Get the free Electronic Funds Transfer (EFT) Information - ryerson

Show details

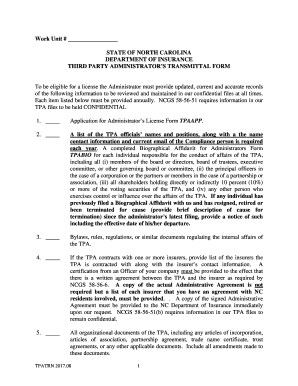

This document is used to collect information necessary for making direct deposits to an organization from Ryerson University, including required supplier and banking information along with authorization

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign electronic funds transfer eft

Edit your electronic funds transfer eft form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your electronic funds transfer eft form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit electronic funds transfer eft online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit electronic funds transfer eft. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out electronic funds transfer eft

How to fill out Electronic Funds Transfer (EFT) Information

01

Gather necessary bank information, including account number and routing number.

02

Log in to the relevant online portal or application.

03

Navigate to the section for Electronic Funds Transfer (EFT) Information.

04

Select the option to add or update your EFT details.

05

Input your bank account number accurately.

06

Enter the correct routing number provided by your bank.

07

Review the information entered to ensure it is correct.

08

Submit the completed EFT form for processing.

Who needs Electronic Funds Transfer (EFT) Information?

01

Individuals receiving government benefits.

02

Businesses processing payroll for employees.

03

Freelancers and contractors receiving payments.

04

Companies conducting regular transactions with vendors.

Fill

form

: Try Risk Free

People Also Ask about

What is an example of an EFT?

An example of an EFT is when your company uses direct deposit to send your paycheck into your bank account. Instead of giving you a physical check, the employer transfers the funds electronically from their bank to the employee's account. This method is efficient, secure, and eliminates the need for manual deposits.

What is the difference between EFT and Etransfer?

Interac e-Transfers are one of the quickest ways to send money to another person or to yourself, with funds typically arriving in under 30 minutes. Money sent through e-Transfers are available immediately, unlike EFTs, which can be subject to a hold period.

What is an EFT?

What is an EFT payment? An electronic funds transfer (EFT), or direct deposit, is a digital money movement from one bank account to another. These transfers take place independently from bank employees. As a digital transaction, there is no need for paper documents.

What is EFT and how does it work?

Depending on what bank or financial institution you use, EFT information can generally be found online (and downloaded or printed) when you log into your account. Examples for a few different institutions can be found below.

What is an example of an EFT payment?

Other transaction types that are considered EFT include direct deposit, ATMs, virtual cards, e-Checks (used globally), peer-to-peer payments, and personal computer banking. As traditional paper processes become digitized, computerized systems like EFT transactions will continue to grow and evolve.

How does electronic funds transfer (EFT) work?

Electronic funds transfer (EFT) is the transfer of money from one bank account to another, either within a single financial institution or across multiple institutions, via computer-based systems.

What is EFT and how does it work?

What is an EFT? Electronic funds transfers (EFTs) are transactions that move funds electronically between different financial institutions, bank accounts, or individuals. EFTs are frequently referred to as electronic bank transfers, e-checks, or electronic payments.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Electronic Funds Transfer (EFT) Information?

Electronic Funds Transfer (EFT) Information refers to data related to the electronic transfer of money from one bank account to another, which can include transactions such as direct deposits, wire transfers, and electronic bill payments.

Who is required to file Electronic Funds Transfer (EFT) Information?

Entities that make tax payments or contributions as required by federal or state regulations, especially businesses and employers who process payroll and other tax-related payments, are required to file Electronic Funds Transfer (EFT) Information.

How to fill out Electronic Funds Transfer (EFT) Information?

To fill out Electronic Funds Transfer (EFT) Information, one must provide details such as the payer's information, the payee's banking information, the amount of the transfer, payment type, and the date of the transaction. Specific forms may vary based on regulatory requirements.

What is the purpose of Electronic Funds Transfer (EFT) Information?

The purpose of Electronic Funds Transfer (EFT) Information is to ensure the secure and efficient processing of electronic payments and to provide necessary records for compliance with tax laws and regulations.

What information must be reported on Electronic Funds Transfer (EFT) Information?

The information that must be reported includes the payer's name and Tax Identification Number (TIN), the amount of the deposit, the date of the transaction, and the type of payment (e.g., federal tax deposit), as well as any other details required by the relevant tax authority.

Fill out your electronic funds transfer eft online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Electronic Funds Transfer Eft is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.