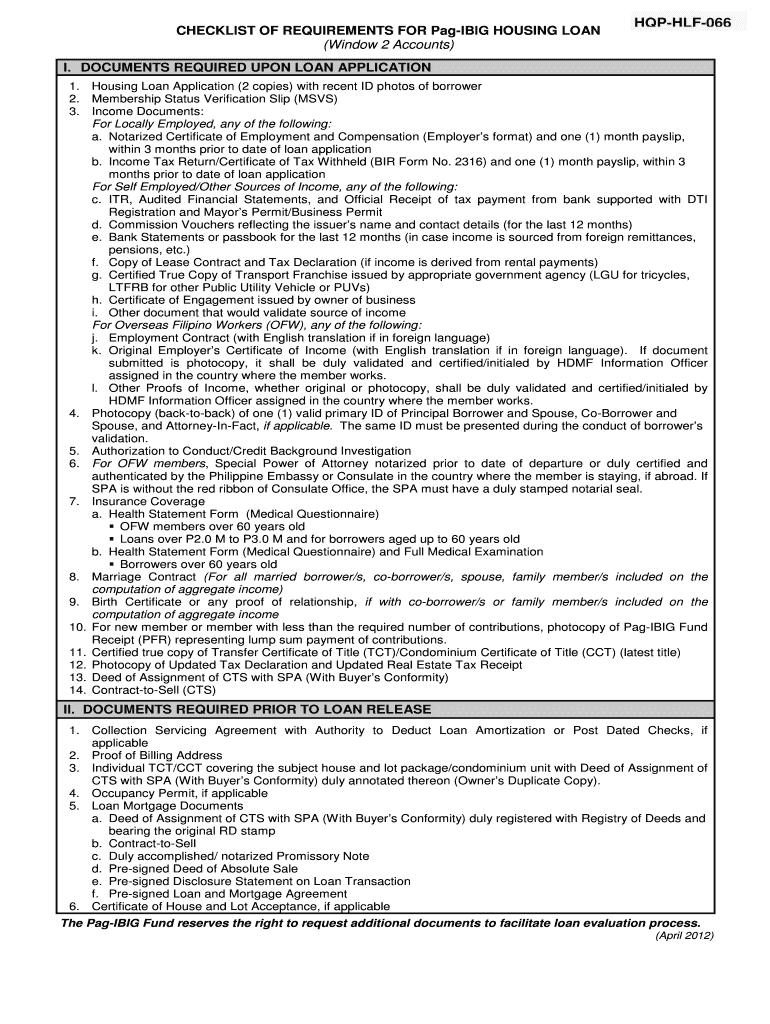

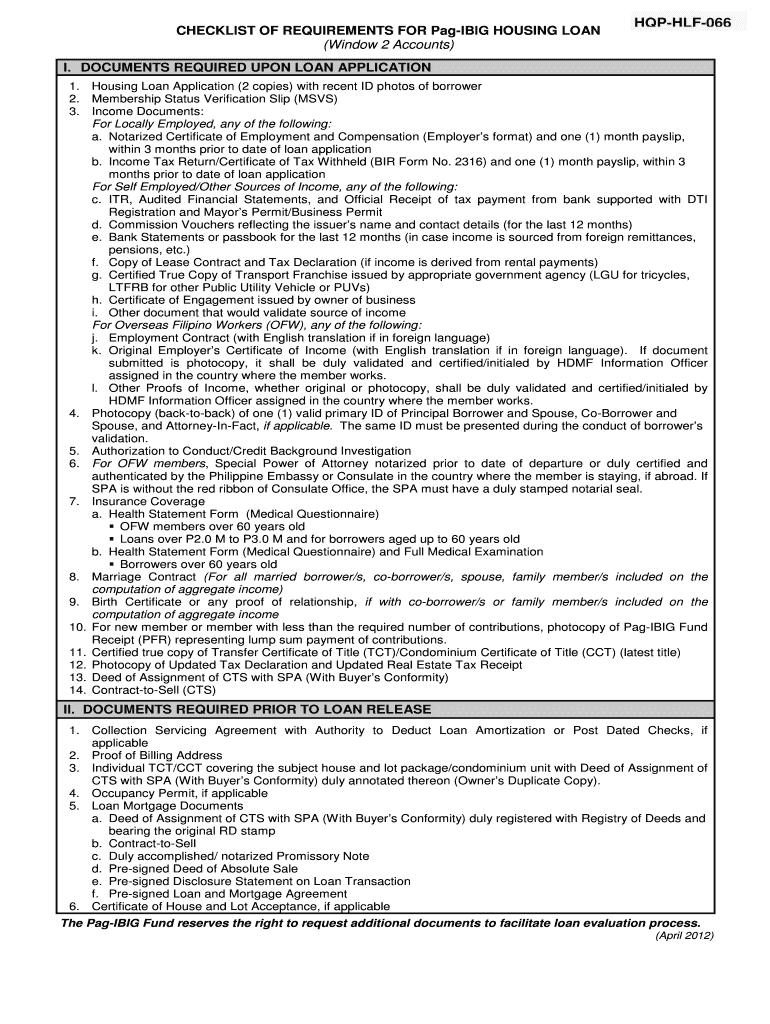

Get the free CHECKLIST OF REQUIREMENTS FOR Pag-IBIG HOUSING LOAN

Show details

This document provides a comprehensive checklist of the requirements needed for the Pag-IBIG housing loan application, including documents required upon application and prior to loan release.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign checklist of requirements for

Edit your checklist of requirements for form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your checklist of requirements for form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit checklist of requirements for online

Use the instructions below to start using our professional PDF editor:

1

Log in to your account. Start Free Trial and register a profile if you don't have one yet.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit checklist of requirements for. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out checklist of requirements for

How to fill out CHECKLIST OF REQUIREMENTS FOR Pag-IBIG HOUSING LOAN

01

Gather personal identification documents such as valid ID or Passport.

02

Prepare proof of income, which can include payslips, bank statements, or income tax return.

03

Obtain a Certificate of Employment if you're currently employed.

04

Collect documents related to the property, such as the Transfer Certificate of Title or Tax Declaration.

05

Fill out the Pag-IBIG Housing Loan Application Form accurately.

06

Prepare a sketch or vicinity map of the property you wish to purchase.

07

Make sure to comply with Pag-IBIG's additional requirements based on the type of loan.

Who needs CHECKLIST OF REQUIREMENTS FOR Pag-IBIG HOUSING LOAN?

01

Individuals who are first-time home buyers looking to finance their property.

02

Employees who are Pag-IBIG fund members seeking financial assistance for housing.

03

Those looking to refinance or renovate their existing homes.

04

Any qualified individuals seeking to avail housing loan benefits provided by Pag-IBIG.

Fill

form

: Try Risk Free

People Also Ask about

What are the conditions for Pag-IBIG housing loan?

To be eligible for the program's housing and other loan offerings, individuals must adhere to the Pag-IBIG housing loan requirements: have maintained Pag-IBIG membership for at least 24 months. no older than 65 years old when you apply for the loan, and no older than 70 years old when the loan is due.

How much Pag-IBIG housing loan for OFW?

How much is Pag Ibig housing loan of OFW? With this HDMF program, an OFW may loan a maximum of 6 Million pesos. Your loan will depend on how much you are earning and willing to pay which is normally 40% of your disposable income. But first, you have to know if you are eligible.

What is the maximum amount for a housing loan?

Home Loan Eligibility Criteria Salaried individuals Age limit Minimum age: Above 21 years at the time of loan commencement Maximum age: Up to 60 years or superannuation, whichever is earlier at the time of loan maturity. Minimum loan amount ₹3 lakh Maximum loan amount Up to ₹5 crore Loan tenure Up to 30 years4 more rows

How to avail Pag-IBIG loan for OFW?

To pass for the loan's eligibility, you must: Have an active Pag-IBIG membership and have at least contributed for at least 24 months. Not be 65 years old or more during the time of application and must not be 70 years old or older during loan maturity. Pass the credit background check.

Can OFW apply for a home loan?

If you are an OFW or based abroad, you can still apply for a home loan while outside the Philippines. This includes a filled-out application form, identification, income and property documents. Who can be your Loan Administrator? Preferably a family member.

How to qualify for a Pag-IBIG housing loan?

To be eligible for the program's housing and other loan offerings, individuals must adhere to the Pag-IBIG housing loan requirements: have maintained Pag-IBIG membership for at least 24 months. no older than 65 years old when you apply for the loan, and no older than 70 years old when the loan is due.

Why would I be disapproved for a Pag-IBIG loan?

Pag-IBIG discovers that any of the documents you have presented is or altered; You didn't pay any three consecutive monthly amortizations; You did not pay your loan for three consecutive monthly amortizations; or. You have violated any policy or guideline of the Pag-IBIG Fund.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is CHECKLIST OF REQUIREMENTS FOR Pag-IBIG HOUSING LOAN?

The CHECKLIST OF REQUIREMENTS FOR Pag-IBIG HOUSING LOAN is a document that outlines all necessary documents and conditions that a borrower must meet to qualify for a housing loan from Pag-IBIG.

Who is required to file CHECKLIST OF REQUIREMENTS FOR Pag-IBIG HOUSING LOAN?

Individuals applying for a housing loan through Pag-IBIG are required to file the CHECKLIST OF REQUIREMENTS to ensure they meet all necessary criteria and documentation requirements.

How to fill out CHECKLIST OF REQUIREMENTS FOR Pag-IBIG HOUSING LOAN?

To fill out the CHECKLIST OF REQUIREMENTS, applicants should carefully review each item listed in the checklist, gather the required documents, and provide accurate information as necessary to demonstrate eligibility for the loan.

What is the purpose of CHECKLIST OF REQUIREMENTS FOR Pag-IBIG HOUSING LOAN?

The purpose of the CHECKLIST OF REQUIREMENTS is to provide a clear and organized guide for applicants to ensure all necessary documentation is submitted, enabling a smoother loan processing experience.

What information must be reported on CHECKLIST OF REQUIREMENTS FOR Pag-IBIG HOUSING LOAN?

The information that must be reported includes personal details of the applicant, income verification documents, proof of identification, property details, and any other relevant documents specified in the checklist.

Fill out your checklist of requirements for online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Checklist Of Requirements For is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.