TX Tax Certificate Request Form free printable template

Show details

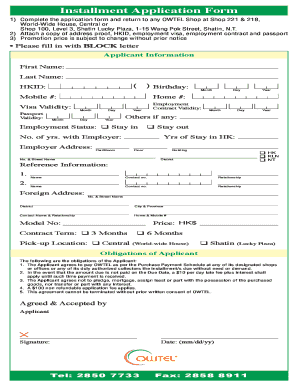

Travis County Tax Office P.O. Box 149328 Austin, TX 78714-9328 (512) 854-9473 voice (512) 854-9235 fax EMAIL: Tax Office co. Travis.TX.us TAX CERTIFICATE REQUEST FORM ALL INFORMATION MUST BE COMPLETE

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign TX Tax Certificate Request Form

Edit your TX Tax Certificate Request Form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your TX Tax Certificate Request Form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing TX Tax Certificate Request Form online

Follow the guidelines below to benefit from a competent PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit TX Tax Certificate Request Form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out TX Tax Certificate Request Form

How to fill out TX Tax Certificate Request Form - Travis

01

Obtain the TX Tax Certificate Request Form from the official Texas Comptroller's website or your local tax office.

02

Fill in the required identification information, including your name, address, and the reason for the request.

03

Provide specific details about the property or business for which the tax certificate is being requested.

04

Include any relevant account numbers or identifiers related to the tax situation.

05

Review the completed form for accuracy and completeness.

06

Submit the form either online, by mail, or in person to the relevant tax authority.

Who needs TX Tax Certificate Request Form - Travis?

01

Individuals or businesses looking to confirm their tax status or obtain proof of tax payments.

02

Property owners seeking to verify property tax payments for refinancing or selling property.

03

Accountants or tax professionals needing documentation for clients.

Fill

form

: Try Risk Free

People Also Ask about

What is a property tax certificate Texas?

A tax certificate is a document showing the current status of taxes, penalties, interest, and any known costs due on a property. To produce a tax certificate the following information is needed: Current tax year property account number. Legal Description. Property Owner.

How do I find out how much property tax I owe in Texas?

To check department records for tax liens, you may view homeownership records online or call our office at 1-800-500-7074, ext. 64471.

How do I get my Texas property tax statement?

You can find out how much your current taxes are and make your payment by going to the Property Tax Account Lookup application or you may request a statement by calling us at 972-547-5020 during business hours. You may also fax us at 972-547-5053 with your name, phone number, and question.

How do I buy a tax delinquent property in Texas?

Delinquent tax property deeds are sold to the highest bidder. Bring acceptable for of payment – cash or cashier's check before bidding on properties. An investor can win a bid by being highest bidder on delinquent tax property deed. The county will issue Sheriff's deed for the property to the highest bidder.

What is a tax certificate Texas real estate?

A tax certificate is a document showing the current status of taxes, penalties, interest, and any known costs due on a property. To produce a tax certificate the following information is needed: Current tax year property account number. Legal Description. Property Owner.

Can I buy a tax lien in Texas?

You cannot buy tax liens in Texas. It's a tax deed state.

Can you buy tax lien certificates in Texas?

Anyone can request a tax certificate. The fee is $10 and certificates are ready in three to five business days. Texas does not sell tax lien certificates to investors, but we do conduct tax foreclosure sales. Learn how you can bid on foreclosed properties.

What is a Texas property tax certificate?

A tax certificate is a document showing the current status of taxes, penalties, interest, and any known costs due on a property. To produce a tax certificate the following information is needed: Current tax year property account number. Legal Description. Property Owner.

What is a tax certificate in Texas?

A tax certificate is a document showing the current status of taxes, penalties, interest, and any known costs due on a property. To produce a tax certificate the following information is needed: Current tax year property account number. Legal Description. Property Owner.

Who pays the tax certificate fee in Texas?

Tax Certificate This is a seller expense. The title company is required to balance and prorate year to date taxes at the time of closing. In order to do this, they order a tax certificate meant to verify the correct amount of taxes to collect.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the TX Tax Certificate Request Form in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your TX Tax Certificate Request Form directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

How do I fill out TX Tax Certificate Request Form using my mobile device?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign TX Tax Certificate Request Form and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

How do I edit TX Tax Certificate Request Form on an Android device?

You can edit, sign, and distribute TX Tax Certificate Request Form on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

What is TX Tax Certificate Request Form - Travis?

The TX Tax Certificate Request Form - Travis is a document used to request a certificate of good standing or a certificate of tax status from the Travis County Tax Assessor-Collector's office in Texas.

Who is required to file TX Tax Certificate Request Form - Travis?

Entities or individuals who need to verify their tax status or obtain a tax certificate for transactions like property sales, loans, or other legal purposes are required to file the form.

How to fill out TX Tax Certificate Request Form - Travis?

To fill out the TX Tax Certificate Request Form - Travis, applicants should provide their name, address, and relevant identification information, along with any specific details regarding the property or tax period in question.

What is the purpose of TX Tax Certificate Request Form - Travis?

The purpose of the TX Tax Certificate Request Form - Travis is to formally request verification of a taxpayer's status with respect to local taxes, ensuring compliance and facilitating various transactions.

What information must be reported on TX Tax Certificate Request Form - Travis?

The information that must be reported on the TX Tax Certificate Request Form - Travis includes the requester's identifying information, the type of certificate requested, property details, and any relevant tax account numbers.

Fill out your TX Tax Certificate Request Form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

TX Tax Certificate Request Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.