Get the free Application for Residence Homestead Exemption

Show details

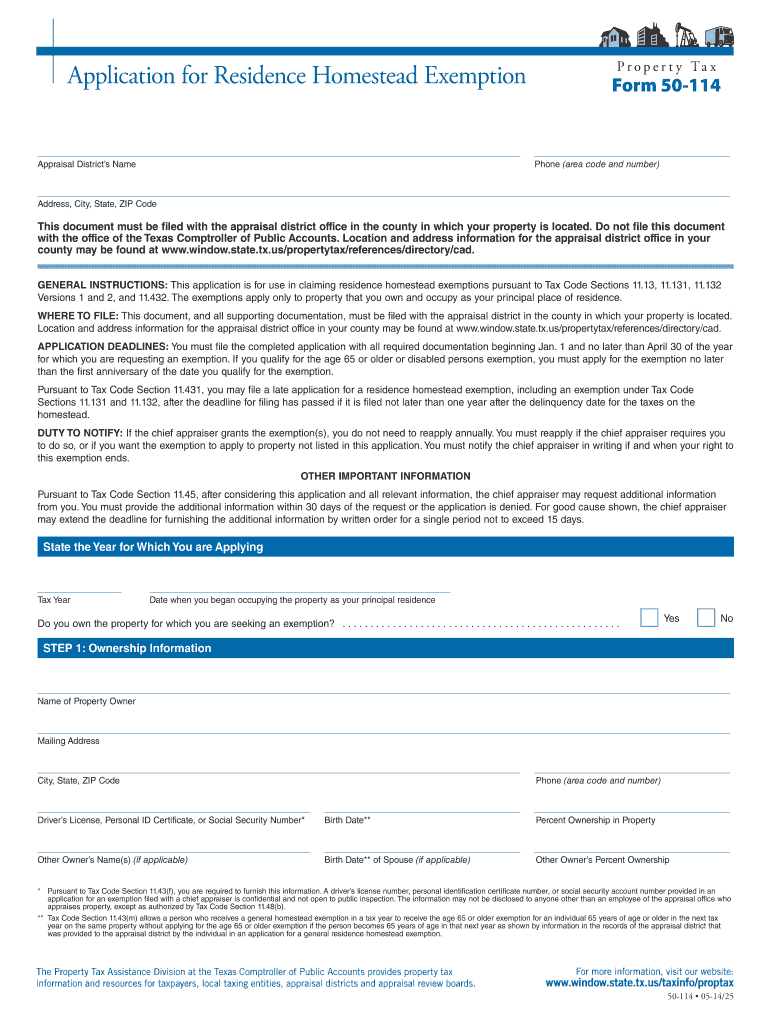

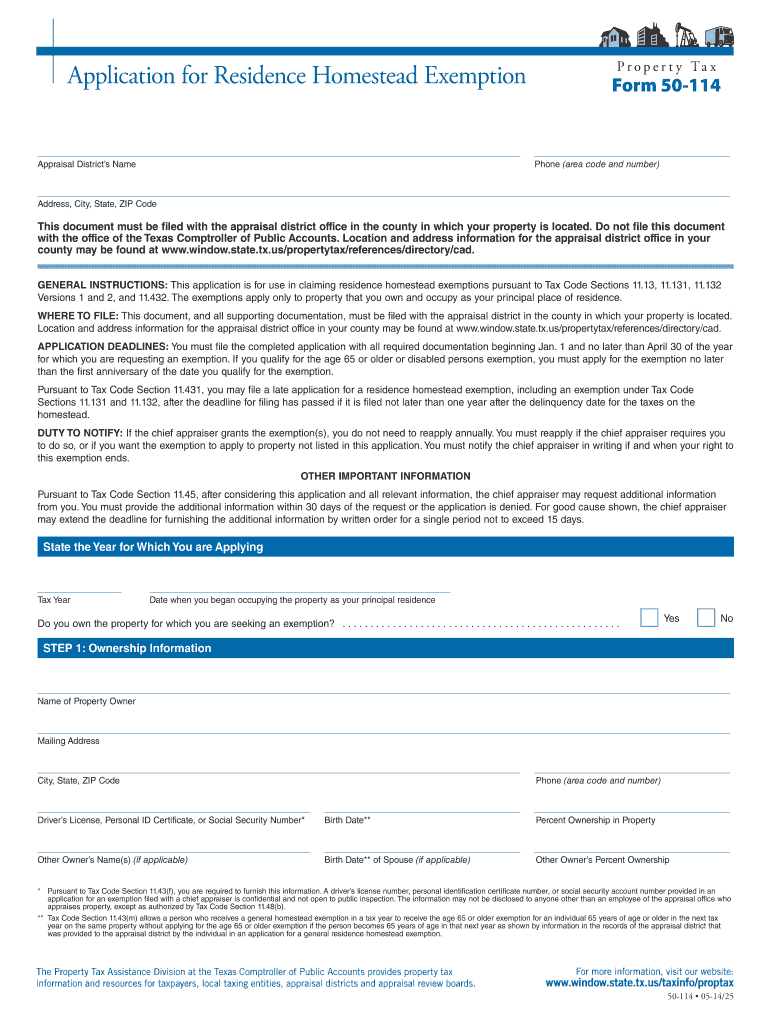

This document is used to apply for residence homestead exemptions in Texas, allowing homeowners to claim property tax exemptions on their principal residence.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign application for residence homestead

Edit your application for residence homestead form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your application for residence homestead form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing application for residence homestead online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit application for residence homestead. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out application for residence homestead

How to fill out Application for Residence Homestead Exemption

01

Obtain the Application for Residence Homestead Exemption form from your local tax assessor's office or their website.

02

Fill out personal information such as name, address, and contact details.

03

Provide information about the property including its legal description and tax identification number.

04

Indicate the date you moved into the property as your primary residence.

05

Attach any required documentation to prove residency, such as utility bills or a driver's license.

06

Review the completed application for accuracy.

07

Submit the application to the appropriate tax authority by the specified deadline.

Who needs Application for Residence Homestead Exemption?

01

Homeowners who occupy their property as their primary residence.

02

Individuals seeking to reduce their property tax burden.

03

People who meet specific eligibility criteria set by local tax authorities.

Fill

form

: Try Risk Free

People Also Ask about

How to file a homestead exemption in CA?

California's Homestead Exemption is generous, but declaring a homestead protects equity for voluntary sales or refinancing Complete a homestead declaration form. Sign your declaration in front of a notary. Record the homestead declaration form with your county recorder's office.

What makes a property a homestead in Texas?

An urban homestead in Texas lets a family or single adult claim one or more contiguous lots in a city or town that is 10 acres or less. The property must either be their home or both their home and a business that is run by the property owner.

How long does it take for a homestead exemption to be approved in Texas?

Check the Status of Your Application Note: Applications will be processed in the order they are received. We strive to process exemptions as quickly as possible, but at times processing could take up to 90 days to process, per Texas Property Tax Code Section 11.45.

How much of a discount do you get for homestead exemption in Texas?

Any taxing unit can exempt up to 20 percent of the value of each qualified homestead. No matter what percentage of value the taxing unit adopts, the dollar value of the exemption must be at least $5,000.

What is required to file a homestead exemption in Texas?

REQUIRED DOCUMENTATION Attach a copy of each property owner's driver's license or state-issued personal identification certificate. The address listed on the driver's license or state-issued personal identification certificate must correspond to the property address for which the exemption is requested.

What documents do I need to file a homestead exemption in Texas?

An heir property owner not specifically identified as the residence homestead owner on a deed or other recorded instrument in the county where the property is located must provide: • an affidavit establishing ownership of interest in the property (see Form 50-114-A); • a copy of the prior property owner's death

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Application for Residence Homestead Exemption?

The Application for Residence Homestead Exemption is a form that property owners file to qualify for a property tax exemption on their primary residence, reducing the amount of property taxes owed.

Who is required to file Application for Residence Homestead Exemption?

Property owners who occupy their property as their primary residence and wish to claim a homestead exemption must file this application.

How to fill out Application for Residence Homestead Exemption?

To fill out the application, provide personal information such as your name, address, and details about the property. Follow the instructions on the form carefully and submit it to the appropriate tax authority.

What is the purpose of Application for Residence Homestead Exemption?

The purpose of the application is to allow homeowners to claim a tax exemption, resulting in reduced property taxes, which provides financial relief to homeowners.

What information must be reported on Application for Residence Homestead Exemption?

The application typically requires information such as the homeowner's name, property address, the date of occupancy, and any other relevant details that verify the property as the homeowner's primary residence.

Fill out your application for residence homestead online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Application For Residence Homestead is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.