Get the free BALANCE TRANSFER APPLICATION - Promotion

Show details

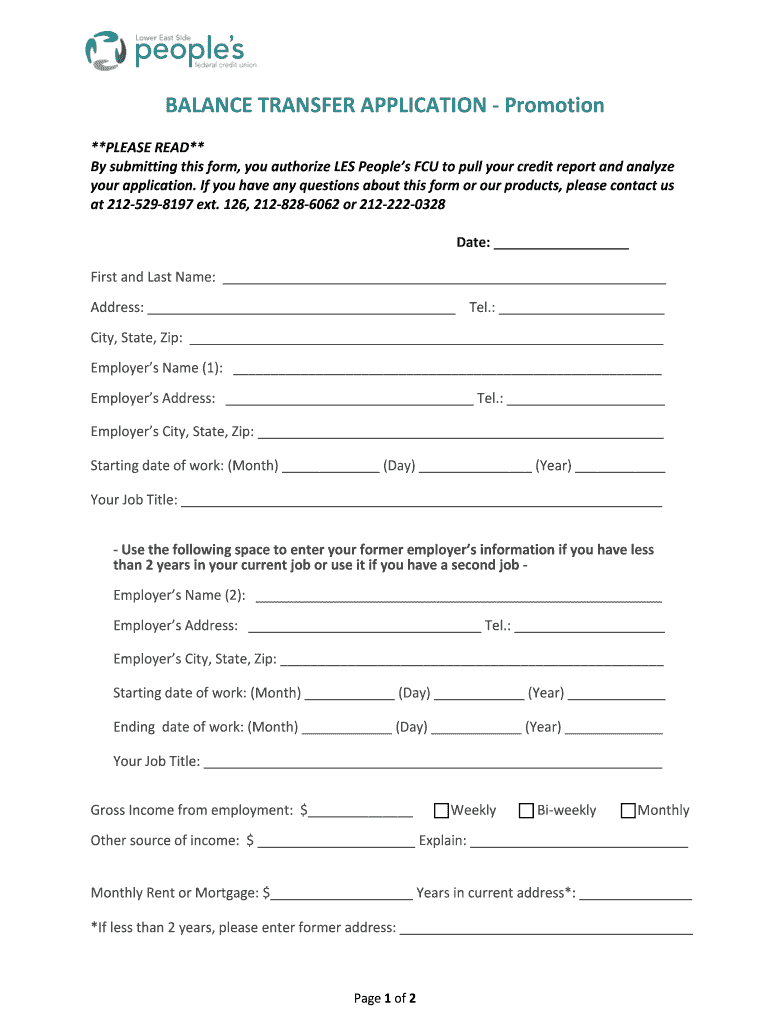

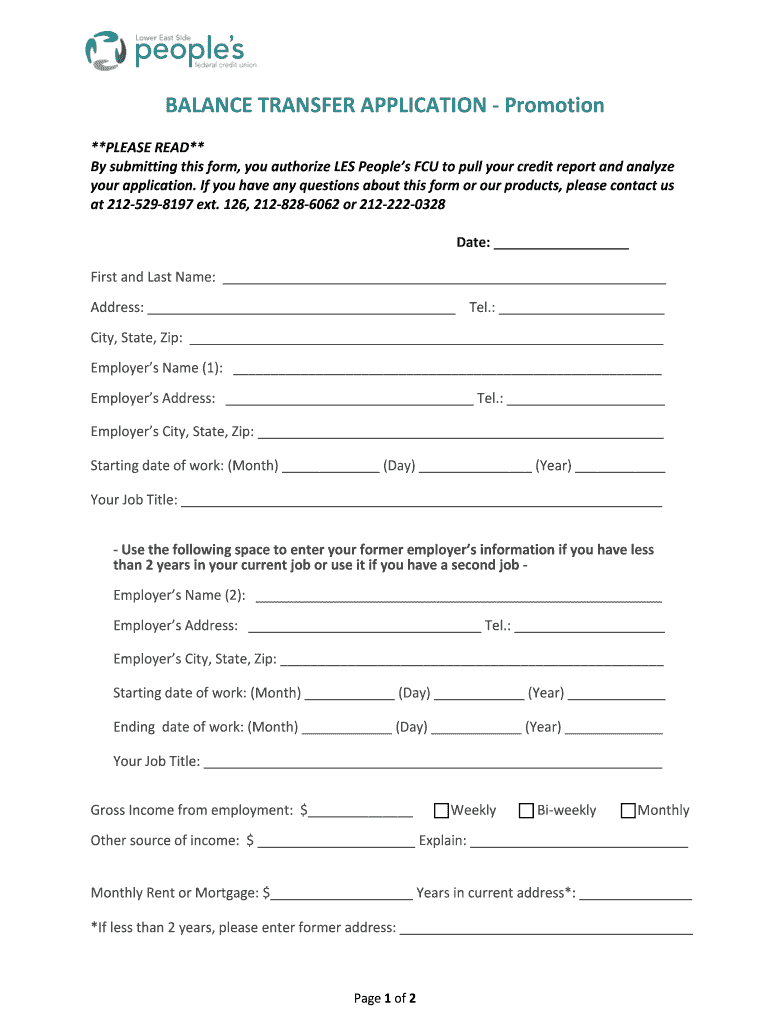

BALANCE TRANSFER APPLICATION Promotion **PLEASE READ** By submitting this form, you authorize LES Peoples FCU to pull your credit report and analyze your application. If you have any questions about

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign balance transfer application

Edit your balance transfer application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your balance transfer application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing balance transfer application online

Use the instructions below to start using our professional PDF editor:

1

Log in to your account. Start Free Trial and register a profile if you don't have one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit balance transfer application. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out balance transfer application

How to fill out a balance transfer application:

01

Gather necessary information: Before filling out the application, gather all the relevant information you will need. This includes details of your current credit cards, such as the issuer, account numbers, and outstanding balances. You may also need your social security number, employment information, and income details.

02

Research balance transfer offers: Before choosing a balance transfer offer, research different credit card companies and their terms. Look for offers with low or 0% introductory APRs, minimal transfer fees, and a suitable credit limit. Compare the offers to find the best fit for your needs.

03

Complete the application form: Start by providing personal information, such as your name, address, and contact details. Fill in the required fields accurately and double-check for any errors or missing information. Be prepared to provide details about your current credit cards, including the issuer, account numbers, and outstanding balances.

04

Verify your identity and creditworthiness: Some balance transfer applications may require you to verify your identity and creditworthiness. This process may involve answering security questions, providing proof of income, or authorizing a credit check. Follow the instructions carefully and provide the necessary documentation as requested.

05

Read and understand the terms and conditions: It is crucial to read and understand the terms and conditions of the balance transfer offer before submitting your application. Pay attention to the length of the introductory APR period, the regular APR after the promotional period, and any applicable fees. Make sure you are comfortable with the terms before proceeding.

06

Submit the application: Once you have filled out the application form and reviewed all the information, submit the application electronically or via mail, following the instructions provided by the credit card company. Keep a copy of the application and any supporting documents for your records.

Who needs a balance transfer application?

01

Individuals with high-interest credit card debt: If you have high-interest credit card debt and are struggling to pay it off, a balance transfer can be an effective tool to save money on interest. By transferring your balances to a credit card with a lower or 0% introductory APR, you can potentially reduce your interest payments and pay off your debt faster.

02

Those seeking to consolidate their credit card debt: If you have multiple credit cards with outstanding balances, managing them can be challenging. A balance transfer can simplify your financial situation by consolidating your debt onto a single credit card. This can make it easier to track and manage your payments.

03

Individuals looking to save money on interest: The main benefit of a balance transfer is the potential to save money on interest payments. By taking advantage of low or 0% introductory APR offers, you can redirect the funds that would have gone toward interest charges towards paying off your principal debt. This can lead to significant savings over time.

04

People wanting to improve their credit score: If you have a high credit utilization ratio on your current credit cards, a balance transfer can help improve your credit score. By transferring your balances to a credit card with a higher credit limit, you can lower your overall credit utilization ratio, which is a factor that influences your credit score.

In conclusion, anyone with high-interest credit card debt, and individuals looking to consolidate their debt, save money on interest, or improve their credit score can benefit from a balance transfer application. However, it is important to carefully review the terms and conditions and ensure that a balance transfer aligns with your financial goals and circumstances.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit balance transfer application from Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including balance transfer application, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How do I edit balance transfer application online?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your balance transfer application to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

How do I edit balance transfer application in Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing balance transfer application and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

What is balance transfer application?

Balance transfer application is a process of transferring outstanding balances from one credit card to another in order to take advantage of a lower interest rate or better terms.

Who is required to file balance transfer application?

Any individual who holds a credit card with an outstanding balance and wishes to transfer that balance to another credit card can file a balance transfer application.

How to fill out balance transfer application?

To fill out a balance transfer application, you will need to provide information about the current credit card with the outstanding balance, the amount to be transferred, and the details of the new credit card. This can usually be done online or by mailing in a physical application.

What is the purpose of balance transfer application?

The purpose of a balance transfer application is to save money on interest payments by moving high-interest debt to a credit card with a lower interest rate or more favorable terms.

What information must be reported on balance transfer application?

Information required on a balance transfer application typically includes details of the current credit card, the amount to be transferred, the account number, and personal information of the applicant.

Fill out your balance transfer application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Balance Transfer Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.