Get the free GOVERNMENT SAVINGS BONDS ACT - rgd legalaffairs gov

Show details

An Act to authorise the Issue of Savings Bonds and to declare the terms and conditions applicable thereto and to provide for the rights and securities of the holders thereof.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign government savings bonds act

Edit your government savings bonds act form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your government savings bonds act form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing government savings bonds act online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit government savings bonds act. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

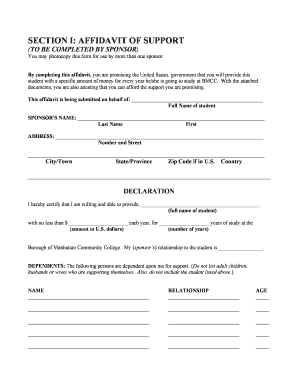

How to fill out government savings bonds act

How to fill out GOVERNMENT SAVINGS BONDS ACT

01

Obtain a copy of the GOVERNMENT SAVINGS BONDS ACT.

02

Read the document carefully to understand its requirements.

03

Gather any necessary personal and financial information.

04

Fill in the required fields accurately, following the instructions provided.

05

Review the completed form for any errors or omissions.

06

Submit the form to the appropriate government agency as directed.

Who needs GOVERNMENT SAVINGS BONDS ACT?

01

Individuals looking to invest in government-backed savings options.

02

Residents seeking a safe and low-risk investment for their savings.

03

Parents or guardians saving for their child's education or future expenses.

04

Retirees looking for stable income through government bonds.

Fill

form

: Try Risk Free

People Also Ask about

How much is a 30 year old $100 savings bond worth?

How much is my savings bond worth after 30 years? DenominationIssue dateValue $100 October 1994 $164.12 $1,000 October 1994 $1,641.20 $10,000 October 1994 $16,412.00 Nov 21, 2024

How long does it take for a $100 savings bond to mature?

At other times, sales of savings bonds have increased or decreased in tandem with changes in interest rates or inflation. Savings bonds earn interest until they reach "maturity," which is generally 20-30 years, depending on the type purchased.

How long does it take for a $10,000 savings bond to mature?

Two types of savings bonds are available to purchase in the U.S. Series EE bonds are guaranteed to reach their face value after 20 years. Series I bonds don't come with guarantees and mature after 30 years. Both bonds can also be cashed out at a cost after one year or penalty-free after five years.

How much is a $100 bond from 2004 worth today?

For example, a $100 EE bond from July 2004 would now redeem for $73.08 but will get you $100 in one year, so holding it one more year gets you the equivalent to a 37% interest rate for that period.

Why is my $100 savings bond only worth $50?

There are two primary reasons a bond might be worth less than its listed face value. A savings bond, for example, is sold at a discount to its face value and steadily appreciates in price as the bond approaches its maturity date. Upon maturity, the bond is redeemed for the full face value.

Can you cash in a savings bond after 30 years?

They're available to be cashed in after a single year, though there's a penalty for cashing them in within the first five years. Otherwise, you can keep savings bonds until they fully mature, which is generally 30 years. These days, you can only purchase electronic bonds, but you can still cash in paper bonds.

How do government savings bonds work?

Savings bonds are an easy way for individuals to loan money directly to the government and receive a return on their investment. Bonds are sold at less than face value, for example, a $50 Series EE bond may cost $25. Bonds accrue interest, and your gains are compounded, meaning that interest is earned on interest.

What happens to savings bonds that are never cashed?

For those fully matured bonds remaining unredeemed, there is no active program by the Bureau to locate the bondholders and pay them the proceeds to which they are entitled. Traditionally, it has been up to the registered owner to remember to redeem the matured bond decades after the initial purchase.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is GOVERNMENT SAVINGS BONDS ACT?

The Government Savings Bonds Act is legislation that governs the issuance and management of savings bonds offered to the public by the government as a means of raising funds.

Who is required to file GOVERNMENT SAVINGS BONDS ACT?

Individuals and entities who purchase government savings bonds are typically required to file any relevant documentation associated with these bonds as stipulated by the regulations of the government.

How to fill out GOVERNMENT SAVINGS BONDS ACT?

To fill out the Government Savings Bonds Act paperwork, individuals should provide their identification information, specify the amount and type of bonds being acquired, and complete any additional required disclosures as per the act's instructions.

What is the purpose of GOVERNMENT SAVINGS BONDS ACT?

The purpose of the Government Savings Bonds Act is to facilitate public investment in government savings bonds, promote savings among the public, and provide a stable source of funding for government projects.

What information must be reported on GOVERNMENT SAVINGS BONDS ACT?

Information required typically includes the bondholder's identification, the serial numbers of the bonds, purchase details, and any interest or redemption information associated with the bonds.

Fill out your government savings bonds act online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Government Savings Bonds Act is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.