Get the free MOTOR FUEL TAX RETURN – PROPANE inventory - sbr gov bc

Show details

This document is used for reporting the propane inventory under the Motor Fuel Tax Act for the specified period.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign motor fuel tax return

Edit your motor fuel tax return form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your motor fuel tax return form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit motor fuel tax return online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit motor fuel tax return. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

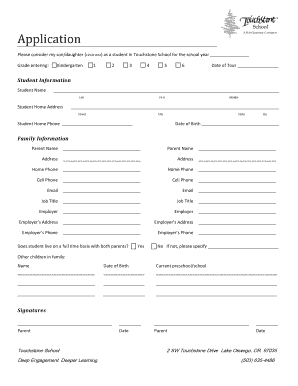

How to fill out motor fuel tax return

How to fill out MOTOR FUEL TAX RETURN – PROPANE inventory

01

Gather all necessary documents related to propane purchases and sales.

02

Calculate the total gallons of propane purchased during the reporting period.

03

List each purchase with corresponding dates, supplier names, and quantities.

04

Calculate the total gallons sold to end-users during the reporting period.

05

Ensure you have records of exempt sales, if applicable, and document them.

06

Complete the Motor Fuel Tax Return form with the calculated totals.

07

Double-check for accuracy and ensure no items are omitted.

08

Submit the completed form to the relevant tax authority by the due date.

Who needs MOTOR FUEL TAX RETURN – PROPANE inventory?

01

Propane retailers and distributors who are required to report their propane inventory.

02

Businesses that sell propane for non-taxable uses and need to account for exempt sales.

03

Companies involved in the wholesale distribution of propane.

04

Businesses that handle significant quantities of propane and must comply with local tax regulations.

Fill

form

: Try Risk Free

People Also Ask about

Who has the highest fuel tax?

The total tax. burden on gasoline from these various taxes and fees varies significantly for drivers across the US. California levies the highest tax on gasoline at 70.9 cents per gallon (cpg), followed by Illinois at 66.4 cpg and Washington at 59.0 cpg.

Which country has the highest tax on fuel?

The Netherlands has the highest gas tax. in the EU at €0.789 per liter ($3.23 per gallon), followed by Italy at €0.728 per liter ($2.98 per gallon) and Greece at €0.700 per liter ($2.86 per gallon).

Is there PST on utilities in BC?

Provincial Sales Tax (PST) A PST exemption on electricity charges is automatically available for residential customers. For business customers, electricity charges are no longer subject to PST effective April 1, 2019.

Is there PST on propane in BC?

Note: Propane for any use is exempt from PST but is subject to motor fuel tax and, in some cases, the 0.4% ICE Fund Tax. Propane is exempt from motor fuel tax when purchased for residential use in a residential dwelling if certain criteria are met. For more information, see Bulletin MFT 014, Propane Exemptions.

Which items are PST exempt in BC?

PST exemptions Food for human consumption (e.g. basic groceries and prepared food such as restaurant meals) Books, newspapers and magazines. Children-sized clothing. Bicycles. Prescription medications and household medical aids such as cough syrup and pain medications.

What is the tax on propane in BC?

Sales taxes Federal and Provincial Consumption Taxes on Petroleum Products (Cents Per Litre) GasolinePropane (motor vehicle) British Columbia – Victoria Area 20.00 2.7 British Columbia – Rest of province 14.50 2.7 Yukon 6.2 28 more rows

How do I get my Missouri gas tax refund?

You may apply for a fuel tax refund for purchases of clear fuel used for non-highway purposes by completing the motor fuel refund claim, Form 4923, along with the applicable Statement of Missouri Fuel Tax Paid for Non-Highway Use, Form 4923S.

Does BC pay carbon tax on gas?

Carbon tax was eliminated effective April 1, 2025. See Carbon tax elimination for transitional information about refunds, special rules for natural gas sellers, what to do if you collect the tax in error and more. The motor fuel tax is still in effect. This page provides the current B.C. carbon tax rates.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is MOTOR FUEL TAX RETURN – PROPANE inventory?

MOTOR FUEL TAX RETURN – PROPANE inventory is a form used by businesses and individuals to report the amount of propane used or sold for motor fuel purposes. It tracks the inventory, sales, and taxes associated with propane as a fuel source.

Who is required to file MOTOR FUEL TAX RETURN – PROPANE inventory?

Individuals or businesses that sell or distribute propane for motor fuel use are required to file the MOTOR FUEL TAX RETURN – PROPANE inventory. This typically includes propane wholesalers, retailers, and other entities involved in the propane supply chain.

How to fill out MOTOR FUEL TAX RETURN – PROPANE inventory?

To fill out the MOTOR FUEL TAX RETURN – PROPANE inventory, one must provide specific details such as the total gallons of propane sold, the tax rate applied, and any inventory changes. Carefully follow the form instructions, ensuring all relevant data is accurately reported.

What is the purpose of MOTOR FUEL TAX RETURN – PROPANE inventory?

The purpose of the MOTOR FUEL TAX RETURN – PROPANE inventory is to ensure compliance with state and federal tax laws, facilitating the proper collection of taxes on propane used as motor fuel. It helps maintain accurate records for taxation and regulation.

What information must be reported on MOTOR FUEL TAX RETURN – PROPANE inventory?

Information that must be reported on the MOTOR FUEL TAX RETURN – PROPANE inventory includes the total gallons of propane sold, any purchases, ending inventory, tax calculations, and details of any tax exemptions claimed.

Fill out your motor fuel tax return online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Motor Fuel Tax Return is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.