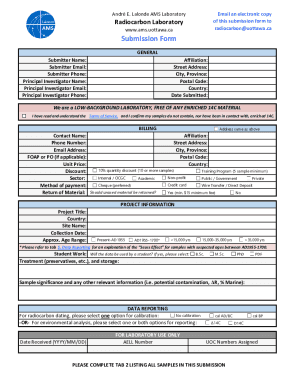

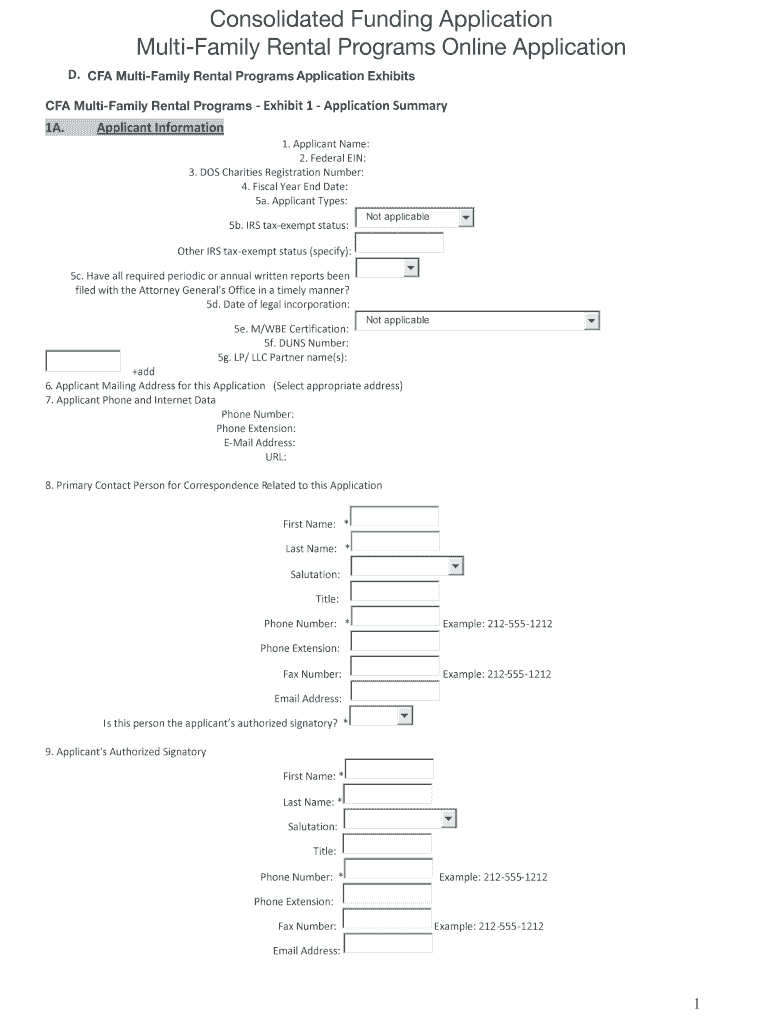

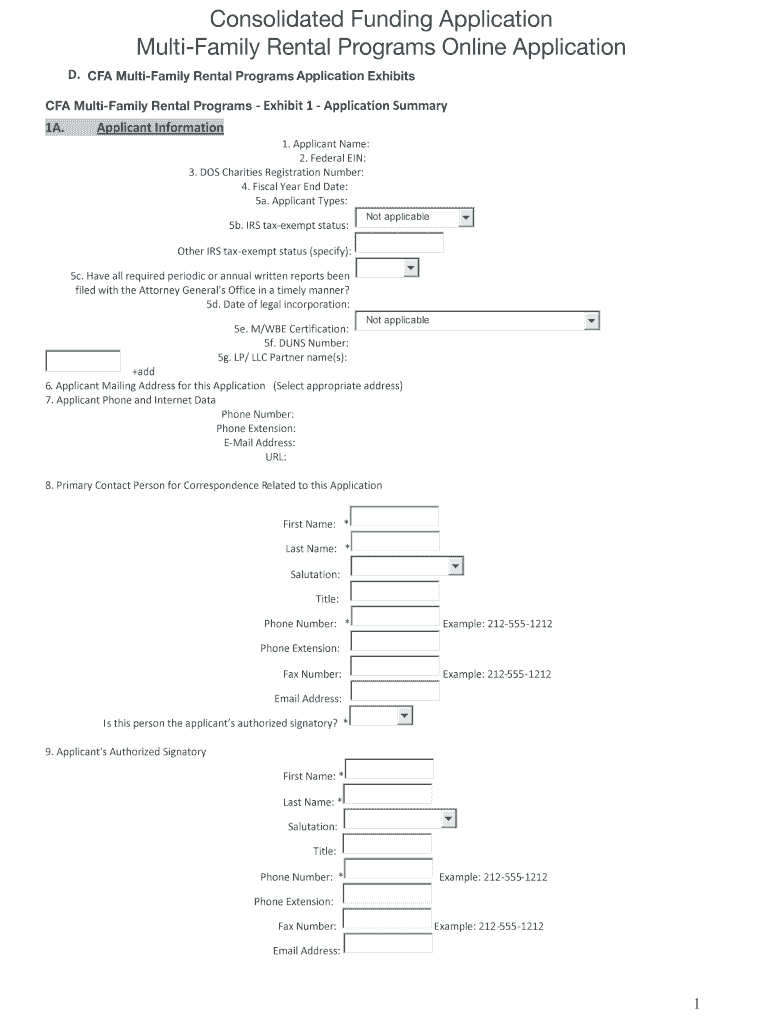

Get the free CFA Multi-Family Rental Programs - Exhibit 1 - Application Summary - nyshcr

Show details

This document serves as an application summary for multifamily rental programs, capturing owner information, program funding requests, project details, and community impact assessments.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign cfa multi-family rental programs

Edit your cfa multi-family rental programs form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your cfa multi-family rental programs form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit cfa multi-family rental programs online

In order to make advantage of the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit cfa multi-family rental programs. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out cfa multi-family rental programs

How to fill out CFA Multi-Family Rental Programs - Exhibit 1 - Application Summary

01

Gather all necessary documentation related to the multi-family rental program application.

02

Start by filling out the applicant's information section, including name, address, and contact details.

03

Provide information about the property, including location, size, and type of multi-family dwelling.

04

Include financial details such as rental income projections and existing debts associated with the property.

05

Detail the ownership structure, listing all owners and their respective shares.

06

Disclose any prior funding received from the CFA for similar projects.

07

Check for compliance with all local, state, and federal regulations and include supporting documents if necessary.

08

Review the entire application for completeness and accuracy before submission.

Who needs CFA Multi-Family Rental Programs - Exhibit 1 - Application Summary?

01

Developers looking to finance multi-family rental projects.

02

Property owners seeking to upgrade or expand existing rental properties.

03

Investors interested in understanding the applications for rental housing funding.

04

Local governments or housing authorities focused on improving affordable housing availability.

Fill

form

: Try Risk Free

People Also Ask about

How much does the CFA Institute pay?

How much does CFA Institute pay? CFA Institute salaries can vary greatly by role, ranging from $37,262 per year (or $18 per hour) for Cashier to $351,506 per year (or $169 per hour) for Managing Director. This is based on 411 salaries submitted on Glassdoor by CFA Institute employees as of August 2025.

How much money does the CFA Institute have?

Cfa Institute, fiscal year ending Aug. 2024 Organization zip code 22902-4868 Organization city Charlottesvle Net assets at end of fiscal year ($) 565,099,840 Total revenue ($) 462,892,00023 more rows

What is the annual revenue of the CFA Institute?

From September 2023 to August 2024, we recorded $376 million in revenue and an operating profit of $72 million, for an operating margin of 19 percent. Credentialing offerings, including the CFA Program, remained a key revenue driver, with $310 million in revenue.

How much money does a CFA make?

Salaries can vary widely for both CFAs and CPAs based on location, experience level, and company size. That being said, according to CFA Institute, the average salary for a CFA is $180,000 and the average salary for a CPA is $70,000.

What are the sections of the CFA exam 1?

The CFA Level 1 Exam tests knowledge in 10 different sections, including ethical and professional standards, quantitative methods, economics, portfolio management, and asset classes.

How to study FSA in CFA level 1?

Financial Statement Analysis for CFA Level 1: Unlock the Secrets of Financial Reports Introduction to Financial Statement Analysis. Analysing Income Statements. Analysing Balance Sheets. Analysing Cash Flow Statements. Analysis of Inventories. Analysis of Long-Term Assets. Topics in Long-Term Liabilities and Equity.

How much money does the CFA Institute make?

From September 2023 to August 2024, we recorded $376 million in revenue and an operating profit of $72 million, for an operating margin of 19 percent. Credentialing offerings, including the CFA Program, remained a key revenue driver, with $310 million in revenue.

How many fixed income questions are on CFA level 1?

Fixed Income is a pretty big deal on the CFA Level I exam. It makes up about 11% to 14% of the total exam, which translates to roughly 19 to 25 questions out of the 180 multiple-choice questions you'll face. This means Fixed Income is a key area to focus on.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is CFA Multi-Family Rental Programs - Exhibit 1 - Application Summary?

CFA Multi-Family Rental Programs - Exhibit 1 - Application Summary is a document used in the application process for funding or financing multi-family rental housing projects. It summarizes key information about the project such as ownership, location, and financing details.

Who is required to file CFA Multi-Family Rental Programs - Exhibit 1 - Application Summary?

The applicants seeking funding or financing under the CFA Multi-Family Rental Programs are required to file the Exhibit 1 - Application Summary. This typically includes developers, property owners, or related entities.

How to fill out CFA Multi-Family Rental Programs - Exhibit 1 - Application Summary?

To fill out the CFA Multi-Family Rental Programs - Exhibit 1 - Application Summary, applicants must provide detailed information regarding the project, including project description, budget, management plans, and any required certifications. It is important to follow the outlined instructions and provide accurate data.

What is the purpose of CFA Multi-Family Rental Programs - Exhibit 1 - Application Summary?

The purpose of the CFA Multi-Family Rental Programs - Exhibit 1 - Application Summary is to collect essential information from developers regarding their proposed multi-family rental projects. This information is used to assess eligibility, feasibility, and compliance with funding requirements.

What information must be reported on CFA Multi-Family Rental Programs - Exhibit 1 - Application Summary?

The information that must be reported includes project name, location, ownership details, proposed financing sources, projected costs, and timelines, along with any additional information required by the funding agency.

Fill out your cfa multi-family rental programs online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Cfa Multi-Family Rental Programs is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.