Get the free SONYMA CLOSING COST ASSISTANCE LOANS ADDENDUM - nyshcr

Show details

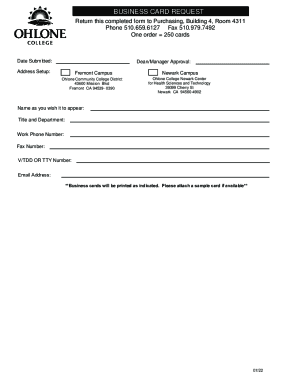

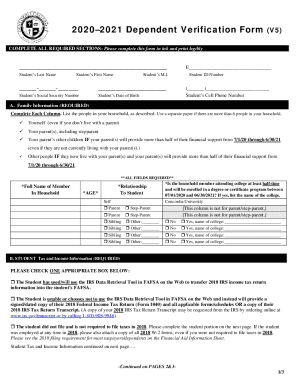

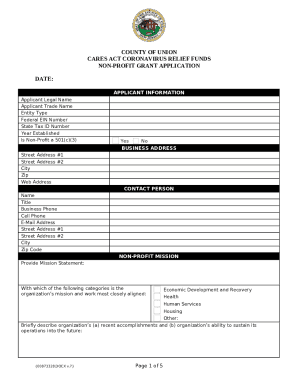

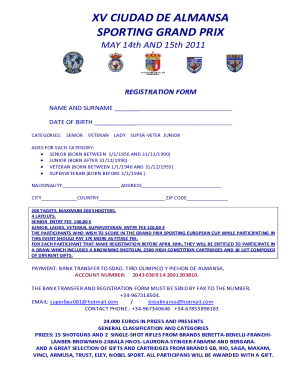

This document serves as a guide for sellers regarding the SONYMA Closing Cost Assistance Loans program, detailing eligibility criteria, requirements for purchasing mortgage loans, and recapture obligations.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign sonyma closing cost assistance

Edit your sonyma closing cost assistance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sonyma closing cost assistance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing sonyma closing cost assistance online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit sonyma closing cost assistance. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out sonyma closing cost assistance

How to fill out SONYMA CLOSING COST ASSISTANCE LOANS ADDENDUM

01

Begin by downloading the SONYMA Closing Cost Assistance Loans Addendum form from the official SONYMA website.

02

Carefully read the instructions provided on the form to understand the requirements.

03

Fill in your personal information, including your full name, address, and contact details.

04

Provide information about the property you are purchasing, including the address and purchase price.

05

Enter the loan amount and the specific closing costs you need assistance with.

06

Review eligibility criteria and check the box if you meet all necessary requirements.

07

Sign and date the form at the designated section to certify the accuracy of the information provided.

08

Submit the completed addendum along with your mortgage application to the lender.

Who needs SONYMA CLOSING COST ASSISTANCE LOANS ADDENDUM?

01

Homebuyers in New York State who qualify for SONYMA loans and need financial assistance to cover closing costs.

Fill

form

: Try Risk Free

People Also Ask about

What is the minimum credit score for a FHA loan?

For those interested in applying for an FHA loan, applicants are now required to have a minimum FICO score of 580 to qualify for the low down payment advantage, which is currently at around 3.5 percent. If your credit score is below 580, however, you aren't necessarily excluded from FHA loan eligibility.

What is DPAL?

Down Payment Assistance Loan (DPAL)

Are there home buyer education requirements in NY?

Applicants must complete a homebuyer education course. All loans with less than a 20% down payment will require Private Mortgage Insurance (PMI)

What is the best loan for first time home buyers?

FHA and VA loans are typically the best for first time home buyers. FHA mortgages can be had with as little as 3.5% down and monthly mortgage insurance. If your credit is very good and/or you have funds available for a down payment, you may also qualify for a 3% or 5% down conventional mortgage.

What credit score do you need for a Sonyma loan?

Available to lower income first- time homebuyers. Down Payment Assistance Loan-up to 3% or $15,000 for down payment/closing costs. SONYMA has no FICO score requirement.

What is the minimum credit score allowed to obtain a mortgage loan?

What Credit Score Do I Need to Buy a House? Loan TypeMinimum Credit Score Conventional loan 620 Jumbo loan 700 FHA loan 500 VA loan 6201 more row • Aug 18, 2025

What is the minimum credit score for a Sallie Mae loan?

Eligibility requirements Noncitizens can qualify by applying with a cosigner who is a U.S. citizen or permanent resident. Credit requirements: Sallie Mae doesn't disclose a minimum credit score for approval but reports an average approval, but private lenders generally look for a minimum FICO credit score of 670.

What credit score do I need to have for a loan?

Key takeaways. You'll typically need a credit score of at least 580 to qualify for a personal loan, but the higher your score, the more affordable your loan rate. Lenders want to see that loan applicants have a history of responsibly paying debt, and your credit score provides a window into your past behavior.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is SONYMA CLOSING COST ASSISTANCE LOANS ADDENDUM?

The SONYMA Closing Cost Assistance Loans Addendum is a document that outlines the terms and conditions regarding financial assistance for closing costs provided to eligible homebuyers through the State of New York Mortgage Agency (SONYMA).

Who is required to file SONYMA CLOSING COST ASSISTANCE LOANS ADDENDUM?

Typically, homebuyers who are receiving closing cost assistance as part of their SONYMA loan are required to file the SONYMA Closing Cost Assistance Loans Addendum.

How to fill out SONYMA CLOSING COST ASSISTANCE LOANS ADDENDUM?

To fill out the SONYMA Closing Cost Assistance Loans Addendum, applicants need to provide their personal information, details about the property purchase, and the amount of assistance being applied for. The form should be completed accurately and signed.

What is the purpose of SONYMA CLOSING COST ASSISTANCE LOANS ADDENDUM?

The purpose of the SONYMA Closing Cost Assistance Loans Addendum is to document the financial assistance provided for closing costs, ensuring that both the lender and the borrower understand the terms and conditions associated with the assistance.

What information must be reported on SONYMA CLOSING COST ASSISTANCE LOANS ADDENDUM?

The information that must be reported on the SONYMA Closing Cost Assistance Loans Addendum includes the borrower’s name, property address, the amount of closing cost assistance requested, and any additional relevant financial details as required by SONYMA.

Fill out your sonyma closing cost assistance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Sonyma Closing Cost Assistance is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.