Get the free Appeal Against Late Fee - uow edu

Show details

This form is for students who intend to appeal a Late Fee imposed by the University, requiring completion of all sections and submission of supporting documentation.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign appeal against late fee

Edit your appeal against late fee form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your appeal against late fee form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing appeal against late fee online

Use the instructions below to start using our professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit appeal against late fee. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

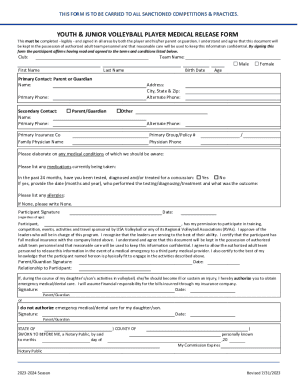

How to fill out appeal against late fee

How to fill out Appeal Against Late Fee

01

Obtain the Appeal Against Late Fee form from the relevant authority or online platform.

02

Fill out your personal information including name, address, and contact details accurately.

03

Provide the details of the late fee, including the reason why it was charged and the date it was incurred.

04

Include any supporting documents that justify your appeal (e.g., receipts, emails, etc.).

05

Clearly state the reasons for your appeal in a concise manner.

06

Review your completed form for accuracy and completeness.

07

Sign and date the form.

08

Submit the appeal form by the specified method (online or in person) before the deadline.

Who needs Appeal Against Late Fee?

01

Individuals who have received a late fee notice and believe it was unwarranted.

02

Students seeking to dispute late fees related to tuition or other academic payments.

03

Customers or clients who wish to contest late fees imposed by service providers.

04

Any person who has mitigating circumstances that contributed to the delay in payment.

Fill

form

: Try Risk Free

People Also Ask about

Can I appeal a late payment of VAT penalty?

Appeal a late payment penalty If you get a late payment penalty, HMRC will tell you in a penalty decision letter. The letter will offer you a review with HMRC. Find out how and when you can appeal against a penalty. You can choose a review or appeal to the tax tribunal.

What is a good reason for filing late?

Acceptable reasons for IRS abatement of late filing penalties include serious illness, natural disasters, or unavoidable absence. Taxpayers must provide clear documentation supporting their claim. The IRS reviews each case individually, considering circumstances beyond the taxpayer's control.

What are the reasons for a late appeal?

Examples of reasons for a late appeal could include a death in the family, serious illness, a postal strike or any other special circumstance.

What is a reasonable excuse for penalty?

A reasonable excuse is something that stopped you meeting a tax obligation for a valid reason, for example: your partner or another close relative died shortly before the tax return or payment deadline. you had an unexpected stay in hospital that prevented you from dealing with your tax affairs.

What is a reasonable excuse for penalty appeal?

A reasonable excuse is something that stopped you meeting a tax obligation for a valid reason, for example: your partner or another close relative died shortly before the tax return or payment deadline. you had an unexpected stay in hospital that prevented you from dealing with your tax affairs.

Can I appeal a late filing fee at Companies House?

If you have a late filing penalty If your penalty is for filing your accounts late, you can appeal through Companies House. You must prove the circumstances were out of your control, for example a fire destroyed your records a few days before your accounts were due.

What is reasonable cause for penalty relief?

There are two components to reasonable cause penalty relief: You acted with ordinary business care and prudence. Circumstances, beyond your control, made it so that you couldn't comply.

How to get out of late filing penalty?

If you do not agree that a penalty is due, you can appeal against it to HMRC. You should consider paying the penalty if you appeal. If you do not, and your appeal is rejected, you'll have to pay interest on the penalty from the date it was due to the date you paid it.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Appeal Against Late Fee?

An Appeal Against Late Fee is a formal request to contest the imposition of a late fee, typically related to tax or administrative obligations, allowing individuals or businesses to explain their circumstances and seek a waiver or reduction of the fee.

Who is required to file Appeal Against Late Fee?

Individuals or entities who have incurred a late fee due to late submission or payment of required documents or taxes are required to file an Appeal Against Late Fee to seek relief from the penalty.

How to fill out Appeal Against Late Fee?

To fill out an Appeal Against Late Fee, one must complete a designated appeal form, provide relevant details such as the reason for the late payment, supporting documents, and any extenuating circumstances that justify the appeal.

What is the purpose of Appeal Against Late Fee?

The purpose of filing an Appeal Against Late Fee is to allow individuals and businesses to challenge the late fee, provide justifications for their delay, and potentially receive a reduction or dismissal of the fee.

What information must be reported on Appeal Against Late Fee?

The information that must be reported on an Appeal Against Late Fee includes the appellant's details, the specifics of the late fee, the reasons for the delay, supporting evidence or documentation, and any prior correspondence with the relevant authority.

Fill out your appeal against late fee online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Appeal Against Late Fee is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.