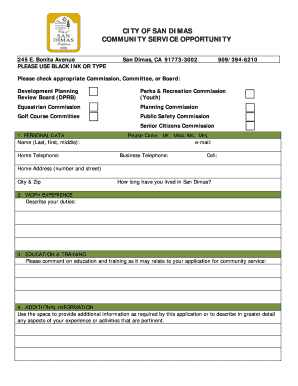

Get the free Credit/Debit Card 3rd Party Vendor Processor Application - busfin uga

Show details

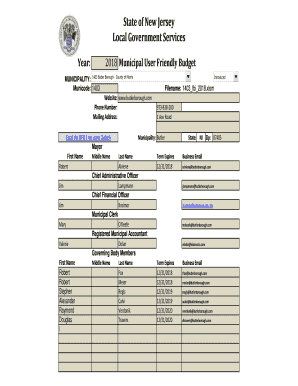

This document is an application form for vendors seeking to process credit/debit card transactions through a university bursar's office. It collects vendor information, departmental approvals, and

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign creditdebit card 3rd party

Edit your creditdebit card 3rd party form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your creditdebit card 3rd party form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing creditdebit card 3rd party online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit creditdebit card 3rd party. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out creditdebit card 3rd party

How to fill out Credit/Debit Card 3rd Party Vendor Processor Application

01

Gather necessary documents, including your business license and tax ID.

02

Visit the website of the payment processor offering the application.

03

Locate the application section and select the 3rd Party Vendor Processor Application.

04

Fill out the application form with your business details, including name, address, and contact information.

05

Provide information about your business activity and the types of payments you will process.

06

Enter your bank account details for payment settlement.

07

Disclose any required compliance information, such as PCI DSS compliance.

08

Review your application for accuracy and completeness.

09

Submit the application online or send it to the processor as directed.

10

Await confirmation or further instructions from the payment processor.

Who needs Credit/Debit Card 3rd Party Vendor Processor Application?

01

Businesses that want to accept credit and debit card payments through a third-party vendor.

02

E-commerce platforms that need a reliable payment processing solution.

03

Retailers who require a payment processor for in-store transactions.

04

Startups looking to establish merchant accounts to facilitate transactions.

05

Companies seeking to integrate payment processing capabilities into their service offerings.

Fill

form

: Try Risk Free

People Also Ask about

Can I become a credit card processor?

In order to build a credit card processing business, you need to be certified and licensed by major payment processors like Visa and Mastercard. In addition, you need to obtain Payment Card Industry Data Security Standard (PCI DSS) certification.

What is a third party credit card processor?

Third-party payment processors (sometimes referred to as payment aggregators or credit card processing companies) are entities that allow merchants to accept credit card payments, online payments, and any other cashless payment method without the need to set up their own merchant accounts.

Is PayPal a third party processor?

PayPal is a common third-party payment processor for both online and in-person payments.

How does a third party payment processor work?

A third-party payment processor is a service that allows businesses to accept online payments. These payment processors facilitate transactions between the customer and the business by transferring funds from the customer's bank or credit account to the business's bank account.

What is an example of a third party processor?

Third-party payment processor examples include companies like PayPal, Stripe, Square, and GoCardless. Without this mediator, your business would be required to set up its ownmerchant account for processing payments and handle the logistics that go with it.

What is a debit card third party account?

Third party merchant accounts are defined as companies that accept and receive credit and debit card payments on behalf of your business. An example of a third party merchant account is PayPal.

What is online payment process using third party processors?

A third-party payment processor helps your business accept online payments without opening a dedicated merchant account. It acts as the link between your checkout, your customer's bank, and your own. The processor handles the payment in real time, so funds move from the customer to your business quickly and securely.

What does "third party processor required" mean?

To recap, third-party processors allow merchants to accept payments without the need for a dedicated merchant account. This offers an easy setup and low barrier to entry but can come with higher transaction fees and less overall control of funds.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

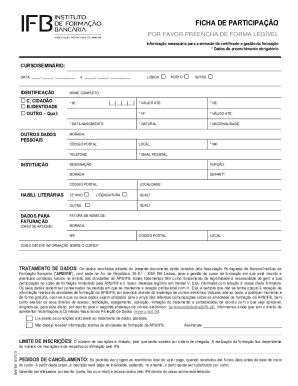

What is Credit/Debit Card 3rd Party Vendor Processor Application?

The Credit/Debit Card 3rd Party Vendor Processor Application is a form or request submitted by businesses that engage third-party vendors to process credit and debit card transactions. It typically requires disclosure of the vendor's details, compliance measures, and operational standards to ensure the secure handling of cardholder information.

Who is required to file Credit/Debit Card 3rd Party Vendor Processor Application?

Businesses that utilize third-party vendors for processing credit and debit card transactions are required to file the Credit/Debit Card 3rd Party Vendor Processor Application. This includes merchants, service providers, and any entities that handle payment processing services through third parties.

How to fill out Credit/Debit Card 3rd Party Vendor Processor Application?

To fill out the Credit/Debit Card 3rd Party Vendor Processor Application, businesses should provide accurate information about themselves and their third-party vendors. The application typically requires basic business details, vendor information, risk management practices, security protocols, and compliance with payment processing standards.

What is the purpose of Credit/Debit Card 3rd Party Vendor Processor Application?

The purpose of the Credit/Debit Card 3rd Party Vendor Processor Application is to ensure that businesses using third-party payment processors are compliant with financial regulations, maintain security standards, and protect cardholder data. It serves as a means of oversight and risk assessment for payment processing activities.

What information must be reported on Credit/Debit Card 3rd Party Vendor Processor Application?

The Credit/Debit Card 3rd Party Vendor Processor Application must report information including the business's name and address, details about the third-party vendor, the nature of the services provided, compliance certifications, risk management practices, and details about how cardholder data will be handled and secured.

Fill out your creditdebit card 3rd party online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Creditdebit Card 3rd Party is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.