Get the free Employee Information and Payroll Documentation - franklinregional k12 pa

Show details

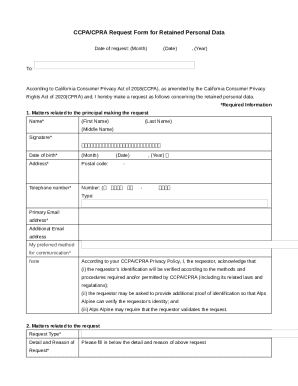

This document contains forms related to employee payroll information, W-4 withholding allowances, direct deposit authorization, residency certification, and information regarding retirement plans.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign employee information and payroll

Edit your employee information and payroll form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your employee information and payroll form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit employee information and payroll online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit employee information and payroll. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out employee information and payroll

How to fill out Employee Information and Payroll Documentation

01

Gather personal details of the employee: full name, social security number, address, and contact information.

02

Fill out the federal tax withholding form (W-4) based on the employee's filing status and exemptions.

03

Provide information about the employee's job position, department, and start date.

04

Complete the payroll information section, including pay rate, hours worked, and payment schedule.

05

Include bank details for direct deposit if applicable.

06

Review the documentation for accuracy and completeness before submission.

Who needs Employee Information and Payroll Documentation?

01

Every new employee must complete the documentation for payroll purposes.

02

Human Resources personnel need the information to maintain accurate employee records.

03

Payroll departments require the documentation to process employee payments.

04

Tax authorities may need the information for reporting and compliance purposes.

Fill

form

: Try Risk Free

People Also Ask about

What information is recorded in a payroll register?

A payroll register is tool that records wage payment information about each employee – gross pay, deductions, tax withholding, net pay and other payroll-related information – for each pay period and pay date.

What is a payroll sheet?

The payroll sheet is a table that contains all the payroll information for employees. The process of creating the payroll sheet includes preparing and disbursing employee salaries on a regular basis.

How to prepare a payroll statement?

We've outlined eight key payroll preparation steps to follow so you can manage your payment systems with confidence. Establish a payroll policy & method. Collect & manage employee data. Calculate taxes & other deductions. Determine gross & net pay. Process & record payments. Prepare & distribute payslips.

Which of the following information is contained in a payroll register?

Payroll registers contain specific data for each employee and pay period: Employee identification: Names and employee ID numbers. Time and attendance data: Regular hours, overtime, and special pay categories.

What columns are included in the payroll register?

A Payroll Register typically includes the columns Name, Regular Earnings, Total Hours Worked, and Deductions.

What is a payroll checklist?

A payroll checklist is a step-by-step guide that outlines all tasks involved in managing payroll, from collecting employee data to processing payments and filing taxes. Its purpose is to create a clear, repeatable process that ensures accuracy, compliance, and efficiency.

What standing data is recorded in a payroll system?

The wages master file contains all the standing data about employees, such as name, address, date of birth, date of starting employment, employee number, rate of pay and tax code. Clock cards are often used to record the hours that employees enter and leave the premises.

How is payroll recorded?

Payroll journal entries are used to record the compensation paid to employees, as well as the associated tax and other withholdings. These entries are then incorporated into an entity's financial statements through the general ledger.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Employee Information and Payroll Documentation?

Employee Information and Payroll Documentation refers to the records and forms that capture essential details about employees, including personal information, employment history, hours worked, wages paid, and tax withholdings.

Who is required to file Employee Information and Payroll Documentation?

Employers and businesses that pay wages to employees are required to file Employee Information and Payroll Documentation to comply with tax regulations and labor laws.

How to fill out Employee Information and Payroll Documentation?

To fill out Employee Information and Payroll Documentation, gather necessary data about the employee such as name, address, Social Security number, positions held, pay rates, and hours worked, and complete the designated forms accurately.

What is the purpose of Employee Information and Payroll Documentation?

The purpose of Employee Information and Payroll Documentation is to ensure compliance with employment laws, facilitate payroll processing, report to tax authorities, and maintain accurate records for both the employer and employee.

What information must be reported on Employee Information and Payroll Documentation?

The information that must be reported includes employee identification details, work hours, wages, tax withholdings, benefits information, and any applicable deductions.

Fill out your employee information and payroll online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Employee Information And Payroll is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.