Get the free Rules of the Department of Revenue - ador state al

Show details

This document outlines the rules and regulations for individual taxpayers' returns in Alabama, including filing requirements, extension policies, and electronic filing procedures.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign rules of form department

Edit your rules of form department form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your rules of form department form via URL. You can also download, print, or export forms to your preferred cloud storage service.

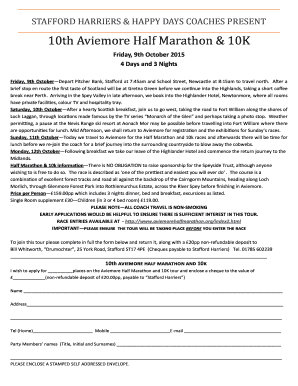

How to edit rules of form department online

Follow the guidelines below to use a professional PDF editor:

1

Check your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit rules of form department. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

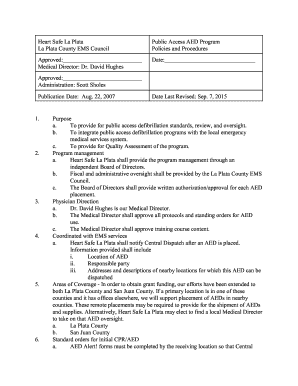

How to fill out rules of form department

How to fill out Rules of the Department of Revenue

01

Obtain a copy of the Rules of the Department of Revenue from the official website or local office.

02

Read through the document to understand the structure and the types of rules included.

03

Identify the specific sections that pertain to your needs or interests.

04

Gather necessary information and documents that may be required to comply with these rules.

05

Fill out any forms or applications as dictated by the rules, ensuring all information is accurate and complete.

06

Review the filled-out forms to make sure you have followed all instructions correctly.

07

Submit your completed forms and any required supporting documents to the appropriate department or office.

Who needs Rules of the Department of Revenue?

01

Businesses seeking to understand their tax obligations.

02

Individuals filing tax returns.

03

Compliance officers ensuring adherence to tax regulations.

04

Accountants managing tax preparation for clients.

05

Legal professionals advising clients on tax matters.

Fill

form

: Try Risk Free

People Also Ask about

What is the departmental revenue?

Departmental revenue is the inflow of cash arising in the course of the ordinary activities of the department, normally from the sale of goods, the rendering of services, and the earning of interest, taxes and dividends. It includes transactions in financial assets and liabilities and also transfers received.

Who is in charge of revenue?

Niall Cody, Chairman Niall Cody is Chairman of the Board of the Revenue Commissioners and is also the Accounting Officer for Revenue.

Who is responsible for revenue in a company?

In short, a CRO is responsible for all activities that generate revenue. In most companies, the CRO is tasked with primary or shared responsibility for operations, sales, corporate development, marketing, pricing, and revenue management.

What is the revenue of Thailand?

Thailand's Ministry of Finance stated that in the first ten months of the fiscal year (October 2024 – July 2025), the government has collected a total revenue of THB 2.25 trillion, an increase of THB 40.82 billion or 1.8% YoY, but still lower than the expectation by THB 37.63 billion or 1.6%.

What is the Department of revenue in the United States?

The Internal Revenue Service (IRS) administers and enforces U.S. federal tax laws.

Which department is responsible for revenue?

The Department of Revenue plays a crucial role in managing India's financial resources by : Tax collection and administration : Levies and collects both direct taxes (income tax, wealth tax, etc.) and indirect taxes (GST, customs duty, excise duty, etc.).

What are the tax laws in Washington state?

No income tax in Washington state Washington state does not have an individual or corporate income tax. However, it does levy other types of taxes such as business and occupation (B&O) tax, retail sales or use tax, public utility tax, and other taxes.

What is the revenue law in India?

India Code: Central Boards of Revenue Act, 1963. Long Title: An Act to provide for the constitution of separate Boards of Revenue for Direct Taxes and for Excise and Customs and to amend certain enactments for the purpose of conferring powers and imposing duties on the said Boards.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Rules of the Department of Revenue?

The Rules of the Department of Revenue are regulations that govern the administration of tax laws and the operations of the Department of Revenue, ensuring compliance and providing guidance for taxpayers.

Who is required to file Rules of the Department of Revenue?

Taxpayers, businesses, and organizations that are subject to taxation under state law are required to follow and adhere to the Rules of the Department of Revenue.

How to fill out Rules of the Department of Revenue?

To fill out the Rules of the Department of Revenue, one must obtain the appropriate tax forms from the Department's website or office, follow the instructions provided carefully, and submit the completed forms by the stipulated deadlines.

What is the purpose of Rules of the Department of Revenue?

The purpose of the Rules of the Department of Revenue is to establish clear guidelines and procedures for tax collection, enforcement, and compliance, ensuring that the tax system operates fairly and efficiently.

What information must be reported on Rules of the Department of Revenue?

The information that must be reported typically includes taxpayer identification details, income, deductions, credits, and any applicable taxable sales or services, as well as any other data relevant to the tax obligation.

Fill out your rules of form department online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Rules Of Form Department is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.