Get the free Form 5.2 - legislation act gov

Show details

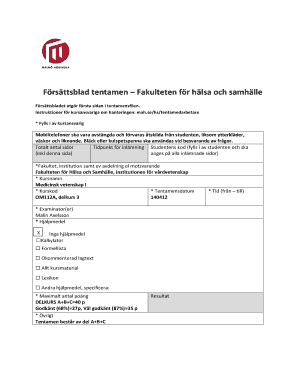

This document serves as an application to the Supreme Court for leave to appeal an order from a lower court, detailing the necessary steps and requirements for both applicant and respondent.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form 52 - legislation

Edit your form 52 - legislation form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 52 - legislation form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form 52 - legislation online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit form 52 - legislation. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form 52 - legislation

How to fill out Form 5.2

01

Obtain Form 5.2 from the official website or authorized source.

02

Read the instructions thoroughly before beginning to fill out the form.

03

Enter your personal information in the designated sections, including name, address, and contact details.

04

Provide relevant identification information as required, such as social security number or tax ID.

05

Fill out the specific details related to the purpose of Form 5.2, ensuring accuracy and completeness.

06

Review the completed form for any errors or missing information.

07

Sign and date the form where indicated.

08

Submit the form according to the provided guidelines, either electronically or by mail.

Who needs Form 5.2?

01

Individuals or entities that are required to report specific information as mandated by regulatory authorities.

02

Organizations that need to comply with legal requirements for documentation.

03

Anyone seeking to apply for permits, licenses, or benefits that necessitate the use of Form 5.2.

Fill

form

: Try Risk Free

People Also Ask about

Can I withdraw all my money from a LIF?

As of January 1, 2025, LIF can no longer be transferred to an RRSP or RRIF. Please note that from the age of 55: You are no longer subject to a maximum withdrawal, allowing you to withdraw any amount you want. You can now request payment of all or part of the balance of your LIF in one or more installments.

Can you unlock a LIF account?

Sometimes the money in a LIRA, LIF is considered too small to provide long-term income. This small amount may be unlocked if you meet the threshold that is based on your age and the Year's Maximum Pensionable Earnings (YMPE). The YMPE is set each year by the Government of Canada.

Can you unlock 50% of Ontario LiF?

A one-time unlocking of the fund up to 50% is permitted within 60 days after receiving funds in a new LIF. If the annuitant is facing financial hardship, which is defined in the governing legislation, up to 50% of YMPE can be withdrawn at any age, once per year.

Can I unlock 50% of my LIRA in Ontario?

Age 55 and over - One-time 50% unlocking: they may transfer 50% of the funds in their RLIF into an RRSP or an RRIF. Cash can then be withdrawn, from either of these vehicles, subject to any applicable income tax rules. The funds cannot be taken directly in cash from an RLIF.

What are the new Lif rules in Ontario?

An owner of an Ontario New LIF cannot combine the money in it with another LIF or locked-in account governed by the pension laws of another jurisdiction. A certain amount must be paid out of a New LIF as income to the owner each fiscal year, except in the initial year of the New LIF.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Form 5.2?

Form 5.2 is a specific form used for reporting certain financial or operational information as required by regulatory authorities or organizations.

Who is required to file Form 5.2?

Entities or individuals that meet the required criteria set by the regulatory authority, such as businesses in specific industries or those that exceed certain thresholds, are required to file Form 5.2.

How to fill out Form 5.2?

To fill out Form 5.2, follow the instructions provided on the form, ensuring to provide accurate and complete information in the required fields, and submit it by the specified deadline.

What is the purpose of Form 5.2?

The purpose of Form 5.2 is to collect essential data for monitoring compliance, assessing financial health, or evaluating operational performance within a specific sector.

What information must be reported on Form 5.2?

Form 5.2 typically requires information such as financial statements, operational metrics, regulatory compliance data, and other specific details relevant to the purpose of the form.

Fill out your form 52 - legislation online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 52 - Legislation is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.