Get the free Accounts Payable

Show details

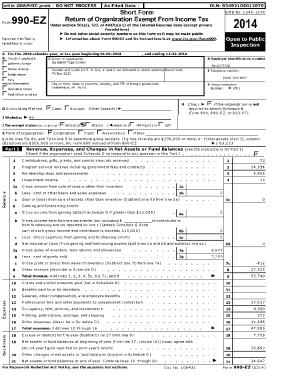

This document outlines the procedures and guidelines related to accounts payable at Dalhousie University, including invoice processing, payment methods, travel claims, and services rendered.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign accounts payable

Edit your accounts payable form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your accounts payable form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit accounts payable online

To use the services of a skilled PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit accounts payable. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out accounts payable

How to fill out Accounts Payable

01

Gather all invoices from vendors.

02

Review each invoice for accuracy and verify against purchase orders.

03

Enter each invoice into the Accounts Payable system with the correct details.

04

Assign appropriate codes to categorize each expense.

05

Set due dates for each invoice based on payment terms.

06

Schedule payments to ensure timely processing and avoid late fees.

07

Obtain necessary approvals from relevant departments or managers.

08

Process payments through the chosen payment method (e.g., checks, electronic transfer).

09

Maintain accurate records of all transactions for accounting purposes.

10

Reconcile Accounts Payable regularly to ensure accuracy.

Who needs Accounts Payable?

01

Businesses that purchase goods or services on credit.

02

Finance or accounting departments managing company expenses.

03

Companies seeking to track liabilities and manage cash flow effectively.

04

Organizations that want to maintain good vendor relationships through timely payments.

Fill

form

: Try Risk Free

People Also Ask about

What is accounts payable in simple words?

Accounts payable (AP) is an accounting term used to describe the money owed to vendors or suppliers for goods or services purchased on credit.

What is the best description of accounts payable?

Accounts payable is a company's obligation to pay for goods and services received on credit, typically within 30 to 90 days.

What is an example of account payables?

Some examples of payables include supplier invoices, legal fees, contractor payments, and so on. Additionally, it will also record purchases from a vendor on credit, a subscription, or an instalment payment (that is due after goods or services have been received).

What is accounts payable for dummies?

Accounts payable (AP) are the debts owed to vendors and suppliers (recorded on a company's balance sheet) to which the company has received goods or services purchased on credit, but hasn't paid the supplier. Your company's accounts payable balance is the sum of all outstanding amounts not yet paid to vendors.

Can you explain what accounts payable is in your own words?

Accounts payable (AP) is an accounting term used to describe the money owed to vendors or suppliers for goods or services purchased on credit.

What best describes accounts payable?

The term accounts payable (AP) describes both a business account and a department that handles invoices. It's a form of accrual accounting that represents a specific account in the general ledger.

How to explain accounts payable in an interview?

What is meant by accounts payable? Answer: For these accounts payable interview questions you could answer that the accounts payable means the amount that should be paid as a liability. It is paid to the vendors for goods and services that were purchased in the past on credit.

What is the job description of accounts payable?

An Accounts Payable officer (AP officer) is responsible for several duties and tasks, such as: Processing of payments and financial transactions to suppliers and obtaining goods and services from suppliers promptly. Liaising with finance officers and suppliers concerning stock management, financial records and accounts.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Accounts Payable?

Accounts Payable refers to the money a company owes its suppliers for goods and services received but not yet paid for. It is a liability on the balance sheet.

Who is required to file Accounts Payable?

All businesses that purchase goods or services on credit and have outstanding obligations to suppliers are required to maintain and file Accounts Payable records.

How to fill out Accounts Payable?

To fill out Accounts Payable, enter the vendor name, invoice number, amount due, payment terms, due date, and any relevant notes in your accounting system or accounts payable ledger.

What is the purpose of Accounts Payable?

The purpose of Accounts Payable is to manage and track the company's outstanding obligations to suppliers, ensuring timely payments and maintaining good vendor relationships.

What information must be reported on Accounts Payable?

Accounts Payable must report the vendor name, invoice number, invoice date, amount owed, payment terms, due date, and any applicable discounts or credits.

Fill out your accounts payable online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Accounts Payable is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.