Get the free 1031 EXCHANGE BASICS - iqcustus

Show details

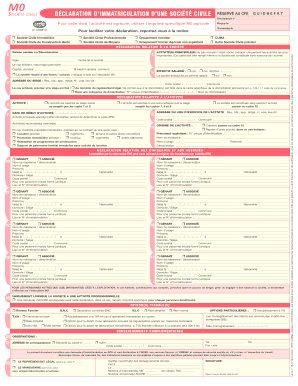

1031 EXCHANGE BASICS 1031 EXCHANGE BASICS CALDWELL BANKER COMMERCIAL 1031 EXCHANGE BASICS The 1031 Exchange is commonly used tool for real estate investors to defer taxes on gain in the sale of a

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 1031 exchange basics

Edit your 1031 exchange basics form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 1031 exchange basics form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 1031 exchange basics online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit 1031 exchange basics. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 1031 exchange basics

How to fill out 1031 exchange basics:

01

Research and understand the concept of a 1031 exchange: Begin by familiarizing yourself with the basic principles and rules of a 1031 exchange. This includes understanding the purpose of a 1031 exchange, the types of properties that qualify, and the timeline and deadlines involved.

02

Consult with a qualified intermediary: To ensure a smooth and compliant 1031 exchange process, it is crucial to work with a qualified intermediary. These professionals specialize in facilitating 1031 exchanges and will guide you through the necessary paperwork, deadlines, and requirements.

03

Identify a qualified relinquished property: The relinquished property is the property you currently own and plan to sell as part of the 1031 exchange. It must be held for investment or business purposes, and certain types of properties, such as personal residences, do not qualify.

04

Find a suitable replacement property: Once you have sold your relinquished property, you have a limited timeframe to identify and acquire a replacement property. Take the time to carefully search for a property that meets your investment goals and satisfies the regulations of a 1031 exchange.

05

Ensure equal or greater value: One of the most crucial aspects of a 1031 exchange is the requirement to acquire a replacement property that is equal or greater in value than the relinquished property. Be mindful of this requirement and work closely with your qualified intermediary to meet this criteria.

06

Complete the necessary paperwork: To document your 1031 exchange, you will need to complete various forms, such as the IRS Form 8824. Consult with your qualified intermediary or tax professional to ensure all paperwork is accurately filled out and submitted within the specified deadlines.

Who needs 1031 exchange basics:

01

Real estate investors: 1031 exchanges are primarily used by real estate investors who aim to defer capital gains taxes when buying and selling investment properties. Having a solid understanding of 1031 exchange basics is essential for investors looking to take advantage of this tax-saving strategy.

02

Business owners: Business owners who own real estate assets as part of their business operations may also benefit from understanding 1031 exchange basics. By exchanging properties instead of selling and repurchasing, they can defer the tax liability and potentially increase their real estate portfolio.

03

Tax and financial professionals: Tax advisors, accountants, and financial professionals who work with clients involved in real estate transactions should have a firm grasp of 1031 exchange basics. This knowledge allows them to offer informed advice and assistance to their clients, ensuring they navigate the exchange process correctly.

04

Those considering real estate investments: Even individuals who are contemplating entering the world of real estate investment can benefit from learning about 1031 exchange basics. Understanding this tax strategy can help them make informed decisions when considering purchasing or selling investment properties.

Overall, anyone involved in real estate transactions or interested in real estate investments should familiarize themselves with the basics of a 1031 exchange. It is a valuable tool in deferring capital gains taxes and maximizing investment opportunities.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my 1031 exchange basics in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your 1031 exchange basics and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

Can I edit 1031 exchange basics on an iOS device?

Use the pdfFiller mobile app to create, edit, and share 1031 exchange basics from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

How do I fill out 1031 exchange basics on an Android device?

On an Android device, use the pdfFiller mobile app to finish your 1031 exchange basics. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

What is 1031 exchange basics?

A 1031 exchange allows an investor to defer paying capital gains taxes on the sale of an investment property if the proceeds are reinvested in a similar property.

Who is required to file 1031 exchange basics?

Any investor who sells an investment property and wishes to defer capital gains taxes by participating in a 1031 exchange is required to file.

How to fill out 1031 exchange basics?

To fill out a 1031 exchange, an investor must work with a qualified intermediary to facilitate the exchange and ensure all IRS requirements are met.

What is the purpose of 1031 exchange basics?

The purpose of a 1031 exchange is to encourage investment in real estate by allowing investors to defer capital gains taxes and reinvest in similar properties.

What information must be reported on 1031 exchange basics?

Information on the original property sold, the replacement property acquired, and the timeline of the exchange process must be reported on a 1031 exchange form.

Fill out your 1031 exchange basics online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

1031 Exchange Basics is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.