Get the free LOCAL SERVICES TAX EMPLOYEE LISTING SHEET

Show details

This document is used by employers to list their employees for the purpose of local services tax reporting, including details such as employee names, social security numbers, tax withheld, and total

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign local services tax employee

Edit your local services tax employee form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your local services tax employee form via URL. You can also download, print, or export forms to your preferred cloud storage service.

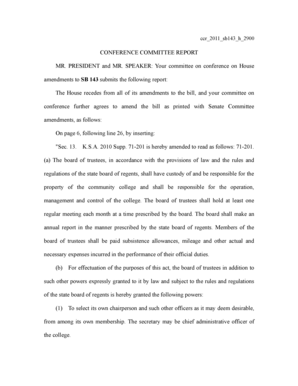

Editing local services tax employee online

To use the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit local services tax employee. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

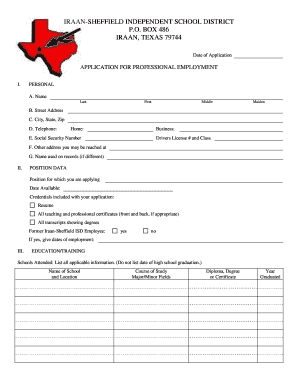

How to fill out local services tax employee

How to fill out LOCAL SERVICES TAX EMPLOYEE LISTING SHEET

01

Obtain the LOCAL SERVICES TAX EMPLOYEE LISTING SHEET form from your local authority or download it from their website.

02

Fill in the employer's name, address, and contact information at the top of the sheet.

03

List each employee's full name and social security number in the designated columns.

04

Indicate the employee's job title and the date they were hired in the respective fields.

05

Provide details about the employee's residency status, indicating if they are a resident or non-resident.

06

Report the total wages earned by each employee for the applicable tax year in the appropriate column.

07

Sign and date the form at the bottom, certifying that the information provided is accurate.

08

Submit the completed form to the corresponding local tax collection office by the specified deadline.

Who needs LOCAL SERVICES TAX EMPLOYEE LISTING SHEET?

01

Employers who have employees working within a jurisdiction that imposes a local services tax.

02

Businesses required to report employee information for local tax assessment.

03

Any entity providing employment that falls under the regulations of local services tax.

Fill

form

: Try Risk Free

People Also Ask about

What is the local service area tax?

A local service tax is created by the municipal council to pay all or part of the cost of a local area service. The tax may be structured as a property value tax, a parcel tax or a combination of the two. The proceeds of a local service tax may only be spent for the local area service for which it is collected.

What is a local service tax?

The Local Services Tax ( LST ) is levied on every individual engaging in an occupation, whether as an employee or self-employed, within his/her respective jurisdictional limits. The LST is a based on where an individual works, not where an individual resides.

What is the local services tax in Pittsburgh PA?

The Local Services Tax is $52/year, collected quarterly. For more information, see: Local Services Tax Regulations. Local Services Tax FAQs.

What is LST on PA W2?

The Local Services Tax (LST) for cities in Pennsylvania is withheld on a mandatory basis from the salaries of employees whose duty stations are located in the cities listed below: City.

What is the meaning of local service tax?

This is a tax levied on wealth and incomes of all persons in gainful employment, self –employed and practicing professionals, self-employed artisans, business men/women and commercial farmers.

What is the purpose of the local service tax?

The Local Services Tax is a local tax payable by all individuals who hold a job or profession within a taxing jurisdiction imposing the tax. Your taxes are used to support police, fire and emergency services and road maintenance.

Do you pay local tax where you live or work?

Earnings and payroll taxes are typically calculated as a percentage of wages, withheld by the employer (though paid by the employee) and paid by individuals who work in the taxing locality, even if the person lives in another city or state without the tax.

What is the meaning of local tax?

A local tax is a tax levied by a local government on the residents of that area. The tax is usually based on the value of the property, income, or goods and services purchased in the area. The purpose of the tax is to raise revenue for the local government to fund local services such as schools, police, and roads.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is LOCAL SERVICES TAX EMPLOYEE LISTING SHEET?

The Local Services Tax Employee Listing Sheet is a document used by employers to report information about their employees for local tax purposes.

Who is required to file LOCAL SERVICES TAX EMPLOYEE LISTING SHEET?

Employers who pay local services tax on behalf of their employees are required to file the Local Services Tax Employee Listing Sheet.

How to fill out LOCAL SERVICES TAX EMPLOYEE LISTING SHEET?

To fill out the Local Services Tax Employee Listing Sheet, employers need to provide accurate employee information, including names, addresses, Social Security numbers, and the amount of local services tax withheld.

What is the purpose of LOCAL SERVICES TAX EMPLOYEE LISTING SHEET?

The purpose of the Local Services Tax Employee Listing Sheet is to ensure proper reporting and compliance with local tax regulations concerning the taxation of employees.

What information must be reported on LOCAL SERVICES TAX EMPLOYEE LISTING SHEET?

The information that must be reported includes employee names, addresses, Social Security numbers, wages, and the local services tax withheld from their pay.

Fill out your local services tax employee online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Local Services Tax Employee is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.