Get the free BOE-261 - cms sbcounty

Show details

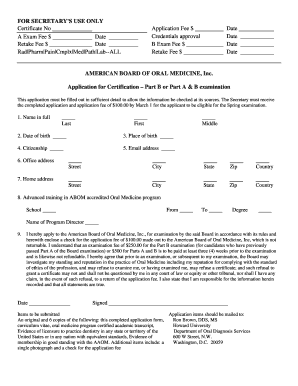

This form is used to claim a property tax exemption for veterans who have served in the Armed Forces. The exemption applies to eligible veterans, their unmarried spouses, or pensioned parents of deceased

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign boe-261 - cms sbcounty

Edit your boe-261 - cms sbcounty form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your boe-261 - cms sbcounty form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing boe-261 - cms sbcounty online

To use the services of a skilled PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit boe-261 - cms sbcounty. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out boe-261 - cms sbcounty

How to fill out BOE-261

01

Obtain the BOE-261 form from the California State Board of Equalization website or local office.

02

Fill out the taxpayer information section with your name, address, and account number.

03

Enter the report period for which you are filing.

04

Provide detailed information on the sales you made during that period, including the total sales amount and any exempt sales.

05

Calculate the sales tax liability based on the provided sales figures and applicable tax rates.

06

Sign and date the form to certify that the information provided is accurate.

07

Submit the completed form by mail or electronically as instructed on the form.

Who needs BOE-261?

01

Businesses and individuals who are required to report sales and use tax in California.

02

Those who have a seller's permit and need to file tax returns for their sales activities.

03

Any taxpayer who has made taxable sales during the reporting period.

Fill

form

: Try Risk Free

People Also Ask about

What benefits does a 100% disabled veteran get in California?

California offers special benefits for its military service members and veterans including motor vehicle registration fees waived, veterans license plates, fishing and hunting licenses, state parks and recreation pass, business license, property tax exemptions, disabled veteran business enterprise business license,

Do 100% disabled veterans pay sales tax on vehicles in California?

Do Disabled Veterans Pay Sales Tax on Vehicles in California? Veterans generally do pay sales tax unless the vehicle is modified for a disability. In those cases, you might qualify for an exemption. Ask your local DMV for details.

Do 100% disabled veterans pay property tax in Louisiana?

Disabled Veteran Exemption: The amount of the disabled Veterans property tax exemption is based on the Veterans disability percentage: Service-connected disability rating of 100%, individual unemployability, or totally disabled is exempt from all property taxes.

Does a 100% disabled veteran have to pay property taxes in California?

California law provides a property tax exemption for the primary residence of a disabled veteran or an unmarried spouse of a qualifying deceased disabled veteran. Who may qualify? US military veterans rated 100% disabled or 100% unemployable due to service connected injury or disease.

Who is exempt from veterans tax in Riverside County?

If you are a California veteran who is rated 100% disabled, blind, or a paraplegic due to service-connected disability while in the armed forces (or if you are the un-remarried surviving spouse of such a veteran or of one who died of service-connected causes while on active duty) you may be eligible for an exemption of

Are disabled veterans exempt from property taxes in San Diego County?

Low-Income Exemption. There are two levels for the Disabled Veterans Property Tax Exemption: Basic and Low-Income. In San Diego County, for example, the Basic Exemption for 2025 is $175,298, and the Low-Income Exemption is $262,950.

Do 100% disabled veterans pay property tax in California?

California law provides a property tax exemption for the primary residence of a disabled veteran or an unmarried spouse of a qualifying deceased disabled veteran. Who may qualify? US military veterans rated 100% disabled or 100% unemployable due to service connected injury or disease.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is BOE-261?

BOE-261 is a form used by the California State Board of Equalization for reporting the sale of $500 or more of cigarettes or tobacco products.

Who is required to file BOE-261?

Manufacturers, distributors, and retailers who sell cigarettes or tobacco products in California are required to file BOE-261 if their sales exceed $500.

How to fill out BOE-261?

To fill out BOE-261, provide the seller's and buyer's information, describe the products sold, date of sale, total amount, and any applicable taxes.

What is the purpose of BOE-261?

The purpose of BOE-261 is to ensure compliance with tax laws regarding the sale of cigarettes and tobacco products in California.

What information must be reported on BOE-261?

The form requires information such as seller and buyer details, product descriptions, sale date, total sales amount, and any relevant tax information.

Fill out your boe-261 - cms sbcounty online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Boe-261 - Cms Sbcounty is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.