Get the free Fund Raising Income and Expense Report (pdf) - Hasan Shrine - hasanshrine

Show details

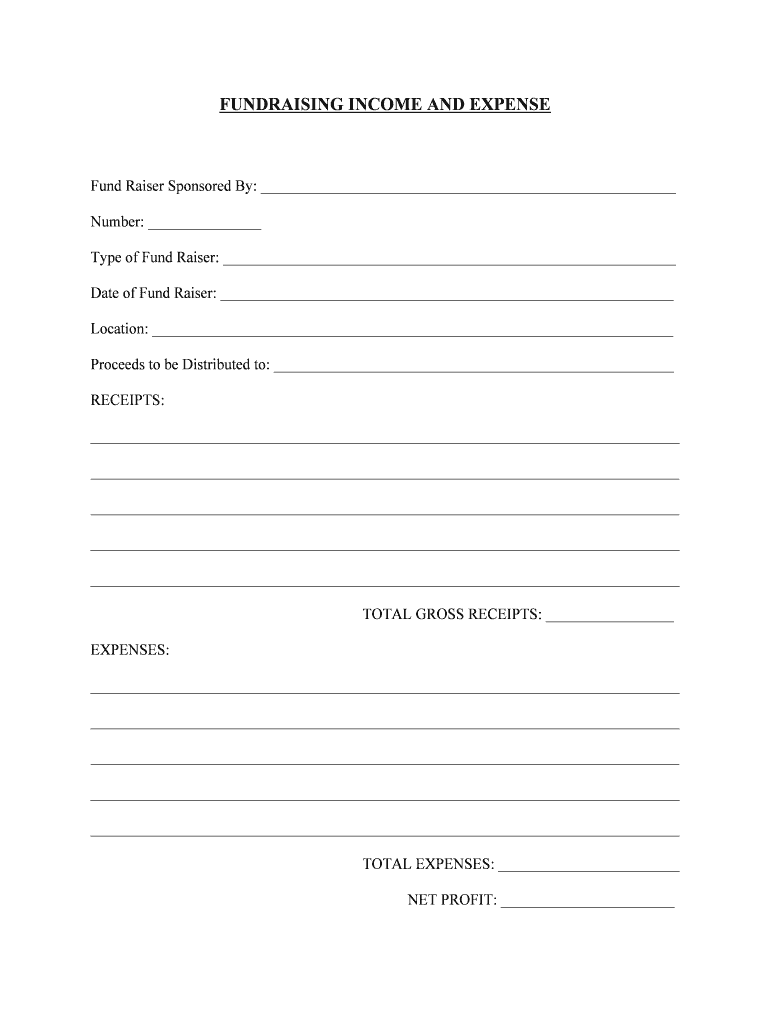

FUNDRAISING INCOME AND EXPENSE Fund Raiser Sponsored By: Number: Type of Fund Raiser: Date of Fund Raiser: Location: Proceeds to be Distributed to: RECEIPTS: TOTAL GROSS RECEIPTS: EXPENSES: TOTAL

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign fund raising income and

Edit your fund raising income and form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fund raising income and form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing fund raising income and online

To use the services of a skilled PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit fund raising income and. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out fund raising income and

How to fill out fund raising income and?

01

Start by gathering all the necessary documents and information related to your fundraising activities. This may include donation receipts, grant agreements, sponsorship agreements, event income records, and any other relevant financial documents.

02

Review the specific requirements and guidelines for filling out the fund raising income and section. This information can usually be found in the instructions provided by the organization or agency that requires the report. It's important to understand what information needs to be reported and in what format.

03

Begin by providing an overview of your organization's fundraising activities. This can include a description of the types of fundraising events or campaigns you conducted, the timeline of these activities, and any significant outcomes or achievements.

04

Break down the income you received from fundraising during the reporting period. Be sure to include all sources of fundraising income, such as individual donations, corporate sponsorships, grants, and revenue from events or product sales. It's important to accurately document the exact amounts received from each source.

05

Clearly identify any restricted funds that were received during the reporting period. Restricted funds refer to donations or grants that can only be used for specific purposes or programs. Make sure to accurately allocate these funds to the respective programs or expenses they are intended for.

06

If applicable, provide a breakdown of any fundraising expenses incurred during the reporting period. This can include costs associated with organizing events, marketing and promotional materials, fundraising staff salaries, and any other expenses directly related to fundraising efforts. Ensure that these expenses are categorized appropriately and supported by relevant documentation.

07

Include any additional information that may be required by the reporting organization or agency. This could include information on the impact of your fundraising activities, specific goals achieved, or any challenges faced during the reporting period.

Who needs fund raising income and?

01

Nonprofit organizations: Nonprofits often need to report their fundraising income and expenses to comply with regulatory requirements, maintain transparency, and demonstrate their financial stability to donors, funders, and stakeholders.

02

Grant-making organizations: Organizations that provide grants or funding to nonprofits may require them to report their fundraising income and expenses as part of their accountability and reporting process. This helps grant-making organizations track how their funds are being utilized and ensure compliance with grant requirements.

03

Government agencies: Government bodies responsible for regulating or overseeing nonprofits may request fundraising income and expense reports to ensure legal compliance, transparency, and accountability in the nonprofit sector.

04

Financial auditors: Independent auditors or accounting firms may need fundraising income and expense reports to conduct financial audits of nonprofit organizations. These audits help ensure the accuracy and reliability of financial information and statements.

05

Donors and supporters: Individuals or entities that donate to nonprofits may be interested in understanding how their funds are being managed and used. Fundraising income and expense reports provide transparency and assurance that the funds are being utilized effectively.

In conclusion, filling out fund raising income and involves gathering the necessary documents, understanding the reporting requirements, providing an overview of fundraising activities, documenting income sources and amounts, allocating restricted funds, reporting fundraising expenses, and including any additional information required. Nonprofits, grant-making organizations, government agencies, financial auditors, and donors may all require fundraising income and expense reports.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit fund raising income and in Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing fund raising income and and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

How do I edit fund raising income and on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as fund raising income and. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

How do I fill out fund raising income and on an Android device?

On an Android device, use the pdfFiller mobile app to finish your fund raising income and. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

What is fund raising income?

Fund raising income is any money received through soliciting donations or grants for a specific cause or organization.

Who is required to file fund raising income?

Non-profit organizations and charities are required to file fund raising income.

How to fill out fund raising income?

Fund raising income should be reported on the appropriate tax forms provided by the IRS or relevant tax authority.

What is the purpose of fund raising income?

The purpose of fund raising income is to support the activities and programs of the organization by generating funds through donations.

What information must be reported on fund raising income?

Information such as the amount of donations received, donor information, and how the funds will be used must be reported on fund raising income forms.

Fill out your fund raising income and online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fund Raising Income And is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.