Get the free Stamp Duty First Home Owner Concession (FHOC)

Show details

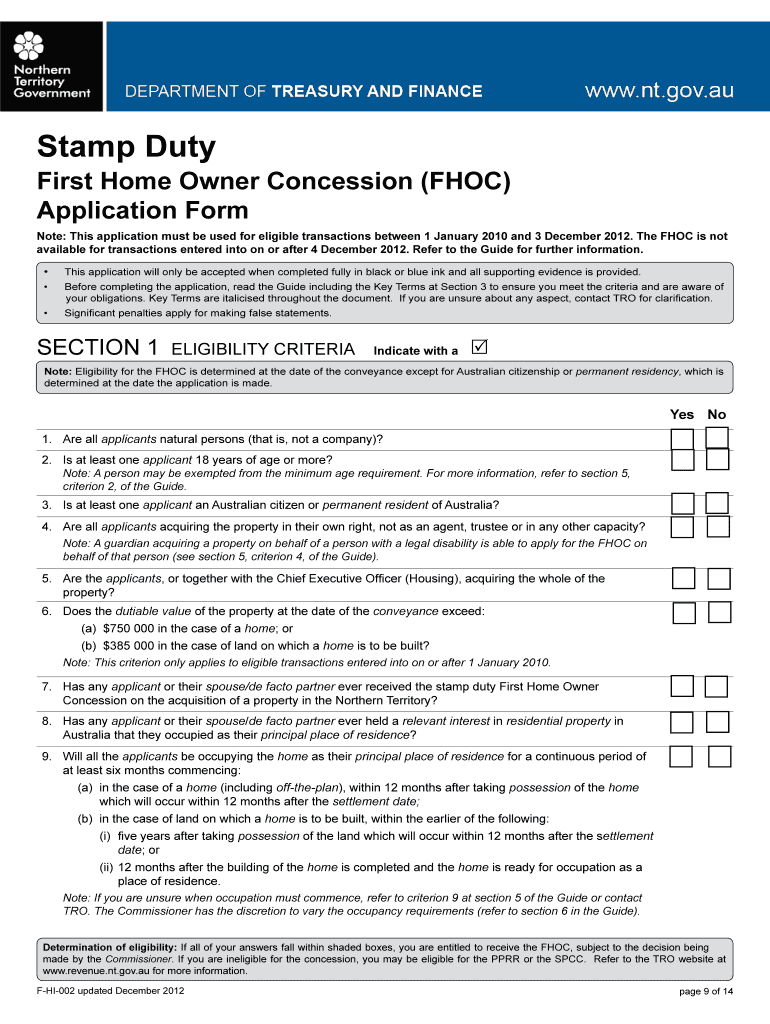

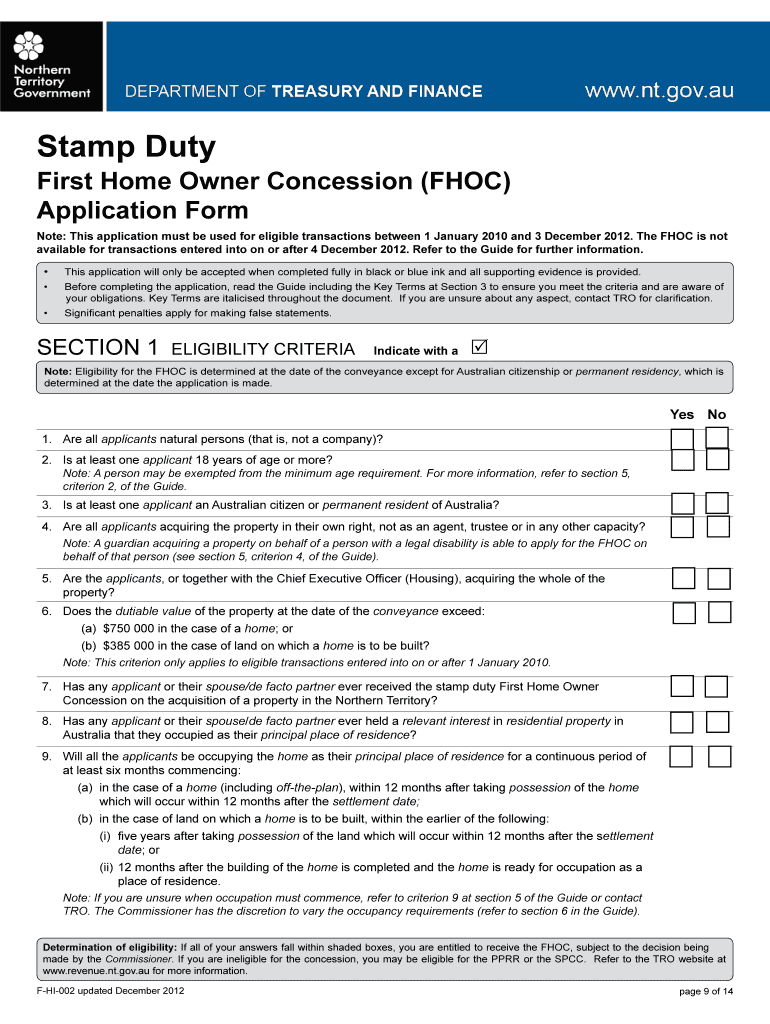

This guide explains the eligibility criteria, application procedures, and supporting evidence required for the First Home Owner Concession (FHOC) in the Northern Territory, Australia, including the

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign stamp duty first home

Edit your stamp duty first home form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your stamp duty first home form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit stamp duty first home online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit stamp duty first home. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is simple using pdfFiller. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out stamp duty first home

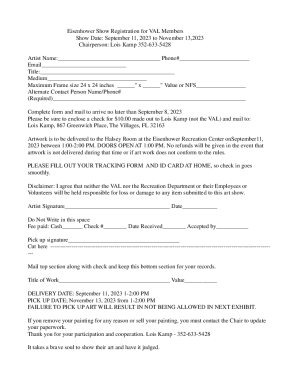

How to fill out Stamp Duty First Home Owner Concession (FHOC)

01

Obtain the Stamp Duty First Home Owner Concession application form from your state or territory's revenue office website.

02

Fill out the personal details section, including your name, address, and contact information.

03

Provide details about the property you are purchasing, including the address and the purchase price.

04

Indicate whether you are applying for the concession as an individual or as part of a couple.

05

Include proof of identity documents, such as a driver's license or passport, as well as any other required documentation regarding your financial situation.

06

Sign and date the application form to confirm that all information is accurate.

07

Submit the completed application form and supporting documents to your local revenue office, either online or by mail.

Who needs Stamp Duty First Home Owner Concession (FHOC)?

01

First-time home buyers who are purchasing a residential property and meet specific eligibility criteria set by their state or territory government.

Fill

form

: Try Risk Free

People Also Ask about

Do I pay stamp duty on my first home in Australia?

The First Home Owner Rate of Duty, provides a concessional rate of stamp duty for properties valued up to $430,000. There is also a sliding scale of concessions for properties valued between $430,001 and $530,000.

Which state has the highest stamp duty for first home buyers?

Victoria is one of the most expensive states for stamp duty but does offer a principal place of residence (PPR) concession for those who live in the property for 12 months after buying. Total government fees (est.)

Do I have to pay stamp duty on my first home in Australia?

What you'll pay. There's no stamp duty for homes valued up to $430,000 (purchased before 9 May 2024) or up to $450,000 (purchased on or after 9 May 2024). Concessions apply for homes valued between $430,001 and $530,000 (purchased before 9 May 2024) or between $450,000 and $600,000 (purchased on or after 9 May 2024).

How to avoid paying stamp duty in VIC?

If you buy a property with a dutiable value of $600,000 or less, you get the first home buyer stamp duty exemption. You pay zero stamp duty. If you buy a property with a dutiable value between $600,001 to $750,000.00 you get the first home buyer duty concession.

What is the act first home buyer stamp duty concession?

What's more, the ACT Home Buyers Concession Scheme frees first home buyers from all stamp duty on properties at any price, as long as their total household income is under the threshold ($250,000 for a household with no dependent children and higher for those with dependents) and they haven't owned property in the last

How much stamp duty do you pay in Canberra?

FAQs Property valueStamp duty rate Up to $260 000 $0.40 for every $100 or part of $100 $260,001 to $300,000 $1,040, plus $2.20 for every $100 or part of $100 over of $260,000 $300,001 to $500,000 $1,920, plus $3.40 for every $100 or part of $100 over of $300,0004 more rows

What is the Help to Buy Scheme Act?

Help to Buy is an Australian Government initiative administered by Housing Australia, designed to support more Australians in achieving homeownership. In March 2025, the Government expanded eligibility for Help to Buy, raising income and property price caps to enhance accessibility.

Who is eligible for stamp duty refund in Victoria?

Stamp Duty Refund Eligibility Common concessions are: the first home buyer concession, the off the plan concession, pensioner/concession card holder discount, the permanent place of residence, and the young farmer concession. Your circumstances changed after you've bought a property.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Stamp Duty First Home Owner Concession (FHOC)?

Stamp Duty First Home Owner Concession (FHOC) is a financial relief program designed to assist first-time home buyers by reducing or waiving the stamp duty they would otherwise pay when purchasing their first residential property.

Who is required to file Stamp Duty First Home Owner Concession (FHOC)?

First-time home buyers who meet specific eligibility criteria, such as being Australian citizens or permanent residents and purchasing a property for their own occupancy, are required to file for the Stamp Duty First Home Owner Concession (FHOC).

How to fill out Stamp Duty First Home Owner Concession (FHOC)?

To fill out the Stamp Duty First Home Owner Concession (FHOC), applicants must complete the relevant application form provided by the state or territory revenue office, providing necessary personal details and property information, and submit it along with any required documentation.

What is the purpose of Stamp Duty First Home Owner Concession (FHOC)?

The purpose of the Stamp Duty First Home Owner Concession (FHOC) is to make home ownership more accessible and affordable for first-time buyers by alleviating the financial burden of stamp duty payments, encouraging home ownership and stability in the housing market.

What information must be reported on Stamp Duty First Home Owner Concession (FHOC)?

The information that must be reported on the Stamp Duty First Home Owner Concession (FHOC) includes the applicant's personal details, property details (such as address and purchase price), and any supporting documents that verify the applicant's eligibility for the concession.

Fill out your stamp duty first home online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Stamp Duty First Home is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.