Get the free SONYMA Loan Extension and Rate Re‐Lock Policy - nyshcr

Show details

This document outlines the revised policy by the State of New York Mortgage Agency (SONYMA) regarding loan extension and interest rate re-lock procedures, effective immediately as of October 25, 2011.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign sonyma loan extension and

Edit your sonyma loan extension and form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sonyma loan extension and form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing sonyma loan extension and online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit sonyma loan extension and. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

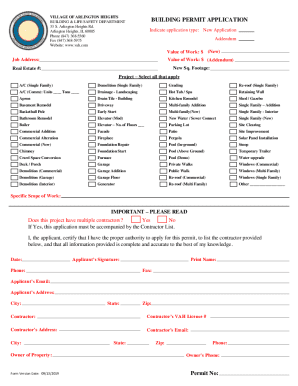

How to fill out sonyma loan extension and

How to fill out SONYMA Loan Extension and Rate Re‐Lock Policy

01

Download the SONYMA Loan Extension and Rate Re-Lock Policy form from the official website.

02

Begin by filling out the borrower’s personal information, including name, address, and contact details.

03

Specify the loan number and property address associated with the SONYMA loan.

04

Indicate the desired new loan terms and the reason for the extension or rate re-lock.

05

If applicable, include documentation to support your request, such as hardship letters or financial statements.

06

Review all information for accuracy and completeness.

07

Sign and date the form at the bottom.

08

Submit the completed form to the designated SONYMA address or email provided on the form.

Who needs SONYMA Loan Extension and Rate Re‐Lock Policy?

01

Homebuyers who have a SONYMA mortgage and wish to extend their loan term or lock in a different interest rate.

02

Borrowers facing financial difficulties or changes in circumstances that affect their current loan agreement.

03

Individuals looking to take advantage of potentially lower interest rates before finalizing their home purchase.

Fill

form

: Try Risk Free

People Also Ask about

What credit score do I need to have for a loan?

Key takeaways. You'll typically need a credit score of at least 580 to qualify for a personal loan, but the higher your score, the more affordable your loan rate. Lenders want to see that loan applicants have a history of responsibly paying debt, and your credit score provides a window into your past behavior.

What is the down payment assistance program in NYC?

The HomeFirst Down Payment Assistance Program provides qualified first-time homebuyers with up to $100,000 toward the down payment or closing costs on a 1-4 family home, a condominium, or a cooperative in one of the five boroughs of New York City.

What credit score do you need for a Sonyma loan?

Available to lower income first- time homebuyers. Down Payment Assistance Loan-up to 3% or $15,000 for down payment/closing costs. SONYMA has no FICO score requirement.

What is the minimum credit score for a Sallie Mae loan?

Eligibility requirements Noncitizens can qualify by applying with a cosigner who is a U.S. citizen or permanent resident. Credit requirements: Sallie Mae doesn't disclose a minimum credit score for approval but reports an average approval, but private lenders generally look for a minimum FICO credit score of 670.

What is the minimum credit score allowed to obtain a mortgage loan?

What Credit Score Do I Need to Buy a House? Loan TypeMinimum Credit Score Conventional loan 620 Jumbo loan 700 FHA loan 500 VA loan 6201 more row • Aug 18, 2025

Are there home buyer education requirements in NY?

Applicants must complete a homebuyer education course. All loans with less than a 20% down payment will require Private Mortgage Insurance (PMI)

What is the credit is due program in NY?

The Credit is Due program is an initiative designed to address racial disparities and increase access to financing for minority households. The program is offered in collaboration with lenders who have chosen to develop a Special Purchase Credit Program (SPCP).

What is the minimum credit score for a FHA loan?

For those interested in applying for an FHA loan, applicants are now required to have a minimum FICO score of 580 to qualify for the low down payment advantage, which is currently at around 3.5 percent. If your credit score is below 580, however, you aren't necessarily excluded from FHA loan eligibility.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is SONYMA Loan Extension and Rate Re‐Lock Policy?

The SONYMA Loan Extension and Rate Re‐Lock Policy allows borrowers to extend the closing date of their loan or to adjust the interest rate if the loan process is taking longer than expected, offering a more flexible lending process.

Who is required to file SONYMA Loan Extension and Rate Re‐Lock Policy?

The borrowers who are experiencing delays in their loan process or wish to take advantage of current interest rates are required to file for the SONYMA Loan Extension and Rate Re‐Lock Policy.

How to fill out SONYMA Loan Extension and Rate Re‐Lock Policy?

To fill out the SONYMA Loan Extension and Rate Re‐Lock Policy, borrowers must provide their loan details, reason for the extension or re-lock, relevant financial information, and any supporting documentation required by SONYMA.

What is the purpose of SONYMA Loan Extension and Rate Re‐Lock Policy?

The purpose of the SONYMA Loan Extension and Rate Re‐Lock Policy is to provide borrowers with increased flexibility in securing favorable loan terms and managing potential delays in the home-buying process.

What information must be reported on SONYMA Loan Extension and Rate Re‐Lock Policy?

Information that must be reported includes the borrower's name, loan number, reason for extension or re-lock, the requested new closing date, and any changes in financial circumstances that might affect the loan.

Fill out your sonyma loan extension and online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Sonyma Loan Extension And is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.