Get the free Retirement Reporting Reminders - drs wa

Show details

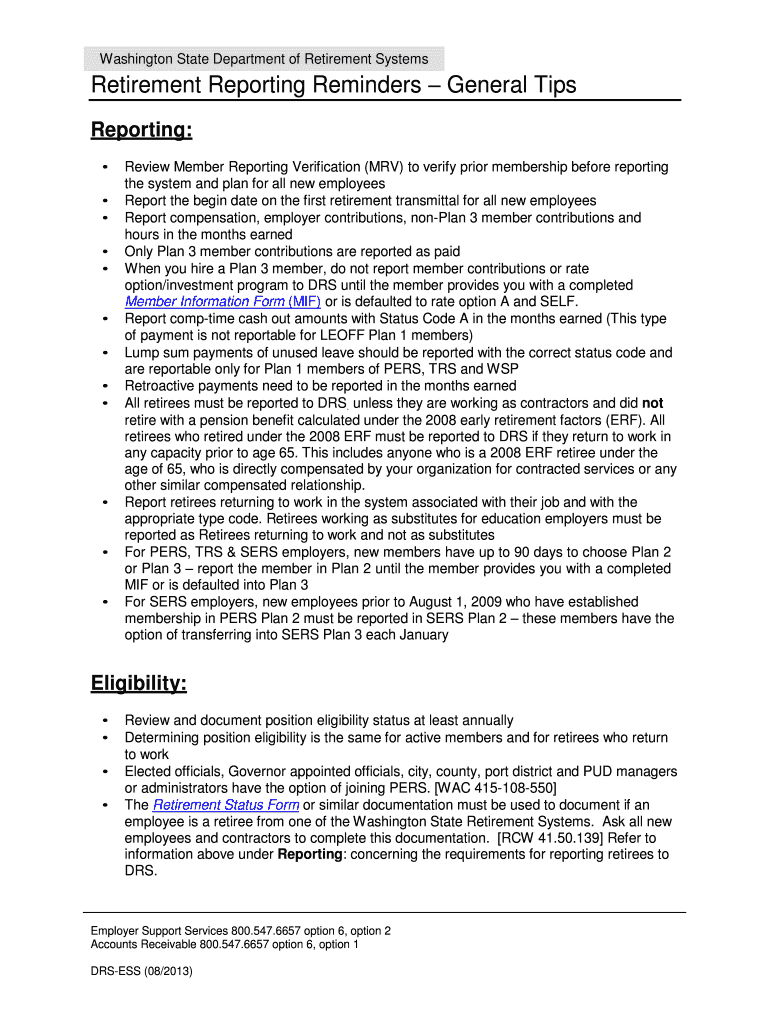

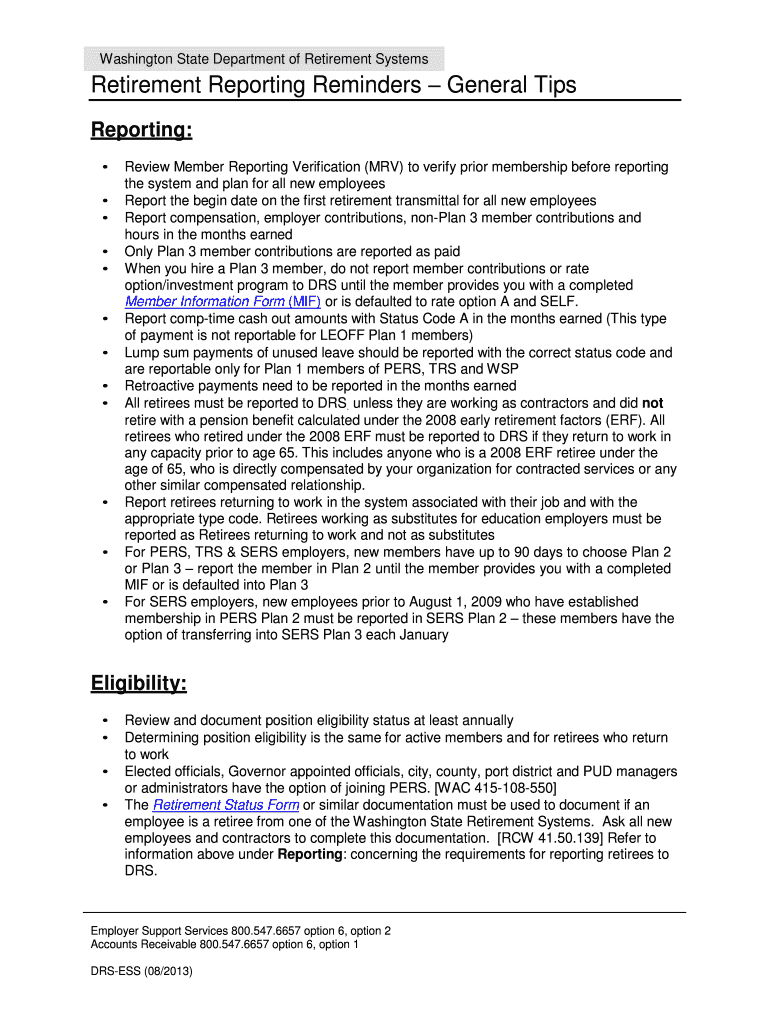

This document provides general tips and reminders for reporting retirement-related information for Washington State Department of Retirement Systems, including guidelines for new members, retirees,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign retirement reporting reminders

Edit your retirement reporting reminders form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your retirement reporting reminders form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing retirement reporting reminders online

To use the services of a skilled PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit retirement reporting reminders. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Dealing with documents is simple using pdfFiller. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out retirement reporting reminders

How to fill out Retirement Reporting Reminders

01

Step 1: Gather all necessary personal information including your Social Security number and retirement account details.

02

Step 2: Review the specific deadlines for submitting your Retirement Reporting Reminders.

03

Step 3: Fill in your personal details accurately on the provided form.

04

Step 4: Include information about your current employment status and future retirement plans.

05

Step 5: Double-check for any changes or corrections needed before submission.

06

Step 6: Submit the completed Retirement Reporting Reminders form to the appropriate authority by the deadline.

Who needs Retirement Reporting Reminders?

01

Employees nearing retirement age who need to report their retirement plans.

02

Employers who need to track employee retirement dates and related benefits.

03

HR departments responsible for managing employee retirement benefits.

04

Financial planners providing advice to clients about retirement.

Fill

form

: Try Risk Free

People Also Ask about

How far in advance should I announce my retirement?

You should give notice for retirement at least 3 to 6 months before the anticipated date of retirement. If you are a junior employer, you may be allowed to give at least a 30-day notice in advance. Research your company retirement policy to know how much notice you should give.

What is the first thing to do before retiring?

Here are six things to do now to set yourself up for a smoother retirement when the big day comes. #1: Find out where you stand. #2: Boost your savings, if you need to. #3: Plan ahead for Social Security. #4: Consider tax-smart strategies now. #5: Get a head start on future health care costs.

How do I say I am retiring?

I am writing to inform you of my upcoming retirement from the position of [job role] at [company name]. Taking into account my notice period of [notice period length], I intend for my last day of work to be [date].

How do I notify of retirement?

Pension payments, annuities, and the interest or dividends from your savings and investments are not earnings for Social Security purposes. You may need to pay income tax, but you do not pay Social Security taxes.

How do you announce your retirement?

Retirement letters are typically cordial and express gratitude. They also usually include an offer to help with the transition and state your last day of work. In more familiar letters, it's also customary to include a brief summary of your time with your employer, your plans for the future, and well wishes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Retirement Reporting Reminders?

Retirement Reporting Reminders are notifications or guidelines that remind individuals or businesses about the requirements and deadlines for submitting retirement-related reports and contributions.

Who is required to file Retirement Reporting Reminders?

Employers, plan administrators, and other entities responsible for maintaining retirement plans are required to file Retirement Reporting Reminders.

How to fill out Retirement Reporting Reminders?

Fill out Retirement Reporting Reminders by providing necessary details such as the plan name, reporting period, contribution amounts, and any relevant participant data, following the specified format and instructions provided.

What is the purpose of Retirement Reporting Reminders?

The purpose of Retirement Reporting Reminders is to ensure compliance with retirement plan reporting requirements, helping to avoid penalties and ensure that plan participants receive their benefits timely.

What information must be reported on Retirement Reporting Reminders?

Information that must be reported includes the retirement plan's name, reporting period, total contributions, participant information, and compliance status with applicable regulations.

Fill out your retirement reporting reminders online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Retirement Reporting Reminders is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.