Get the free Penalty Waivers for Small Business Paperwork Violations - Public bb - pdc wa

Show details

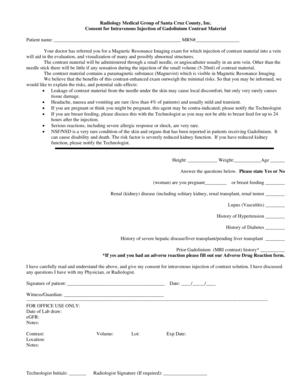

State of Washington PUBLIC DISCLOSURE COMMISSION 711 Capitol Way Rm. 206, PO Box 40908 Olympia, Washington 985040908 (360) 7531111 FAX (360) 7531112 Toll Free 18776012828 Email: PDC.Wei.gov Website:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign penalty waivers for small

Edit your penalty waivers for small form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your penalty waivers for small form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing penalty waivers for small online

Follow the steps down below to take advantage of the professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit penalty waivers for small. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out penalty waivers for small

How to Fill Out Penalty Waivers for Small:

Understand the Penalty Waiver Process:

01

Familiarize yourself with the requirements and guidelines for penalty waivers for small.

02

Research the specific forms and documentation needed for the waiver application.

Gather Relevant Information:

01

Collect all necessary information such as personal details, business information, and penalty details.

02

Make sure to have documentation supporting the reason for the penalty waiver request.

Complete the Penalty Waiver Application Form:

01

Obtain the appropriate penalty waiver application form from the relevant authority.

02

Fill out the form accurately and provide all requested information.

03

Double-check for any errors or missing details before submitting the form.

Include Supporting Documentation:

01

Attach any supporting documentation that proves the validity of your penalty waiver request.

02

This may include financial statements, invoices, medical records, or any other relevant evidence.

Explain the Reason for the Penalty Waiver:

01

Clearly state the reason why you believe you should qualify for the penalty waiver.

02

Provide a detailed explanation, emphasizing any extenuating circumstances or hardships faced.

Submit the Application:

01

Review the completed penalty waiver application thoroughly to ensure accuracy.

02

Submit the application along with the necessary supporting documents as instructed.

03

Keep copies of all documents submitted for your records.

Who Needs Penalty Waivers for Small?

Small Business Owners:

01

Small business owners who have been penalized for non-compliance with certain regulations or taxes may require penalty waivers.

02

These waivers can provide financial relief and help avoid additional penalties.

Individuals:

01

Individuals who have received penalties for various reasons, such as late tax payments or failure to comply with specific requirements, may need penalty waivers.

02

Waivers can provide an opportunity to explain mitigating circumstances and request relief from the penalties imposed.

Non-Profit Organizations:

01

Non-profit organizations facing penalties due to non-compliance or failure to meet specific obligations may also benefit from penalty waivers.

02

These waivers can help alleviate the financial burden faced by such organizations.

In conclusion, anyone who has incurred penalties for small-related issues, including small business owners, individuals, and non-profit organizations, may need to go through the process of filling out penalty waivers for small. Following the appropriate steps and providing relevant supporting documentation will help increase the chances of a successful penalty waiver application.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute penalty waivers for small online?

pdfFiller has made filling out and eSigning penalty waivers for small easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

Can I create an electronic signature for signing my penalty waivers for small in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your penalty waivers for small and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

How do I complete penalty waivers for small on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your penalty waivers for small. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is penalty waivers for small?

Penalty waivers for small refer to the exemptions or pardons given to small business entities or individuals to avoid paying penalties for certain offenses or violations.

Who is required to file penalty waivers for small?

Small business entities or individuals who have committed an offense or violation that is eligible for a penalty waiver are required to file for penalty waivers for small.

How to fill out penalty waivers for small?

To fill out penalty waivers for small, you need to obtain the specific form or application from the relevant authority or agency. Then, provide all the required information accurately and submit it within the specified deadline.

What is the purpose of penalty waivers for small?

The purpose of penalty waivers for small is to provide relief for small business entities or individuals from financial burdens by waiving or reducing penalties for certain offenses or violations.

What information must be reported on penalty waivers for small?

The specific information that must be reported on penalty waivers for small can vary depending on the offense or violation. However, generally, it may include details about the business entity or individual, nature of the offense, circumstances of the violation, and any supporting documents or evidence.

Fill out your penalty waivers for small online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Penalty Waivers For Small is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.