Get the free Investment Bond full or partial surrender Request bformb - Eames Laurie

Show details

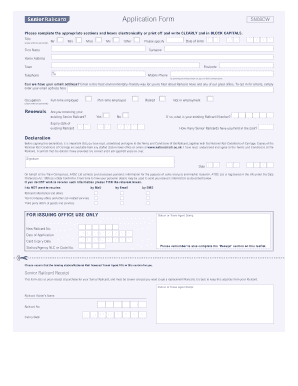

Investment Bond

full or partial surrender

Request form

For use with Zurich Investment Bonds only

Alternatives to cancelling your bond offers alternatives to cancelling; for example,

a partial withdrawal

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign investment bond full or

Edit your investment bond full or form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your investment bond full or form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing investment bond full or online

To use our professional PDF editor, follow these steps:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit investment bond full or. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out investment bond full or

How to fill out an investment bond:

01

Gather the necessary information: Before filling out the investment bond, make sure you have all the required information such as your personal details, investment amount, investment objectives, and any specific instructions or preferences.

02

Read the instructions: Carefully read the instructions provided with the investment bond. It will guide you through the process and highlight any specific sections or fields that need attention.

03

Provide personal details: Start by providing your personal information such as your full name, address, contact details, and social security number. This will help identify you as the investor and ensure accurate record-keeping.

04

Specify the investment amount: Indicate the amount of money you wish to invest in the bond. Be sure to double-check the currency and decimal points to avoid any errors.

05

Outline investment objectives: Clearly state your investment objectives for the bond. Are you looking for long-term growth, income, capital preservation, or a combination of these? This information will assist in allocating your investments appropriately.

06

Select investment options: The investment bond may offer various investment options such as stocks, bonds, mutual funds, or ETFs. Choose the options that align with your investment goals and risk tolerance. Consider seeking advice from a financial professional if you are unsure.

07

Review and sign: Once you have completed all the necessary sections, carefully review the form to ensure accuracy. Cross-check your personal details, investment amount, and instructions. Finally, sign the investment bond as required.

Who needs an investment bond:

01

Individuals seeking long-term financial stability: Investment bonds can be ideal for individuals who are planning for their retirement or want to ensure financial stability in the future. These bonds offer an opportunity to grow your wealth over time.

02

Investors looking for tax advantages: Depending on the jurisdiction, investment bonds may provide certain tax benefits. Individuals seeking to reduce their tax liabilities may find investment bonds beneficial.

03

Those seeking a diversified investment portfolio: Investment bonds often allow investors to choose from a range of investment options. This diversity can help spread risk and potentially enhance returns.

04

High net worth individuals: Investment bonds may be appealing to high net worth individuals who are looking for investment opportunities beyond traditional offerings like stocks and real estate.

05

Individuals with a long-term investment horizon: Investment bonds are generally designed for long-term investment. If you have a long-term investment horizon, an investment bond may be suitable.

Remember, it's always recommended to consult a financial advisor or professional before making any investment decisions to ensure it aligns with your individual circumstances and risk tolerance.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is investment bond full or?

An investment bond full or is a type of financial instrument that combines features of a bond and an investment.

Who is required to file investment bond full or?

Investors who have purchased or sold investment bonds are required to file investment bond full or.

How to fill out investment bond full or?

To fill out an investment bond full or, investors must provide detailed information about their investment transactions.

What is the purpose of investment bond full or?

The purpose of investment bond full or is to report investment transactions to the appropriate authorities for tax and regulatory compliance.

What information must be reported on investment bond full or?

Information such as the date of purchase/sale, amount invested, interest earned, and any capital gains or losses must be reported on investment bond full or.

How can I modify investment bond full or without leaving Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like investment bond full or, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How can I get investment bond full or?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific investment bond full or and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

Can I create an eSignature for the investment bond full or in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your investment bond full or right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

Fill out your investment bond full or online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Investment Bond Full Or is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.