WA F242-052-000 2008 free printable template

Show details

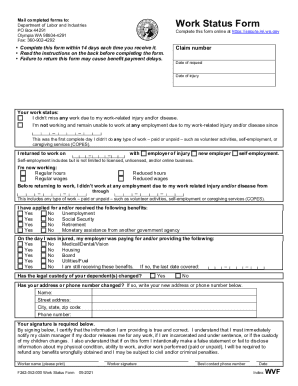

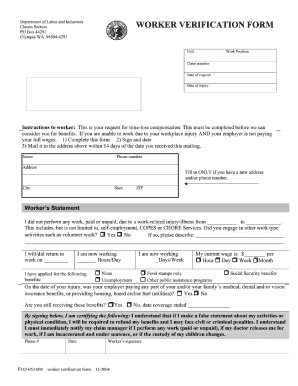

Phone Date Worker s name please print F242-052-000 worker verification form 10-2008 Worker s signature. Department of Labor and Industries Claims Section PO Box 44291 Olympia WA 98504-4291 WORKER VERIFICATION FORM Claim number Date of request Date of injury Instructions to worker Complete this form so we can consider paying time loss benefits. If you can t work due to your workplace injury or disease AND your employer is not paying your full wages 1 Fill out this form* 2 Sign and date it. 3...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign WA F242-052-000

Edit your WA F242-052-000 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your WA F242-052-000 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit WA F242-052-000 online

To use our professional PDF editor, follow these steps:

1

Log in to account. Start Free Trial and register a profile if you don't have one yet.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit WA F242-052-000. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

WA F242-052-000 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out WA F242-052-000

How to fill out WA F242-052-000

01

Obtain the WA F242-052-000 form from the official website or relevant agency.

02

Fill in the required personal information, including your name, address, and contact details.

03

Provide any necessary identification or reference numbers as specified on the form.

04

Complete the sections that require you to describe the purpose of the form and the details related to your application or request.

05

Review the form for any errors or missing information.

06

Sign and date the form where indicated.

07

Submit the form according to the instructions provided, either electronically or by mail.

Who needs WA F242-052-000?

01

Individuals or organizations needing to report specific activities or ensure compliance with Washington state regulations.

02

People applying for permits or licenses requiring documentation outlined in the WA F242-052-000 form.

03

Businesses seeking to maintain accurate records for state reporting purposes.

Fill

form

: Try Risk Free

People Also Ask about

What are the two types of verification of employment?

Employers can expect to receive two types of standardized employment verification from lenders, written verification and verbal verification. The written verification of employment is done with employers when a current or previous employee applies for a loan.

How do I verify employment without contacting employer?

What can be done to verify current employment without having to contact the current employer? The employer can request pay stubs from the employee that will show what wage they are currently earning, their current position, and employment dates.

How do you conduct an employment verification?

The number is 1-800-EMP-AUTH (1-800-367-2884).Information that can be provided includes: Dates of employment, Title (job classification), Employment history (all position, dates and salary since date of hire), Gross salary for the past two years, Year to date salary, and. Annual salary.

How do you conduct employee verification?

To obtain free employment verification of an applicant, an employer–or HR team member–will need to contact each workplace listed on the applicant's resume to determine if the applicant was employed there, how long they were employed, and the job titles held during their employment.

What is an employment verification?

An employment verification is when an employer, or a designated 3rd party such as a background check company, validates a job candidate's employment history. This article provides an overview of employment verifications for recruiting professionals.

What are the types of employment verification?

6 Types of Employment and Income Verification Documents Form I-9. Employment Verification Letter. Unemployment Verification Form. State-specific income verification form. Loss of Income Form. Paystub.

What can be asked during employment verification?

An employment verification will usually verify a candidate's title, employment dates (start and end), and occasionally salary history and job duties. Salary related questions are becoming less frequent as local laws are prohibiting those types of questions.

How can you verify if someone is working?

Contact references provided by the person on credit applications, lease applications and similar documents. A person's reference contacts, such as friends, family members and coworkers may provide information to help you verify the person's employment.

What questions are employers allowed to ask previous employers?

Why the employee left the job. Whether the employee was terminated for cause. Whether there were any issues with the employee regarding absenteeism or tardiness. Whether the employee is eligible for rehire.

How do I pass employment verification?

7 Tips for Ensuring You Pass Employment Background Checks Make sure you're well-prepared for these checks. Check your credit. Review your driving record. Be informed about banned substances. Contact former employers and ask for copies of your employment records. Research local employment laws. Beat employers to it.

What do they check for employment verification?

An employment verification will usually verify a candidate's title, employment dates (start and end), and occasionally salary history and job duties. Salary related questions are becoming less frequent as local laws are prohibiting those types of questions.

What is employment verification?

An employment verification is when an employer, or a designated 3rd party such as a background check company, validates a job candidate's employment history. This article provides an overview of employment verifications for recruiting professionals.

What are the two types of verification of employments?

Verification of Employment Requests from Lenders: Employers can expect to receive two types of standardized employment verification from lenders, written verification and verbal verification. The written verification of employment is done with employers when a current or previous employee applies for a loan.

How do you verify proof of employment?

The number is 1-800-EMP-AUTH (1-800-367-2884).Information that can be provided includes: Dates of employment, Title (job classification), Employment history (all position, dates and salary since date of hire), Gross salary for the past two years, Year to date salary, and. Annual salary.

What to ask when calling for employment verification?

Greet the contact person when he gets on the line. Ask him to verify the former employee's job title, duties, attendance and ending salary. Finish your phone conversation by asking the supervisor for his overall opinion of the worker. Ask if he would rehire the person if given the opportunity.

What questions can be asked for employment verification?

What information should be sought during employment verifications? Dates/length of employment. Job title(s) and time spent at each position within the company. Pay/wage history. Overall job performance. Reason for termination or separation. Job-related knowledge, qualifications and skills.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get WA F242-052-000?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific WA F242-052-000 and other forms. Find the template you want and tweak it with powerful editing tools.

How do I edit WA F242-052-000 online?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your WA F242-052-000 to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

How do I fill out WA F242-052-000 on an Android device?

Complete WA F242-052-000 and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

What is WA F242-052-000?

WA F242-052-000 is a form used in Washington State for reporting specific information related to business taxes or compliance.

Who is required to file WA F242-052-000?

Individuals or businesses who engage in activities that necessitate reporting under this form, typically those subject to Washington State tax regulations.

How to fill out WA F242-052-000?

To fill out WA F242-052-000, provide the required information in the designated fields on the form, ensuring accuracy and completeness before submission.

What is the purpose of WA F242-052-000?

The purpose of WA F242-052-000 is to collect essential information for tax compliance and reporting, facilitating regulatory oversight by state authorities.

What information must be reported on WA F242-052-000?

The information required includes business identification details, financial data, and other specifics as outlined in the form instructions.

Fill out your WA F242-052-000 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

WA f242-052-000 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.