Get the free Circular No. 05/2011

Show details

The document provides guidelines on the deduction of income tax at source from salaries under Section 192 of the Income-Tax Act for the financial year 2011-2012, detailing the rates applicable, responsibilities

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign circular no 052011

Edit your circular no 052011 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your circular no 052011 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing circular no 052011 online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit circular no 052011. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

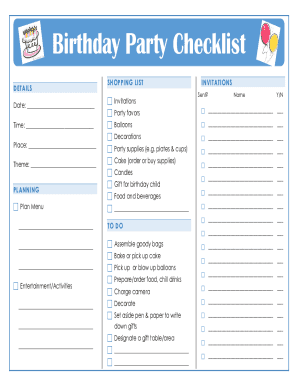

How to fill out circular no 052011

How to fill out Circular No. 05/2011

01

Obtain a copy of Circular No. 05/2011 from the relevant authority.

02

Read the circular carefully to understand its purpose and requirements.

03

Gather all necessary documents that may be required for filling out the circular.

04

Fill in your personal information accurately in the designated sections.

05

Ensure all required fields are completed, including any applicable dates and references.

06

Review the completed document for any errors or missing information.

07

Submit the filled-out Circular No. 05/2011 to the appropriate department or authority as instructed.

Who needs Circular No. 05/2011?

01

Individuals or entities required to comply with the regulations set out in Circular No. 05/2011.

02

Businesses seeking to align with legal or administrative guidance provided in the circular.

03

Government officials and employees who need to implement or enforce the directives of the circular.

Fill

form

: Try Risk Free

People Also Ask about

What is circular number 6 2016 dated 29th february 2016?

6/2016 dated 29.02. 2016, it was clarified that income arising from transfer of listed shares and securities held for more than twelve months, which are treated as capital assets by the concerned taxpayer on a consistent basis, would be taxed under the head 'capital gains'.

What is the explanation of Section 14A?

Section 14A is a disallowance provision. This section provides that while computing the total income of any assessee, no deduction will be permitted in respect of any expense incurred in relation to any income which is exempt from income tax.

What is circular no 5 2014 dated 11 february 2014?

The CBDT vide its circular [No. 5 / 2014 dated 11-2-2014] has clarified that Rule 8D and section 14A of the Act provides for disallowance of the expenditure even where taxpayer in a particular year has not earned any exempt income.

What is the Circular No 2 of 2011?

2/2011 : Circular No. 2/2011, dated 27-4-2011 27 April 2011. The procedure for regulating refund of amount paid by the deductor in excess of the tax deducted at source (TDS) and/or deductible is governed by Board circular No. 285, dated 21-10-1980.

What is the Circular No 09 of 2015?

Circular 9/2015 [F. NO. 312/22/2015-OT], dated 9-6-2015 is issued by the Central Board of Direct Taxes (CBDT) for dealing the matters relating to applications for condonation of delay in filing returns claiming refund and returns claiming carry forward of loss and set-off thereof.

What is the circular no 5 2014 dated 11 february 2014?

The CBDT vide its circular [No. 5 / 2014 dated 11-2-2014] has clarified that Rule 8D and section 14A of the Act provides for disallowance of the expenditure even where taxpayer in a particular year has not earned any exempt income.

What is CBDT Circular No 14 XL 35 dated 11 April 1955?

In Circular No. 14 dated 11-4-1955 CBDT has emphasized that the Department should not take advantage of the assessee's ignorance to collect more tax out of him than the liability due from him. This Circular is very much binding on the Department.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Circular No. 05/2011?

Circular No. 05/2011 is a regulatory document issued by the relevant authority outlining specific reporting and compliance requirements for organizations operating in a particular sector.

Who is required to file Circular No. 05/2011?

Organizations and individuals engaged in activities specified within the scope of the circular are required to file Circular No. 05/2011.

How to fill out Circular No. 05/2011?

To fill out Circular No. 05/2011, entities must complete the designated forms, providing accurate and complete information as per the guidelines set forth in the circular.

What is the purpose of Circular No. 05/2011?

The purpose of Circular No. 05/2011 is to ensure transparency, compliance with regulations, and proper reporting of specific activities to enhance oversight and governance.

What information must be reported on Circular No. 05/2011?

The information that must be reported on Circular No. 05/2011 typically includes financial data, operational activities, compliance checks, and other relevant metrics as required by the issuing authority.

Fill out your circular no 052011 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Circular No 052011 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.