Get the free FHOG requirements

Show details

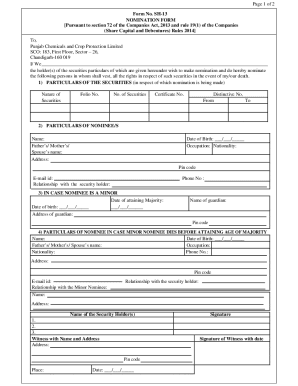

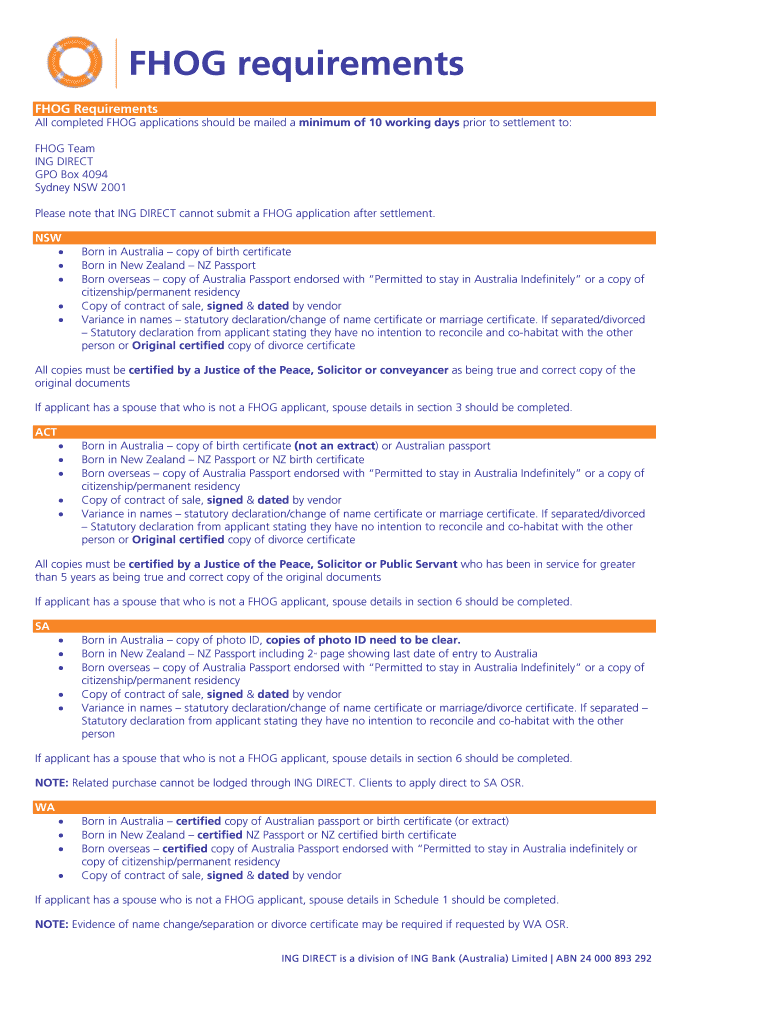

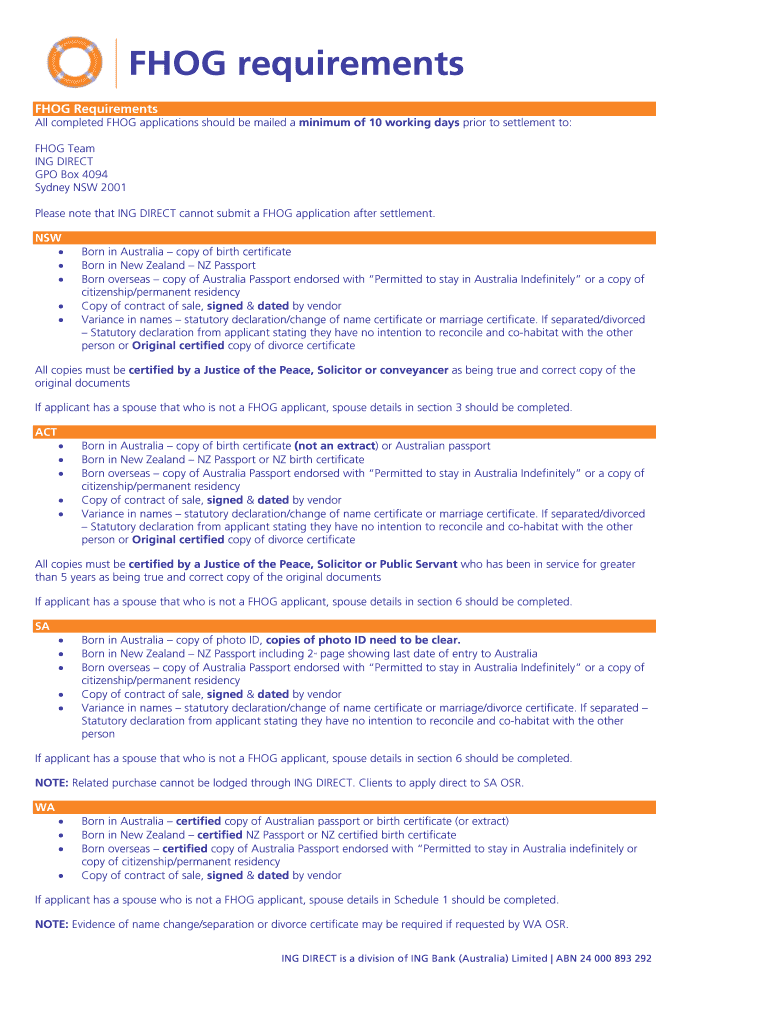

This document outlines the requirements for submitting applications for the First Home Owner Grant (FHOG) across various states and territories in Australia, detailing the necessary documentation

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign fhog requirements

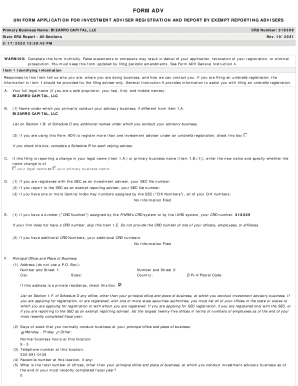

Edit your fhog requirements form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fhog requirements form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing fhog requirements online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit fhog requirements. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Dealing with documents is always simple with pdfFiller.

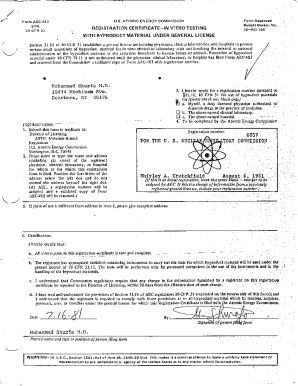

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out fhog requirements

How to fill out FHOG requirements

01

Check your eligibility for the First Home Owner Grant (FHOG) based on your location.

02

Gather necessary documents, including proof of identity, proof of income, and details of the property.

03

Complete the FHOG application form provided by the relevant state or territory authority.

04

Submit the completed application form along with the required documentation.

05

Ensure that your application is submitted within the specified timeframe allowed for the FHOG.

Who needs FHOG requirements?

01

First-time home buyers looking to purchase or build a new home.

02

Individuals meeting specific criteria set by their state or territory government.

03

Home buyers seeking financial assistance to help with the cost of purchasing their first home.

Fill

form

: Try Risk Free

People Also Ask about

How much deposit for first home buyer vic?

The First Home Guarantee is part of the Home Guarantee Scheme, an Australian Government initiative that helps home buyers to buy a home sooner. The First Home Guarantee supports home buyers who have saved a minimum deposit of 5% of the Property Value, and meet other eligibility criteria, to buy a home.

How much is the first home buyers grant wa?

The first home owner grant (FHOG) is a one-off payment to encourage and assist first home buyers to buy or build a new residential property for use as their principal place of residence. The grant is $10,000 or the consideration paid to buy or build the house if less than that amount.

What documents are required for first home buyers grant in Victoria?

Step 1: Gather Required Documentation Citizenship or Residency Proof: If you are a permanent resident, provide your residency documentation. Contract of Sale: A copy for new homes. Building Contract: For those constructing a new home. Proof of Settlement or Completion: Settlement statement or certificate of occupancy.

What is the $30 000 first home buyers grant in Queensland?

The first home owner grant helps eligible first time, new home buyers get into the property market. Depending on your circumstances, you may qualify for a grant of $15,000 or $30,000 to put towards the cost of buying or building a new home in Queensland. After 30 June 2026, the grant amount will revert to $15,000.

How much is the first home buyer grant in VIC?

The First Home Owner Grant is a $10,000 payment to help eligible first home buyers buy or build a new home in Victoria. Your first new home can be any type of residential property: a house, townhouse, apartment or unit.

What is the 15000 dollar first time home buyer grant?

Financial Assistance: Income-eligible first-time homebuyers can benefit from a $15,000 grant, specifically designated for down payment or closing cost assistance. This substantial amount significantly reduces the out-of-pocket expenses that often come with buying a home.

What are the conditions for the first home owner grant in Victoria?

First Home Owner Grant Your new home must be valued at $750,000 or less and be a new home. The property must not have been previously sold as a place of residence, occupied as a home, leased out or used for short-term accommodation, such as Airbnb.

Who is eligible for the QLD grant?

You must be building or buying a new home. The value of the home is under $750,000 (including contract variations). You must move into the new home as your principal place of residence within 1 year and live there continuously for 6 months.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is FHOG requirements?

FHOG requirements refer to the criteria and guidelines established for applicants seeking the First Home Owner Grant (FHOG), which is a government initiative to assist first-time home buyers.

Who is required to file FHOG requirements?

Individuals who are first-time home buyers and wish to claim the First Home Owner Grant are required to file FHOG requirements.

How to fill out FHOG requirements?

To fill out FHOG requirements, applicants must complete a designated application form, provide necessary identification, and submit relevant documentation related to their property purchase.

What is the purpose of FHOG requirements?

The purpose of FHOG requirements is to ensure that applicants meet specific eligibility criteria for financial assistance when purchasing their first home.

What information must be reported on FHOG requirements?

Information that must be reported on FHOG requirements includes personal details of the applicant, property details, purchase price, and any prior ownership history.

Fill out your fhog requirements online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fhog Requirements is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.