Get the free APPLICATION FOR ELDERLY PENSIONERS HOMEOWNERS TAX DEFERRAL PROGRAM

Show details

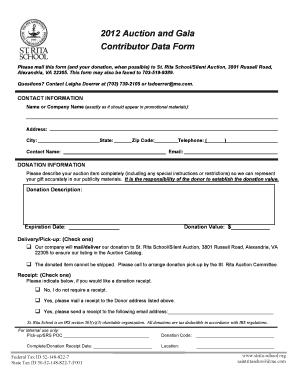

This document is an application form for elderly homeowners in Whitby to apply for a tax deferral program based on their eligibility for tax reduction or deferral on property taxes.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign application for elderly pensioners

Edit your application for elderly pensioners form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your application for elderly pensioners form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit application for elderly pensioners online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to your account. Click on Start Free Trial and register a profile if you don't have one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit application for elderly pensioners. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out application for elderly pensioners

How to fill out APPLICATION FOR ELDERLY PENSIONERS HOMEOWNERS TAX DEFERRAL PROGRAM

01

Obtain the APPLICATION FOR ELDERLY PENSIONERS HOMEOWNERS TAX DEFERRAL PROGRAM form from your local tax office or website.

02

Fill in your personal information, including your name, address, and contact details.

03

Provide information about your property, including the address and property identification number.

04

Indicate your age, confirming that you meet the minimum age requirement for the program.

05

List your income sources and provide documentation to verify your eligibility, including income tax returns or proof of pension.

06

Sign and date the application form, certifying that the information provided is accurate.

07

Submit the completed application to your local tax office by the specified deadline.

Who needs APPLICATION FOR ELDERLY PENSIONERS HOMEOWNERS TAX DEFERRAL PROGRAM?

01

Elderly homeowners who are on a fixed income and facing financial difficulties in paying property taxes may need the APPLICATION FOR ELDERLY PENSIONERS HOMEOWNERS TAX DEFERRAL PROGRAM.

Fill

form

: Try Risk Free

People Also Ask about

Is there a senior discount on California property taxes?

Senior Tax Exemptions in California The Senior Citizen Homeowners' Property Tax Exemption is available to homeowners who are at least 65 years old and meet certain income requirements.

Who is exempt from paying property taxes in the USA?

Common property tax exemptions include Veteran, Disabled Veteran, Homestead, Over 65 and more. Depending on where you live, you may be able to claim multiple property tax exemptions. Not all Veterans or homeowners qualify for these exemptions. Exemptions can vary by county and state.

Is there anywhere in the US with no property tax?

Sadly for investors, the answer is no, there are no states without property tax. This is because property tax is a useful way for local governments to fund public services such as schools, fire and police departments, infrastructure and libraries.

At what age do you stop paying property taxes in the USA?

The minimum age requirement for senior property tax exemptions is generally between the ages of 61 to 65. While many states like New York, Texas and Massachusetts require seniors be 65 or older, there are other states such as Washington where the age is only 61.

What states do you not have to pay property tax after 65?

For instance, while most states set the bar at 65, states like Washington allow exemptions starting at 61. Alabama is the only state that offers total property tax exemption to seniors 65 and up.

How do I get a senior discount on property taxes in Illinois?

To qualify you must: be age 65 by December 31st of the assessment year for which the application is made. own and occupy the property. be liable for the payment of real estate taxes on the property.

How to pay deferred property tax in BC?

You can repay all or part of your tax deferment account: By pre-authorized debit through eTaxBC. Online through your bank or financial institution. At a Service BC Centre. By mail. By a lawyer, notary or other party.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is APPLICATION FOR ELDERLY PENSIONERS HOMEOWNERS TAX DEFERRAL PROGRAM?

The Application for Elderly Pensioners Homeowners Tax Deferral Program is a financial assistance program that allows eligible elderly homeowners to defer payment of property taxes on their primary residence until they sell the property, move, or pass away.

Who is required to file APPLICATION FOR ELDERLY PENSIONERS HOMEOWNERS TAX DEFERRAL PROGRAM?

Individuals who are elderly homeowners (typically defined as age 65 or older) and meet certain income and residency requirements are required to file this application to qualify for the tax deferral program.

How to fill out APPLICATION FOR ELDERLY PENSIONERS HOMEOWNERS TAX DEFERRAL PROGRAM?

To fill out the application, eligible homeowners must provide personal information, including their age, income, a description of the property, and any supporting documentation required by the program guidelines. It's essential to ensure all information is accurate and complete before submission.

What is the purpose of APPLICATION FOR ELDERLY PENSIONERS HOMEOWNERS TAX DEFERRAL PROGRAM?

The purpose of the program is to assist elderly homeowners by providing them with the ability to defer property tax payments, relieving financial pressure and allowing them to remain in their homes without the burden of immediate tax payments.

What information must be reported on APPLICATION FOR ELDERLY PENSIONERS HOMEOWNERS TAX DEFERRAL PROGRAM?

The application must report information such as the applicant's name, age, income, property address, property value, and other financial details as required by the program's specifications.

Fill out your application for elderly pensioners online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Application For Elderly Pensioners is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.