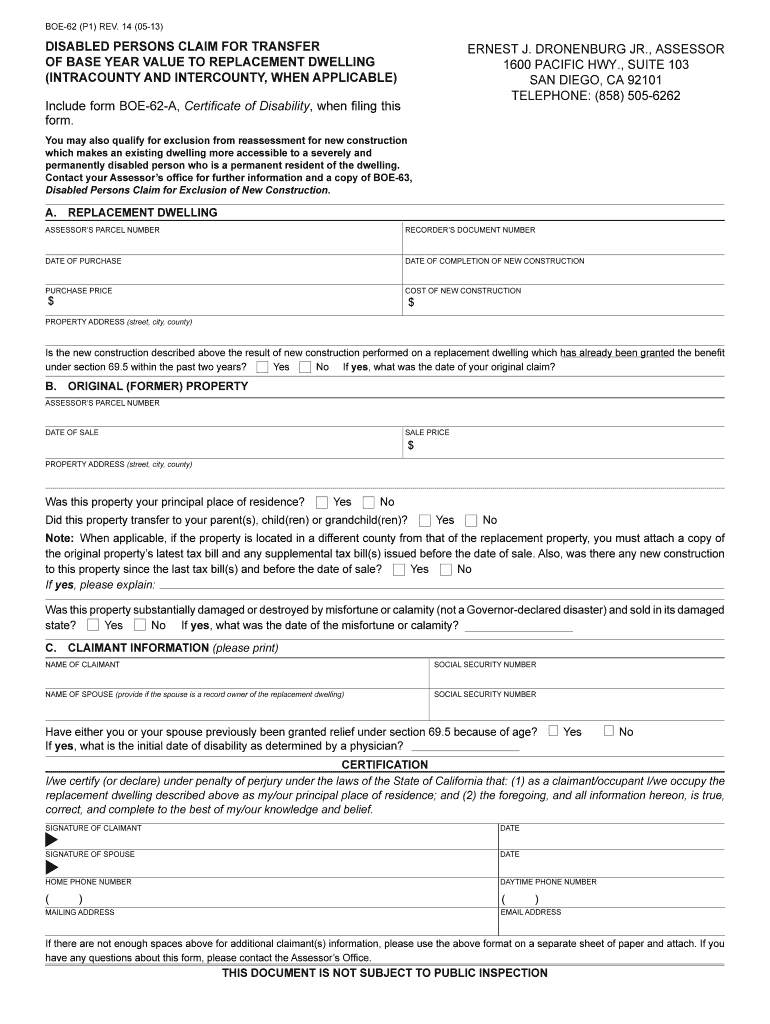

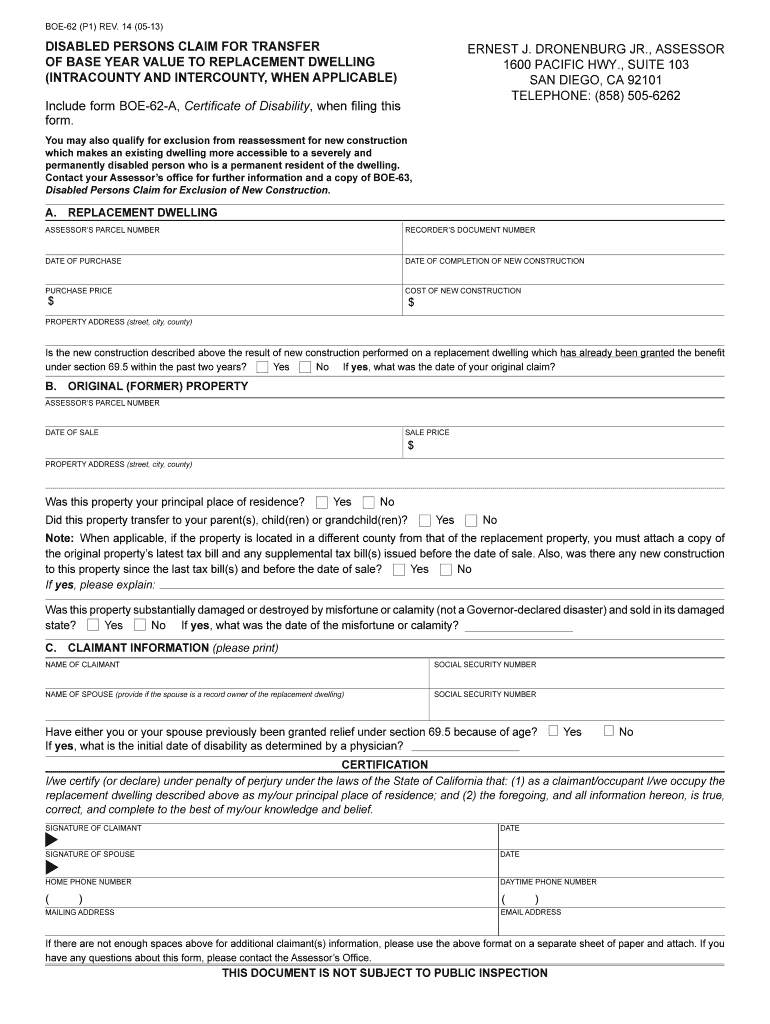

This form is used by disabled persons to claim a transfer of their property tax base year value to a replacement dwelling, including required certifications and disclosures related to the disability

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign boe-62

Edit your boe-62 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your boe-62 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit boe-62 online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit boe-62. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out boe-62

How to fill out BOE-62

01

Obtain the BOE-62 form from the California Board of Equalization website or a relevant office.

02

Fill in the taxpayer's name, address, and contact information in the designated fields.

03

Indicate the type of property being reported.

04

Provide the assessed value of the property as of the date specified on the form.

05

Include any adjustments or exemptions that apply to your situation.

06

Review all information for accuracy.

07

Sign and date the form.

08

Submit the completed BOE-62 to the appropriate county assessor's office by the regulatory deadline.

Who needs BOE-62?

01

Property owners in California who are requesting an exemption or a reduction in assessed value for their property.

02

Individuals or entities involved in the assessment process for property tax purposes.

Fill

form

: Try Risk Free

People Also Ask about

What does it mean when a title is perfected?

A quick definition of perfect title: It proves that someone has the right to control and sell the property. There are different types of titles, like clear titles that have no problems, and defective titles that have issues. A perfect title is a type of title that is good and valid without any doubts.

What is the most common deed used to transfer title to real property in California?

Today, Californians most often transfer title to real property by a simple written instrument, the grant deed. The word “grant” is expressly designated by statute as a word of conveyance. (Civil Code Section 1092) A second form of deed is the quitclaim deed.

What is non-reappraisable trust transfer sec 62d?

Section 62(d) excludes from reappraisal creation or termination of a trust in which the trustor retains the reversion and in which the interest of others does not exceed 12 years duration. It makes no difference who the trustee is.

What is form boe 19 p?

CLAIM FOR REASSESSMENT EXCLUSION FORTRANSFER BETWEEN PARENT AND CHILD OCCURRING ON OR AFTER FEBRUARY 16, 2021. = Compliance with State of California Web Accessibility Standards. 2025 - BOE-19-P.

What is the perfection of title SEC 62b?

Revenue and Taxation Code section 62(b) excludes from change in ownership a transfer for the purpose of perfecting title to the property. While the owner of the legal title to property is presumed to be the owner of the full beneficial interest, this presumption may be rebutted by clear and convincing evidence.

What is the property tax rule in California?

Property taxes are calculated based on the purchase price of the property. In California, the purchase price equals the assessed value. This value can increase every year but is capped at 2% annually.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is BOE-62?

BOE-62 is a form used by the California Board of Equalization for reporting transactions related to the use tax.

Who is required to file BOE-62?

Individuals and businesses that have purchased taxable items for use in California, but did not pay sales tax at the time of purchase, are required to file BOE-62.

How to fill out BOE-62?

To fill out BOE-62, you need to provide details about the items purchased, including descriptions, dates of purchase, and the amounts paid, along with any applicable use tax calculations.

What is the purpose of BOE-62?

The purpose of BOE-62 is to report and pay the use tax owed to the state of California for items purchased out-of-state or without paying sales tax.

What information must be reported on BOE-62?

Information that must be reported on BOE-62 includes the purchaser's name and address, the date of purchase, a description of the items, purchase amounts, and the calculated use tax owed.

Fill out your boe-62 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Boe-62 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.