Get the free Employer / Employee

Show details

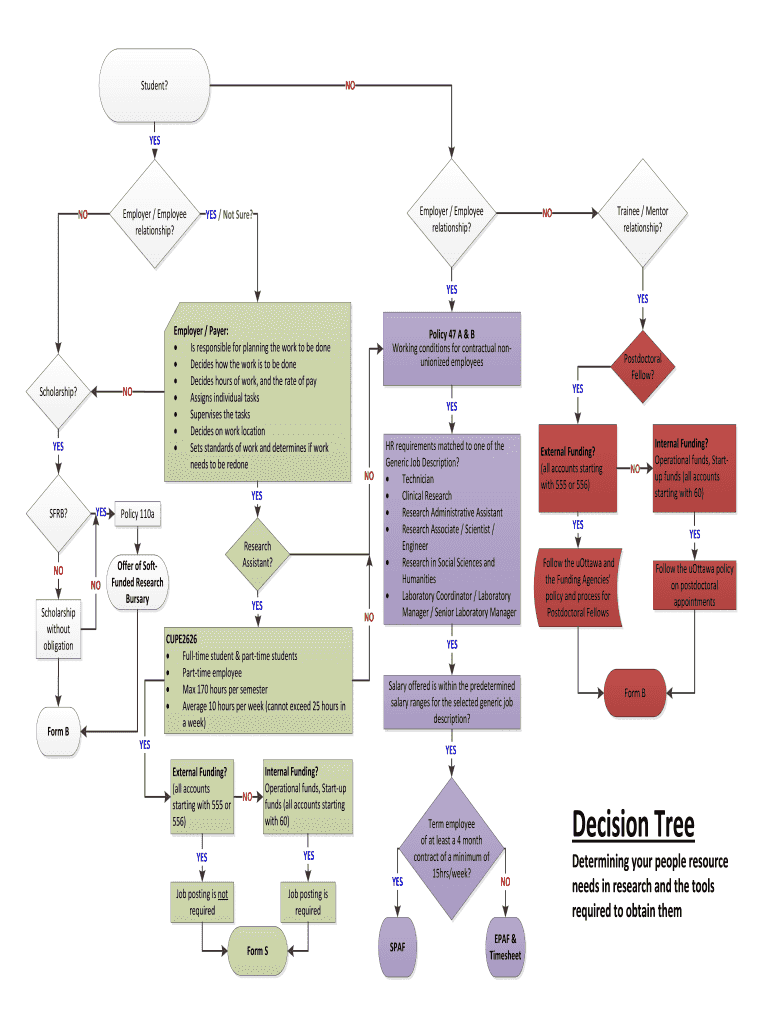

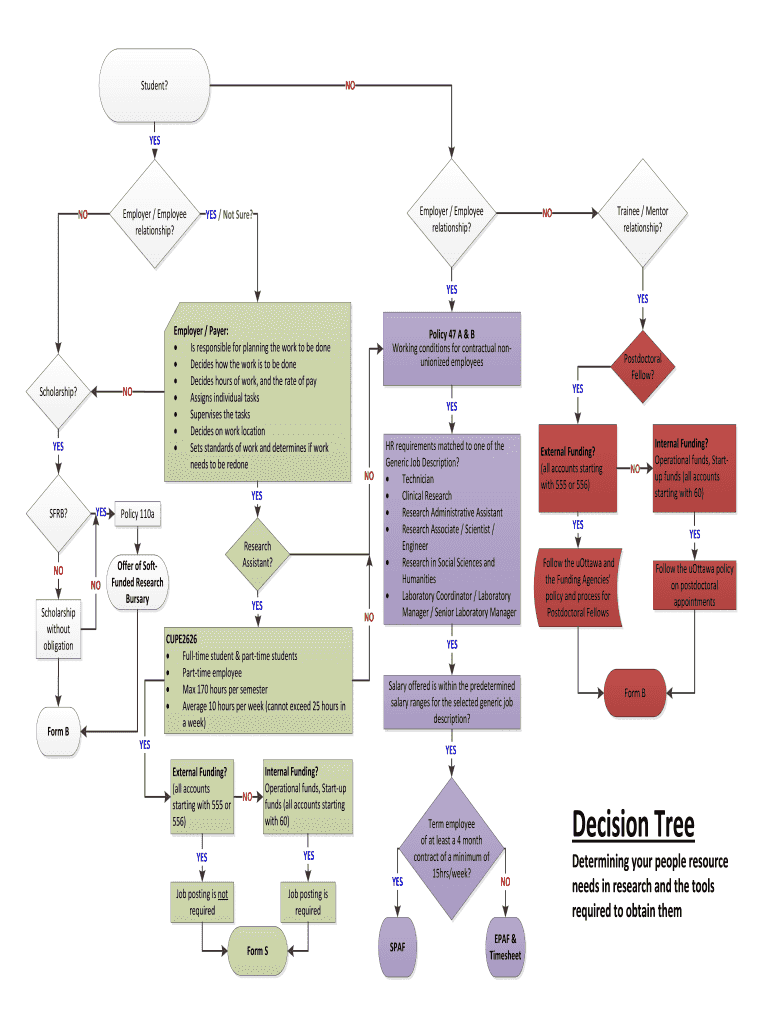

Student?NOYESEmployer / Employee relationship? Employer / Employee relationship?YES / Not Sure? Trainee / Mentor relationship?NOYESScholarship? Employer / Payer: Is responsible for planning the work

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign employer employee

Edit your employer employee form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your employer employee form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit employer employee online

To use our professional PDF editor, follow these steps:

1

Log in to account. Click on Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit employer employee. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out employer employee

How to fill out employer employee:

01

Gather necessary information: Before filling out the employer employee form, make sure you have all the required information handy. This may include the employee's personal details, such as their full name, contact information, Social Security number, and date of birth, as well as the employer's information, such as their name, address, and federal employer identification number (FEIN).

02

Determine employment status: Identify whether the employee will be classified as a regular employee, temporary worker, contractor, or any other employment category. This is important for accurate reporting and tax purposes.

03

Complete general employee information: Start by providing the basic employee details, such as their full name, home address, contact number, and email address. Additionally, include their work designation, job title, and department.

04

Fill in tax-related information: Make sure to include the employee's Social Security number (SSN) or tax identification number (TIN). This is crucial for payroll and tax purposes. You may also need to collect their bank account details for direct deposit purposes.

05

Establish payroll details: Specify the employee's pay frequency (weekly, biweekly, monthly, etc.), their hourly wage or salary, as well as any additional bonuses, commissions, or allowances they may be eligible for. Additionally, provide the starting date of employment and any probationary period if applicable.

06

Determine tax withholding: Based on the employee's tax status (single, married, etc.) and the number of allowances they claim, calculate the appropriate federal and state tax withholdings. You may need to refer to tax tables or consult a tax professional for accuracy.

07

Include benefit information: If the employer offers any employee benefits, such as health insurance, retirement plans, or paid time off, make sure to mention them on the form. Provide details about the specific benefits the employee is eligible for and the corresponding deductions or premiums, if any.

08

Obtain employee signature: Once you have filled out all the necessary information, have the employee review the form and sign it. This confirms that they have provided accurate details and understand their rights and responsibilities as an employee.

Who needs employer employee?

01

Employers: Employers, including small business owners and large corporations, require employer employee forms to establish a legal and contractual relationship with their workers. This helps in maintaining accurate records, complying with tax regulations, and ensuring proper payment of wages.

02

Human Resources (HR) departments: HR departments within organizations are responsible for managing the hiring process, onboarding new employees, and maintaining employee records. They need employer employee forms to collect and document all the necessary details required for payroll, benefits administration, and legal compliance.

03

Employees: While employees do not create the employer employee form, they play a crucial role in providing accurate and complete information. This helps in ensuring that they receive their rightful compensation and benefits, as well as complying with legal requirements like tax withholdings.

In conclusion, filling out the employer employee form requires gathering relevant information, determining employment status, providing personal and tax details, establishing payroll and benefit information, obtaining necessary signatures, and ensuring accuracy and compliance. The form is needed by employers, HR departments, and employees themselves to establish a legal and contractual relationship and maintain proper employment records.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send employer employee to be eSigned by others?

When your employer employee is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How do I edit employer employee in Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your employer employee, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

How do I edit employer employee on an iOS device?

Create, edit, and share employer employee from your iOS smartphone with the pdfFiller mobile app. Installing it from the Apple Store takes only a few seconds. You may take advantage of a free trial and select a subscription that meets your needs.

What is employer employee?

An employer-employee relationship is when an individual works for a company as an employee under an employment contract.

Who is required to file employer employee?

Employers are required to file employer-employee information with the appropriate government agencies.

How to fill out employer employee?

Employer-employee information can usually be filled out online through the government's reporting portal or through specific forms provided by the agency.

What is the purpose of employer employee?

The purpose of filing employer-employee information is to ensure compliance with labor laws, tax regulations, and to provide accurate data for government records.

What information must be reported on employer employee?

Employer-employee information typically includes details such as employee wages, hours worked, benefits, and tax withholdings.

Fill out your employer employee online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Employer Employee is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.