Get the free 20S - ador state al

Show details

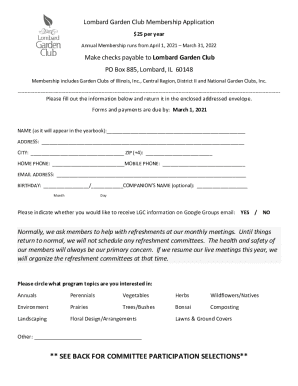

This document provides detailed instructions for Alabama S corporations on how to complete their tax return, including necessary schedules and the requirements for filing.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 20s - ador state

Edit your 20s - ador state form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 20s - ador state form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 20s - ador state online

Follow the steps below to take advantage of the professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit 20s - ador state. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 20s - ador state

How to fill out 20S

01

Gather all necessary financial documents and information.

02

Obtain the 20S form from the appropriate tax authority website or office.

03

Begin filling out Part 1 with your basic information, such as name, address, and tax identification number.

04

Complete Part 2 by declaring your income sources accurately.

05

Fill out Part 3 to list any deductions or credits you are eligible for.

06

Double-check all entries for accuracy and completeness.

07

Sign and date the form where required.

08

Submit the completed form to the designated tax office by the deadline.

Who needs 20S?

01

Individuals with specific types of income relevant to the 20S form.

02

Business owners or self-employed individuals reporting their income.

03

Taxpayers claiming eligible deductions or credits indicated on the form.

04

Any resident who is required to file a tax return in accordance with local tax laws.

Fill

form

: Try Risk Free

People Also Ask about

What does 20's mean?

the twenties the decade (= period of ten years) between 20 and 29 in any century, usually 1920–1929 or 2020–2029: She was born in the twenties.

Why were the 1920s referred to as the new era?

The 1920s heralded a dramatic break between America's past and future. Before World War I the country remained culturally and psychologically rooted in the nineteenth century, but in the 1920s America seemed to break its wistful attachments to the recent past and usher in a more modern era.

What term is used to describe the 1920s?

Roaring twenties, jazz age, and age of jazz are all phrases used to describe the 1920s.

What is the 20s era called?

Similarly, 20 is written as twenty.

How to write 20s?

No apostrophe. If you're talking about the decade, you can put one in front to take the place of the omitted portion (2020s = '20s), but you don't have to.

What is 1920s style called?

The flapper dress was one of the most iconic looks of the Great Gatsby era. This style was characterized by its knee-length skirt and loose fit, which allowed for more freedom of movement. They were often made from light materials like chiffon or silk, adding to their airy feel.

What is another name for the 1920s era?

What is another word for Roaring Twenties? twenties1920s 20s Golden Twenties Flapper Era Mad Decade Age of the Red-Hot Mamas Jazz Age

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 20S?

20S refers to the Form 20S, which is a tax form used by small business corporations in certain jurisdictions to report income and calculate taxes.

Who is required to file 20S?

Small business corporations, also known as S corporations, are generally required to file Form 20S.

How to fill out 20S?

To fill out Form 20S, gather the necessary financial information, complete the form sections related to income, deductions, and tax credits, and submit it to the relevant tax authority by the due date.

What is the purpose of 20S?

The purpose of Form 20S is to report the income, deductions, and credits of S corporations to ensure that the correct amount of taxes is calculated and paid.

What information must be reported on 20S?

Form 20S requires reporting on various items, including total income, cost of goods sold, deductions for operating expenses, and credits such as those for taxes paid.

Fill out your 20s - ador state online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

20s - Ador State is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.