Get the free Simon Fraser University Carbon Tax Calculation Form 2010 - sfu

Show details

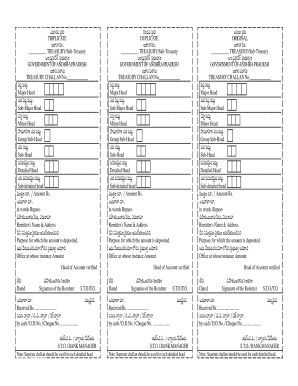

Calculation of carbon tax paid by the organization for fuel purchased in 2010, including detailed tax rates and total claims.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign simon fraser university carbon

Edit your simon fraser university carbon form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your simon fraser university carbon form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit simon fraser university carbon online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit simon fraser university carbon. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out simon fraser university carbon

How to fill out Simon Fraser University Carbon Tax Calculation Form 2010

01

Obtain the Simon Fraser University Carbon Tax Calculation Form 2010 from the university's website or administration office.

02

Review the instructions provided on the form carefully to understand the required sections.

03

Fill in your personal and contact information at the top of the form.

04

Calculate your energy consumption by gathering data on your usage of fuel sources such as natural gas, gasoline, and electricity for the specified measurement period.

05

Use the carbon tax rates provided on the form to calculate the tax owed based on your energy consumption figures.

06

Input your calculated carbon tax into the designated section of the form.

07

Complete any additional sections that may require further information or calculations, such as exemptions or deductions.

08

Review the entire form for accuracy and completeness.

09

Sign and date the form to certify that the information provided is true and accurate.

10

Submit the completed form to the appropriate department as indicated on the form.

Who needs Simon Fraser University Carbon Tax Calculation Form 2010?

01

Students and staff at Simon Fraser University who are required to report and calculate their carbon tax obligations related to energy consumption.

02

Departments within the university that are involved in budgeting and financial planning concerning environmental tax obligations.

Fill

form

: Try Risk Free

People Also Ask about

Who pays the highest carbon tax?

France and Canada Lead in Global Carbon Tax Revenue CountryGovernment revenue in 2022 ($ billions) ?? France $8.9 ?? Canada $7.8 ?? Sweden $2.3 ?? Norway $2.111 more rows • Apr 16, 2024

Is the GHG Protocol mandatory?

The International Financial Reporting Standard (IFRS) was issued by ISSB and requires GHG emission reporting in IFRS S2 Climate-related Disclosures. The IFRS S2 requires companies to use the GHG Protocol to measure GHG emissions to the extent that it does not conflict with IFRS S2 requirements.

What is the carbon air tax?

A carbon tax is a tax imposed on releases of carbon dioxide (CO2), which is emitted largely through the combustion of fossil fuels used in electricity production; industrial, commercial, and residential heating; and transportation.

How much is the carbon tax in Canada?

Canada's carbon levy started in 2019 at C$20 per tonne and went up by $10 a year to $50 in 2022. It's now increasing by $15 a year until 2030, when it will reach $170 per tonne.

What is a carbon tax?

A carbon tax is levied on the carbon content of fossil fuels. The term can also refer to taxing other types of greenhouse gas emissions, such as methane. A carbon tax puts a price on those emissions to encourage consumers, businesses, and governments to produce less of them.

What was the carbon tax in 2008?

On 19 February 2008, British Columbia announced its intention to implement a carbon tax of $10 per tonne of carbon dioxide equivalent (CO2e) emissions (2.41 cents per litre on gasoline) beginning 1 July 2008, the first North American jurisdiction to implement such a tax.

What is the carbon tax in Fraser Institute report?

According to a 2021 study published by the Fraser Institute, a $170 per tonne carbon tax (the level its's slated to reach in 2030) would impose significant costs on Canada's economy, causing a 1.8 per cent drop in GDP and the loss of about 185,000 jobs nationwide.

What is the carbon climate tax?

A carbon tax is a tax levied on the carbon emissions from producing goods and services. Carbon taxes are intended to make visible the hidden social costs of carbon emissions. They are designed to reduce greenhouse gas emissions by essentially increasing the price of fossil fuels.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Simon Fraser University Carbon Tax Calculation Form 2010?

The Simon Fraser University Carbon Tax Calculation Form 2010 is a document used by the university to calculate and report carbon taxes owed based on greenhouse gas emissions related to its operations.

Who is required to file Simon Fraser University Carbon Tax Calculation Form 2010?

All departments and units within Simon Fraser University that generate greenhouse gas emissions and are subject to carbon tax regulations are required to file the Simon Fraser University Carbon Tax Calculation Form 2010.

How to fill out Simon Fraser University Carbon Tax Calculation Form 2010?

To fill out the Simon Fraser University Carbon Tax Calculation Form 2010, one must gather relevant data on carbon emissions, calculate the carbon tax owed using the specified rates, and then complete all sections of the form accurately before submitting it to the appropriate office.

What is the purpose of Simon Fraser University Carbon Tax Calculation Form 2010?

The purpose of the Simon Fraser University Carbon Tax Calculation Form 2010 is to ensure compliance with carbon tax regulations, promote accountability in carbon emissions reporting, and contribute to the university's sustainability goals.

What information must be reported on Simon Fraser University Carbon Tax Calculation Form 2010?

The Simon Fraser University Carbon Tax Calculation Form 2010 must report information such as the total greenhouse gas emissions, applicable carbon tax rates, total carbon tax payable, and any relevant exemptions or deductions.

Fill out your simon fraser university carbon online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Simon Fraser University Carbon is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.