Get the free Accounts Payable - busfin uga

Show details

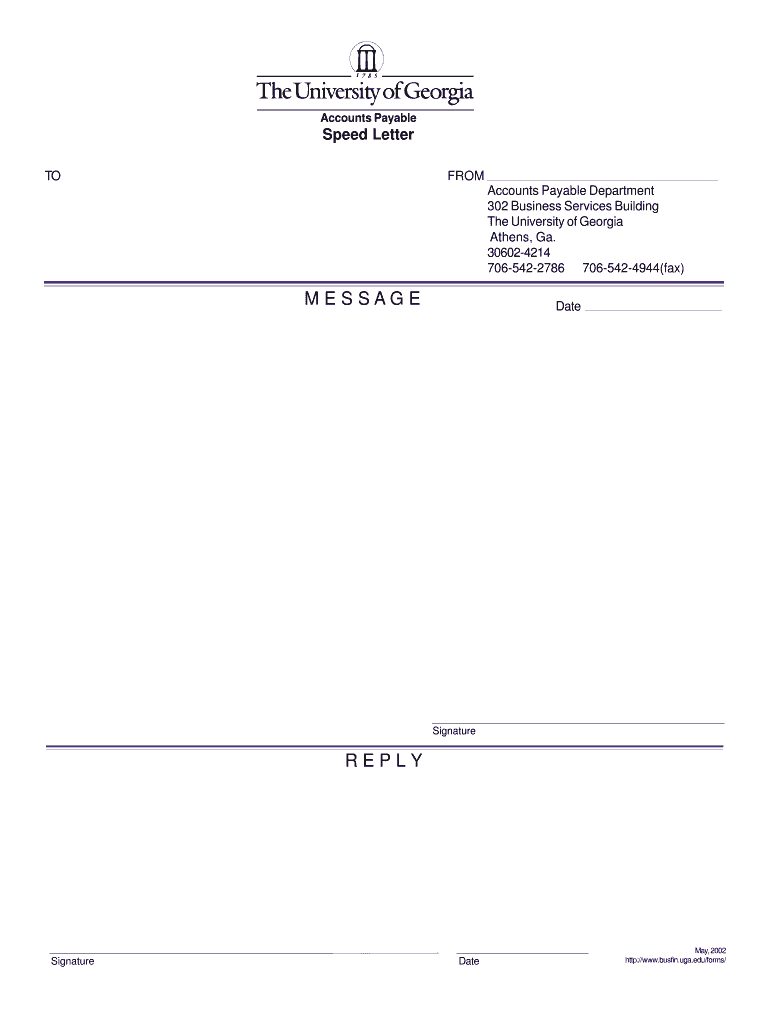

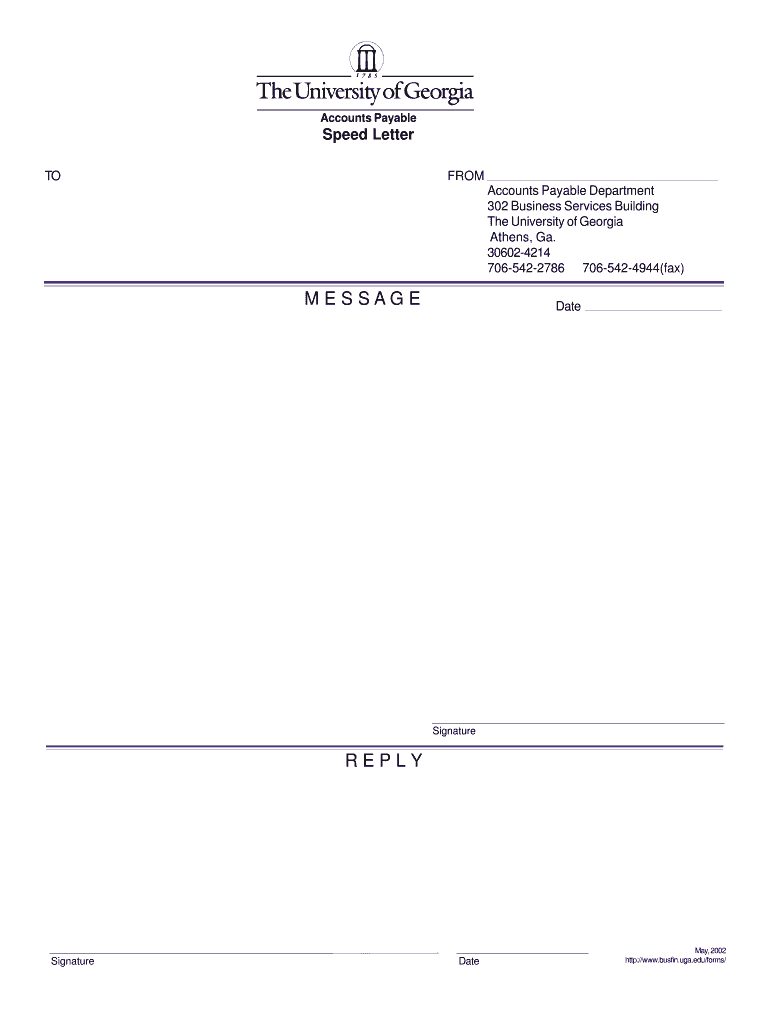

A communication template for the Accounts Payable Department at the University of Georgia, used for sending messages.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign accounts payable - busfin

Edit your accounts payable - busfin form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your accounts payable - busfin form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit accounts payable - busfin online

To use the services of a skilled PDF editor, follow these steps:

1

Check your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit accounts payable - busfin. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out accounts payable - busfin

How to fill out Accounts Payable

01

Gather all invoices and bills from suppliers.

02

Verify the accuracy of each invoice against purchase orders and delivery receipts.

03

Enter invoice details into the Accounts Payable system or spreadsheet, including amounts, due dates, and vendor information.

04

Assign appropriate general ledger accounts for each expense category.

05

Schedule payments based on due dates to avoid late fees.

06

Approve invoices according to company policy, ensuring proper authorization.

07

Process payments via check, electronic transfer, or other methods as specified by the vendor.

08

Record payments in the Accounts Payable system to update balances.

09

Reconcile Accounts Payable regularly to ensure accuracy of records.

Who needs Accounts Payable?

01

Businesses and organizations that purchase goods or services on credit.

02

Accounting departments responsible for managing cash flow and financial obligations.

03

Finance teams that need to maintain accurate financial reporting and budgeting.

04

Suppliers and vendors who require timely payments for goods and services rendered.

Fill

form

: Try Risk Free

People Also Ask about

What is accounts payable in simple words?

Accounts payable (AP) is an accounting term used to describe the money owed to vendors or suppliers for goods or services purchased on credit.

What is the best description of accounts payable?

Accounts payable is a company's obligation to pay for goods and services received on credit, typically within 30 to 90 days.

What is an example of account payables?

Some examples of payables include supplier invoices, legal fees, contractor payments, and so on. Additionally, it will also record purchases from a vendor on credit, a subscription, or an instalment payment (that is due after goods or services have been received).

What is accounts payable for dummies?

Accounts payable (AP) are the debts owed to vendors and suppliers (recorded on a company's balance sheet) to which the company has received goods or services purchased on credit, but hasn't paid the supplier. Your company's accounts payable balance is the sum of all outstanding amounts not yet paid to vendors.

Can you explain what accounts payable is in your own words?

Accounts payable (AP) is an accounting term used to describe the money owed to vendors or suppliers for goods or services purchased on credit.

What best describes accounts payable?

The term accounts payable (AP) describes both a business account and a department that handles invoices. It's a form of accrual accounting that represents a specific account in the general ledger.

How to explain accounts payable in an interview?

What is meant by accounts payable? Answer: For these accounts payable interview questions you could answer that the accounts payable means the amount that should be paid as a liability. It is paid to the vendors for goods and services that were purchased in the past on credit.

What is the job description of accounts payable?

An Accounts Payable officer (AP officer) is responsible for several duties and tasks, such as: Processing of payments and financial transactions to suppliers and obtaining goods and services from suppliers promptly. Liaising with finance officers and suppliers concerning stock management, financial records and accounts.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Accounts Payable?

Accounts Payable is a financial entry that represents an entity's obligation to pay off a short-term debt to its creditors. It is a liability on the balance sheet.

Who is required to file Accounts Payable?

Most businesses and organizations that purchase goods or services on credit are required to maintain and file Accounts Payable as part of their accounting practices.

How to fill out Accounts Payable?

To fill out Accounts Payable, gather all invoices and bills, record the amounts owed, input the supplier details, the due dates, and any payment terms, and ensure to categorize expenses appropriately.

What is the purpose of Accounts Payable?

The purpose of Accounts Payable is to manage a company's short-term liquidity, ensure timely payment to suppliers, track outstanding debts, and maintain good supplier relationships.

What information must be reported on Accounts Payable?

Accounts Payable must report details such as the amount owed, vendor information, invoice numbers, payment due dates, and the terms of the payment agreement.

Fill out your accounts payable - busfin online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Accounts Payable - Busfin is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.