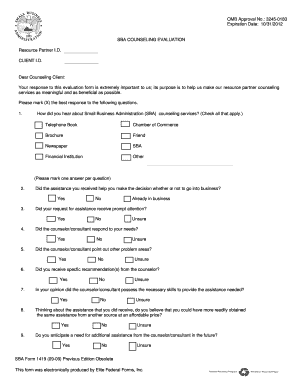

Get the free SELF-DIRECTED ETIREMENT SAVINGS PLAN APPLICATION - sw8

Show details

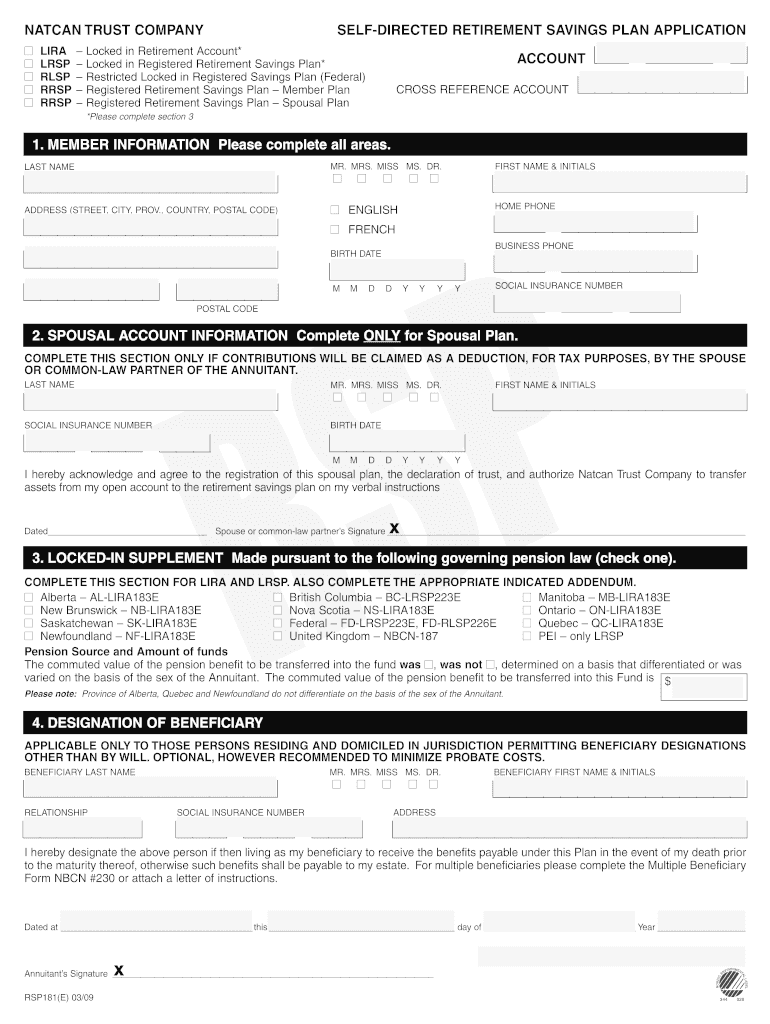

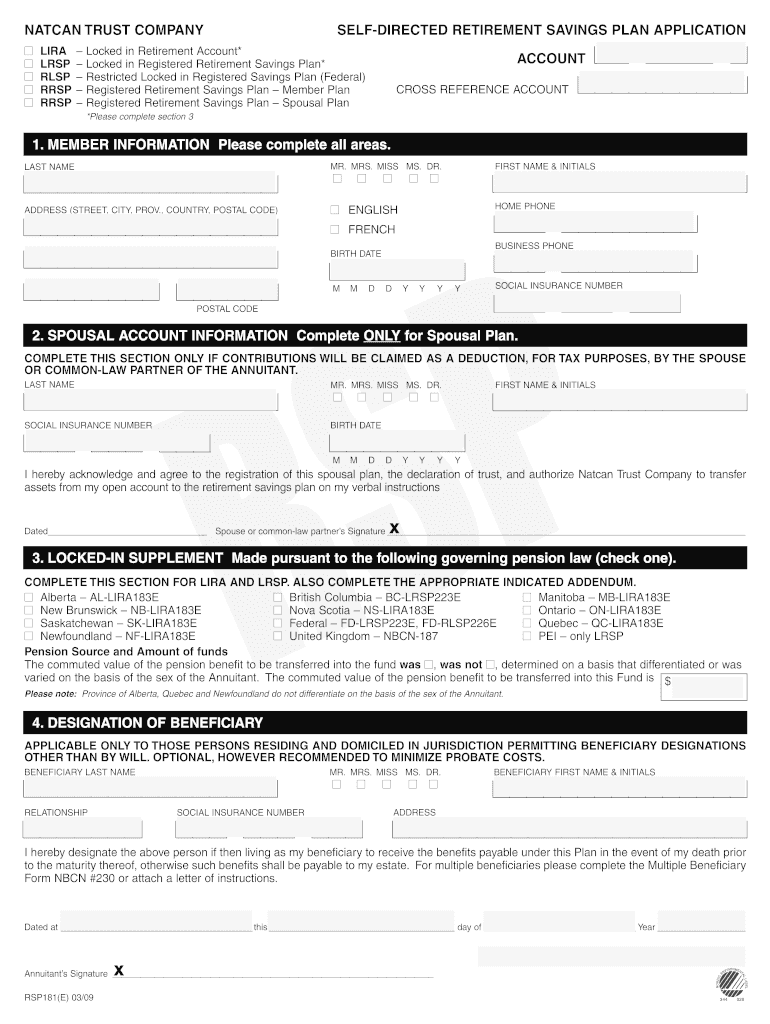

Print Form SELF-DIRECTED RETIREMENT SAVINGS PLAN APPLICATION Reset Form NATHAN TRUST COMPANY LIRA LSP RESP RESP RESP SELF-DIRECTED RETIREMENT SAVINGS PLAN APPLICATION Locked in Retirement Account*

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign self-directed etirement savings plan

Edit your self-directed etirement savings plan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your self-directed etirement savings plan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing self-directed etirement savings plan online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit self-directed etirement savings plan. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out self-directed etirement savings plan

How to Fill Out a Self-Directed Retirement Savings Plan:

01

Start by reviewing the requirements and guidelines of the self-directed retirement savings plan. Familiarize yourself with the specific rules and regulations that apply to the plan you have chosen.

02

Determine your investment goals and risk tolerance. It is important to have a clear understanding of what you hope to achieve with your retirement savings and how much risk you are willing to take on.

03

Establish a budget and determine how much you can contribute to your self-directed retirement savings plan on a regular basis. Consider your monthly expenses and income, and identify a comfortable amount to allocate towards your retirement savings.

04

Choose the right investment options for your self-directed retirement savings plan. Research different investment opportunities such as stocks, bonds, mutual funds, or real estate, and select those that align with your goals and risk tolerance.

05

Fill out the necessary paperwork to open your self-directed retirement savings plan. This may include application forms, beneficiary designation forms, and other relevant documents. Ensure that you provide accurate and up-to-date information.

06

Contribute funds to your self-directed retirement savings plan as per the guidelines and limitations set by the plan. Regularly monitor and adjust your contributions based on your financial situation and investment performance.

07

Keep track of your investments and review their performance periodically. Stay updated on market trends and make informed decisions regarding your portfolio. Consider consulting with a financial advisor if you require expert guidance.

08

Continuously educate yourself about retirement planning and investment strategies. Stay informed about changes in tax laws or regulations that may impact your self-directed retirement savings plan.

09

Regularly reassess and adjust your self-directed retirement savings plan as needed. Life circumstances and financial goals may change over time, so it is important to review and make necessary modifications to your plan.

Who Needs a Self-Directed Retirement Savings Plan?

01

Individuals who want more control over their retirement investments may opt for a self-directed retirement savings plan. Unlike traditional retirement plans, self-directed plans allow individuals to choose a wider range of investment options.

02

Self-directed retirement savings plans are suitable for those who have the knowledge and interest in investing. These plans require active involvement and decision-making regarding investment selections and strategies.

03

People seeking diversification beyond typical investment options such as stocks and bonds may find self-directed retirement savings plans appealing. These plans often allow investing in alternative assets like real estate, precious metals, or private equity.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the self-directed etirement savings plan electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your self-directed etirement savings plan in seconds.

How can I fill out self-directed etirement savings plan on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your self-directed etirement savings plan. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

How do I edit self-directed etirement savings plan on an Android device?

With the pdfFiller Android app, you can edit, sign, and share self-directed etirement savings plan on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

What is self-directed retirement savings plan?

A self-directed retirement savings plan is a type of retirement account that allows individuals to have more control over their investments by choosing where to invest their funds.

Who is required to file self-directed retirement savings plan?

Individuals who want to take control of their retirement savings and make their own investment decisions are required to file a self-directed retirement savings plan.

How to fill out self-directed retirement savings plan?

To fill out a self-directed retirement savings plan, individuals need to choose a provider, select their investments, and make contributions according to the plan's guidelines.

What is the purpose of self-directed retirement savings plan?

The purpose of a self-directed retirement savings plan is to give individuals more control and flexibility over their retirement investments, potentially leading to higher returns.

What information must be reported on self-directed retirement savings plan?

The information reported on a self-directed retirement savings plan includes account contributions, investment choices, and account balances.

Fill out your self-directed etirement savings plan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Self-Directed Etirement Savings Plan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.