Get the free Pre-Authorized Monthly Tax and Utility Payment Plan

Show details

This document outlines the terms and conditions for enrolling in the Pre-Authorized Monthly Tax and Utility Payment Plan for property taxes and utilities in the Resort Municipality of Whistler.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign pre-authorized monthly tax and

Edit your pre-authorized monthly tax and form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your pre-authorized monthly tax and form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing pre-authorized monthly tax and online

Use the instructions below to start using our professional PDF editor:

1

Log in to account. Click on Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit pre-authorized monthly tax and. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

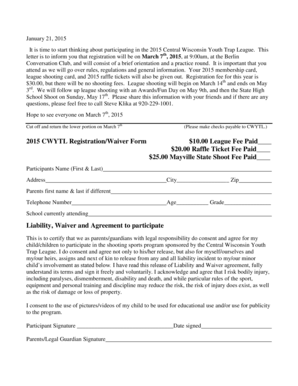

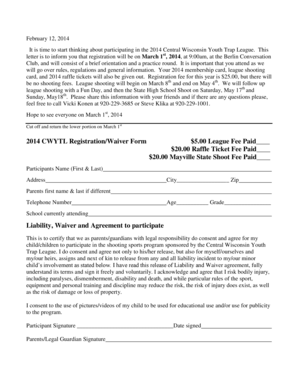

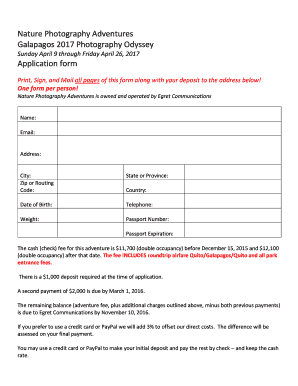

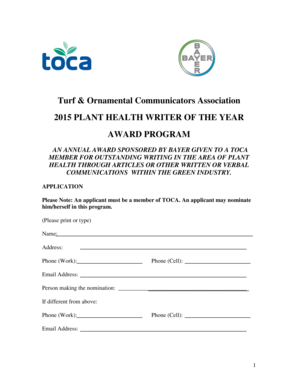

How to fill out pre-authorized monthly tax and

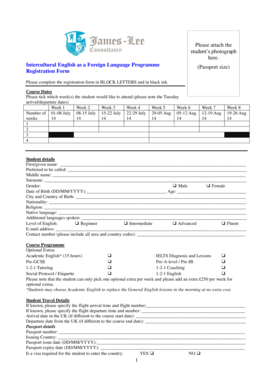

How to fill out Pre-Authorized Monthly Tax and Utility Payment Plan

01

Step 1: Gather your tax and utility bills to know the amounts you need to pay.

02

Step 2: Visit your local tax authority or utility provider's website to find the Pre-Authorized Payment Plan enrollment form.

03

Step 3: Fill out the enrollment form with your personal details, including name, address, and payment information.

04

Step 4: Specify the amounts you wish to deduct monthly, ensuring they align with your tax and utility bills.

05

Step 5: Review the payment schedule; choose your preferred monthly deduction date.

06

Step 6: Sign the form to authorize the payment plan.

07

Step 7: Submit the completed form to your local tax authority or utility provider, either online or by mail.

08

Step 8: Monitor your bank statements to confirm that the payments are being deducted as planned.

Who needs Pre-Authorized Monthly Tax and Utility Payment Plan?

01

Homeowners and renters with tax and utility obligations.

02

Individuals seeking to manage their cash flow by spreading payments over the year.

03

Those who prefer automated payments to avoid late fees.

04

Families or individuals with variable incomes who want predictable monthly expenses.

Fill

form

: Try Risk Free

People Also Ask about

Do pre-authorized payments come out automatically?

Pre-authorized debits (PADs) are a convenient way to pay bills and make other payments automatically. Instead of sending a payment, a company withdraws funds from your bank account.

Can I pay my UK tax bill in installments?

You can set up a Budget Payment plan to make weekly or monthly Direct Debit payments towards your next Self Assessment tax bill.

How does pre-authorized payment work?

A pre-authorized debit allows the biller to withdraw money from your bank account when a payment is due. Pre-authorized debits may be useful when you want to make payments from your account on a regular basis.

What is a pap for property taxes in barrie?

The Monthly PAP Plan is available to owners of properties that are NOT in property tax arrears. A monthly amount is withdrawn 10 times per year, excluding November and December. Installments are withdrawn from the taxpayer's bank account on the last business day of each month.

How often do you pay Toronto property tax?

The City of Toronto issues two property tax bills each year. Interim bills are mailed in January and Final bills are mailed in May.

Does a pre-authorisation take money from your account?

The pre-authorisation amount is not an actual charge, but a temporary hold. This amount is deducted from your available balance, reserving these funds for the potential future transaction. The actual account balance doesn't decrease at this stage.

How does a pre-authorization work?

A pre authorization charge, or pre auth, is a temporary hold placed on a customer's credit card by a merchant for certain transactions. It ensures that the customer has sufficient funds available to cover the requested amount without immediately debiting their account.

Do you get pre-authorization money back?

If the purchase is not completed, the preauthorization amount is released back into the card's available balance after a certain period, which can vary depending on the card issuer's policies. This process is a standard practice to verify that a card is active and can cover potential charges.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Pre-Authorized Monthly Tax and Utility Payment Plan?

The Pre-Authorized Monthly Tax and Utility Payment Plan is a program that allows property owners to pay their property taxes and utility bills automatically on a monthly basis, directly from their bank account.

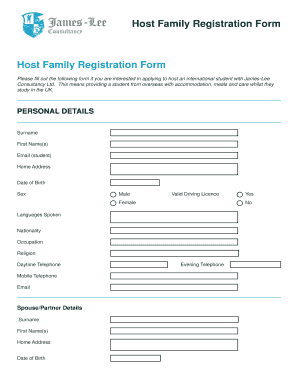

Who is required to file Pre-Authorized Monthly Tax and Utility Payment Plan?

Property owners who wish to participate in the plan must fill out the necessary forms; it is typically optional rather than mandatory, but some municipalities may require it for certain programs.

How to fill out Pre-Authorized Monthly Tax and Utility Payment Plan?

To fill out the plan, property owners need to complete an application form provided by their municipality, providing their banking information and authorization for the automatic withdrawals.

What is the purpose of Pre-Authorized Monthly Tax and Utility Payment Plan?

The purpose of the plan is to simplify the payment process for property owners, ensuring timely payments and reducing the risk of late fees or penalties.

What information must be reported on Pre-Authorized Monthly Tax and Utility Payment Plan?

The information required typically includes the property owner's name, address, banking details, account number, and a signed authorization to debit their account monthly.

Fill out your pre-authorized monthly tax and online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Pre-Authorized Monthly Tax And is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.