Get the free CASH RECEIPT TRANSMITTAL FORM - imamuseum

Show details

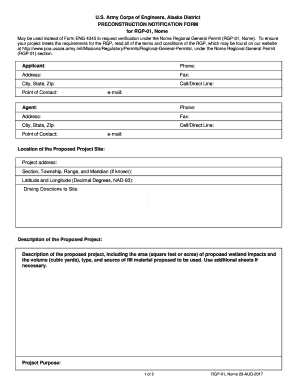

This form is used to record and transmit cash, checks, and charges to the finance office for processing. It includes sections for date, affiliate group, program/event, and various financial details

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign cash receipt transmittal form

Edit your cash receipt transmittal form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your cash receipt transmittal form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit cash receipt transmittal form online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit cash receipt transmittal form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out cash receipt transmittal form

How to fill out CASH RECEIPT TRANSMITTAL FORM

01

Obtain a copy of the CASH RECEIPT TRANSMITTAL FORM from the appropriate source.

02

Fill in the date of the transaction at the top of the form.

03

Enter the name of the person or entity making the payment.

04

Indicate the purpose of the cash receipt in the designated section.

05

Record the amount of cash being transmitted.

06

List any checks or other payment methods used, if applicable.

07

Include the total amount of cash and checks transmitted.

08

Sign and date the form at the bottom.

09

Keep a copy of the form for your records once it is completed.

Who needs CASH RECEIPT TRANSMITTAL FORM?

01

Individuals or entities that receive cash payments and need to document the transmittal of those funds.

02

Accountants or finance personnel responsible for managing cash transactions.

03

Organizations required to keep financial records for auditing or compliance purposes.

Fill

form

: Try Risk Free

People Also Ask about

What is a cash receipt form?

A cash receipt is a document that shows evidence of a cash transaction. It should show the specific amount transferred between the parties and an itemized list of goods and services provided.

In what forms can cash receipts be made?

Recording Cash Receipts procedure This could be in the form of cash, check, electronic transfer, or credit card payment. Provide the customer with a receipt that includes details such as the date, amount received, method of payment, and a brief description of the transaction.

How to fill out a cash receipt form?

Every receipt you issue should include: Date of the transaction. A clear description of the products or services provided. Itemized pricing. Total amount paid. Method of payment (cash, card, etc.)

What is a cash transmittal?

Cash Receipts Transmittal Form Instructions This form should capture all income from cash and checks received for each deposit to a banking institution. Each deposit account, such as Extension District Board, Councils, Clubs, etc., should have its own form.

What is an example of a cash receipt transaction?

Examples of cash receipts could include fees collected by a lawyer, deposits made toward the purchase of a home and refundable airline tickets bought by a customer and returned after their flights are cancelled. Cash receipts can come from the sale of goods instead of services as well.

What is a proof of cash receipts?

Proof of Cash is a financial process used to verify a company's cash and cash equivalents by reconciling accounting records with actual cash balances and activities during a specific period. This ensures that reported cash matches the physical cash on hand without discrepancies.

What is a cash receipt?

A cash receipt is a document that shows evidence of a cash transaction. It should show the specific amount transferred between the parties and an itemized list of goods and services provided.

What is the purpose of CRJ?

One of these journals is called a cash journal and is a “diary” of all the cash transactions of the business. A Cash Receipts Journal (CRJ) is used to record all cash received. A Cash Payments Journal (CPJ) is used to record all cash paid. In the CPJ, the Bank account is always credited because assets decreased.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is CASH RECEIPT TRANSMITTAL FORM?

The Cash Receipt Transmittal Form is a document used to report and summarize cash receipts for a specific period. It provides a formal record of cash transactions received by an organization.

Who is required to file CASH RECEIPT TRANSMITTAL FORM?

Typically, organizations or departments that handle cash transactions or receive payments must file the Cash Receipt Transmittal Form to ensure accurate accounting and auditing.

How to fill out CASH RECEIPT TRANSMITTAL FORM?

To fill out the Cash Receipt Transmittal Form, enter the organization’s details, the date of the transaction, the amount of cash received, the purpose of the receipt, and any other required information such as account numbers. Ensure all calculations are accurate and double-check for completeness before submission.

What is the purpose of CASH RECEIPT TRANSMITTAL FORM?

The purpose of the Cash Receipt Transmittal Form is to maintain accurate records of cash inflow, facilitate tracking of income for accounting purposes, and provide documentation for audits and financial reporting.

What information must be reported on CASH RECEIPT TRANSMITTAL FORM?

The information that must be reported on the Cash Receipt Transmittal Form typically includes the date of cash receipt, source of the cash, amount received, purpose of the cash collection, name of the person handling the transaction, and any relevant account numbers.

Fill out your cash receipt transmittal form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Cash Receipt Transmittal Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.