Get the free TRANSFER OF MORTGAGE - legislation act gov

Show details

This form is to be used for lodging a transfer of mortgage under the Land Titles Act 1925. It includes important instructions for completion, contact information, and privacy details regarding the

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign transfer of mortgage

Edit your transfer of mortgage form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your transfer of mortgage form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing transfer of mortgage online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit transfer of mortgage. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

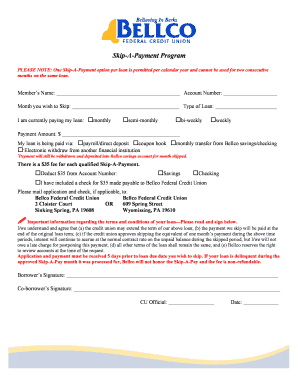

How to fill out transfer of mortgage

How to fill out TRANSFER OF MORTGAGE

01

Obtain the 'Transfer of Mortgage' form from your lender or a legal resource.

02

Fill out the borrower's information, including full name, address, and contact details.

03

Provide the original mortgage loan number and property details.

04

Specify the new mortgage lender's information if applicable.

05

Sign the form as the borrower, and ensure any joint borrowers also sign.

06

Have the form notarized if required by your lender or state law.

07

Submit the completed form to your lender or the appropriate financial institution.

Who needs TRANSFER OF MORTGAGE?

01

Homeowners looking to transfer their mortgage to another lender.

02

Individuals who are refinancing their mortgage to get better terms.

03

Property buyers assuming the existing mortgage of the seller.

04

Trustees or executors managing a deceased estate that includes a mortgage.

Fill

form

: Try Risk Free

People Also Ask about

What does it mean when your mortgage is transferred?

When a mortgage is transferred, it does not affect the terms of the loan. The main difference the borrower will notice is that their payments are sent to a different address.

What happens when you transfer your mortgage?

Porting is paying off an existing mortgage and taking out a new one with the same terms on a new property. This allows you to keep your current interest rate and related product features. It's important to know that it is not a transfer of the mortgage loan. It's a transfer of the mortgage product or deal.

What is transfer of mortgage?

A transfer of a mortgage is the process of reassigning an existing home loan to another person or entity. The new borrower agrees to make all future payments at the original interest rate. The transfer typically eliminates any legal obligations the original borrower has to the loan.

How does a mortgage transfer work?

The process of transferring a mortgage involves the new owner taking on the loan's original terms, generally without changing the terms or length of the loan. Due-on-sale clauses can be included by lenders to prevent mortgage transfers, requiring full repayment of the loan if a property changes ownership.

What does it mean to transfer your mortgage?

Key takeaways: Mortgage switching is when you transfer your existing mortgage to a new lender. Switching your mortgage lets you change your interest rate, prepayment options and payment frequency. Don't wait until the last minute if you want to switch your mortgage before your mortgage renews.

What happens when you transfer a mortgage?

What does 'porting' a mortgage mean? Many mortgage deals are 'portable'. This means, if you're moving home, you may be able to take your mortgage deal with you to your new property and keep the interest rate.

What does it mean when a mortgage is transferred?

A transfer of a mortgage is the process of reassigning an existing home loan to another person or entity. The new borrower agrees to make all future payments at the original interest rate. The transfer typically eliminates any legal obligations the original borrower has to the loan.

Is it possible to transfer mortgages?

Porting your mortgage means taking your existing mortgage — along with its current rate and terms — from your current home to your new home. You can port your mortgage if you're purchasing a new property at the same time you're selling your existing one.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is TRANSFER OF MORTGAGE?

TRANSFER OF MORTGAGE refers to the process of transferring the rights and obligations of a mortgage from one lender or property owner to another. This is often necessary when the property is sold or refinanced.

Who is required to file TRANSFER OF MORTGAGE?

Typically, the current mortgage holder or the lender is required to file the TRANSFER OF MORTGAGE, especially when it involves a change in ownership or refinancing.

How to fill out TRANSFER OF MORTGAGE?

To fill out a TRANSFER OF MORTGAGE, you need to provide details such as the names of the parties involved, the original mortgage details, the property address, and the effective date of the transfer. It may also require notarization and submission to a relevant authority.

What is the purpose of TRANSFER OF MORTGAGE?

The purpose of TRANSFER OF MORTGAGE is to legally document the change in the mortgage's ownership, ensuring that the new holder has the right to collect payments and enforce the terms of the mortgage.

What information must be reported on TRANSFER OF MORTGAGE?

The TRANSFER OF MORTGAGE must report information including the original borrower's details, the new lender's information, the mortgage amount, the property description, and any pertinent terms of the transfer.

Fill out your transfer of mortgage online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Transfer Of Mortgage is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.