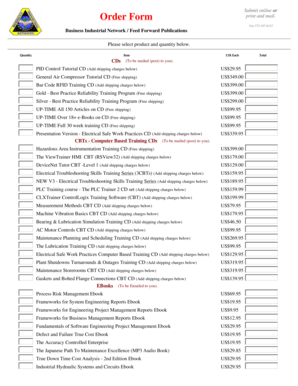

Get the free Gift of Securities Transfer Form - cape

Show details

Gift of Publicly Listed Securities to: The Canadian Health and Environment Education and Research Foundation (CHEER)* *Please note: CHEER is the charitable wing of The Canadian Association of Physicians

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign gift of securities transfer

Edit your gift of securities transfer form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your gift of securities transfer form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit gift of securities transfer online

To use the services of a skilled PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit gift of securities transfer. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out gift of securities transfer

How to Fill Out Gift of Securities Transfer:

01

Obtain the necessary forms: Start by contacting the organization to which you wish to donate your securities. They will provide you with the required forms for making the gift of securities transfer. These forms may vary depending on the organization, so make sure to request the specific ones needed.

02

Provide your personal information: Fill out your personal information accurately and completely on the forms. This may include your name, address, contact information, and social security number. Ensure that all details are correct to avoid any delays or complications in the transfer process.

03

Specify the securities you plan to donate: Indicate the exact securities you intend to donate on the form. This usually involves providing the name of the stock, the number of shares, and any other relevant details. Be thorough and double-check the accuracy of this information to prevent any confusion.

04

Determine the valuation date: The valuation date is the specific date on which the value of the securities will be determined. This is essential for calculating the tax deduction you may be eligible for. Consult with a tax advisor or the organization’s guidelines to ascertain the correct valuation date and ensure compliance with tax regulations.

05

Sign and date the forms: Review the completed forms thoroughly and sign and date them accordingly. Your signature indicates your consent and understanding of the terms and conditions of the gift of securities transfer. Make sure to date the documents to establish the timeline of the transfer accurately.

Who needs a gift of securities transfer?

01

Individuals looking to make tax-effective charitable contributions: Making a gift of securities transfer can be a beneficial way to support charitable organizations while receiving potential tax advantages. If you are keen on maximizing the impact of your donation while potentially enjoying tax benefits, a gift of securities transfer may be suitable for you.

02

Organizations accepting donations of securities: Charitable organizations that accept donations of securities need individuals who are willing to transfer their securities as a form of contribution. These organizations may provide the necessary forms, instructions, and guidance to make the process as smooth as possible for donors.

03

Individuals with appreciated securities: If you hold securities that have grown in value over time, donating them as a gift can be a strategic way to support a cause while potentially avoiding capital gains taxes. By transferring appreciated securities directly to a charitable organization, you may receive a tax deduction for the current fair market value of the securities.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is gift of securities transfer?

Gift of securities transfer is the act of transferring ownership of securities, such as stocks or bonds, as a gift to another person or entity.

Who is required to file gift of securities transfer?

The person or entity transferring the securities is required to file gift of securities transfer.

How to fill out gift of securities transfer?

To fill out gift of securities transfer, you need to provide information about the securities being transferred, the recipient of the gift, and the value of the securities.

What is the purpose of gift of securities transfer?

The purpose of gift of securities transfer is to transfer ownership of securities as a gift to another person or entity.

What information must be reported on gift of securities transfer?

The information that must be reported on gift of securities transfer includes details of the securities being transferred, the recipient of the gift, and the value of the securities.

How can I send gift of securities transfer to be eSigned by others?

To distribute your gift of securities transfer, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How do I execute gift of securities transfer online?

Filling out and eSigning gift of securities transfer is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

Can I create an electronic signature for the gift of securities transfer in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your gift of securities transfer and you'll be done in minutes.

Fill out your gift of securities transfer online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Gift Of Securities Transfer is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.