Get the free form 60 pdf download

Show details

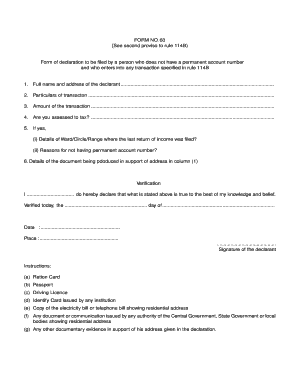

FORM NO. 60 See second proviso to rule 114B Form of declaration to be filed by a person who does not have a permanent account number and who enters into any transaction specified in rule 114B 1. Full name and address of the declarant 2. Particulars of transaction 3 Amount of the transaction 4. Are you assessed to tax Yes /No NO 5. If yes i Details of Ward/ Circle/ Range where the last return of income was filed ii Reasons for not having permanent account number 6. Details of the document...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form 60 pdf download

Edit your form 60 pdf download form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 60 pdf download form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form 60 pdf download online

To use the services of a skilled PDF editor, follow these steps below:

1

Log in to account. Start Free Trial and register a profile if you don't have one yet.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit form 60 pdf download. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form 60 pdf download

How to fill out form 60 pdf:

01

Start by downloading the form 60 pdf from a reliable source, such as the official website of the relevant government agency.

02

Open the downloaded form using a pdf reader software or application.

03

Fill in your personal information, including your full name, date of birth, address, and contact details, in the designated fields.

04

Provide your unique identification details, such as your PAN (Permanent Account Number) or Aadhaar number, if applicable.

05

Indicate your occupation, whether you are employed, self-employed, or unemployed.

06

If you are employed, provide details of your employer, such as their name, address, and contact information.

07

If you are self-employed, mention the nature of your business or profession.

08

Specify your income details, including the sources of income and the estimated amount earned in the financial year.

09

If you have any dependent individuals, indicate their details, such as their relationship to you and their financial dependency.

10

Review the filled-out form for any errors or omissions.

11

Sign the form 60 pdf using your digital or physical signature.

12

Submit the completed form to the appropriate authority as per the instructions provided.

Who needs form 60 pdf:

01

Individuals who do not possess a PAN (Permanent Account Number) and are carrying out specific financial transactions are typically required to fill out form 60 pdf.

02

This form is necessary for individuals who may not be eligible for a PAN but still need to perform transactions that require documenting their financial information.

03

Examples of individuals who may need form 60 pdf include those who wish to open a bank account, conduct high-value transactions, or invest in certain financial instruments, among others.

Fill

form

: Try Risk Free

People Also Ask about

Where can I download Form 60?

You can also download Form 60 from the income tax portal.

What is a Form 60 declaration?

Form 60 is a declaration to be filed by an individual or a person (not being a company or firm) who does not have a permanent account number and who enters into any transaction specified in rule 114B. Hence, any persons who does not have PAN while entering into certain transactions must file Form 60.

What is Form 60 PDF?

Form for declaration to be filed by an individual or a person (not being a company or firm) who does not have a permanent. account number and who enters into any transaction specified in rule 114B. 1 First Name. Middle. Name.

What is form of form 60?

Form 60 is an important document that is submitted when an individual does not have a permanent account number and enters into certain transactions specified in Rule 114B of the Income-tax Rules, 1962.

What is fixed deposit with Form 60?

Form 60 is needed for making a fixed deposit of amount exceeding Rs. 50,000 with any banks. Form 60 is must for depositing in any post office savings bank of amount Rs. 50,000 or more.

How do I fill out a No 60 form?

How to fill Form 60? Full name and address of declarant. Date of birth of the declarant and name of the Father (in case of individual) Full address of the declarant with the mobile number. Details of the transaction including the amount.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find form 60 pdf download?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the form 60 pdf download in seconds. Open it immediately and begin modifying it with powerful editing options.

Can I create an eSignature for the form 60 pdf download in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your form 60 pdf download and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

Can I edit form 60 pdf download on an Android device?

You can edit, sign, and distribute form 60 pdf download on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

What is form 60 pdf?

Form 60 is a declaration form used in India for individuals who do not have a Permanent Account Number (PAN) and wish to conduct high-value financial transactions.

Who is required to file form 60 pdf?

Individuals who do not possess a PAN and want to engage in certain transactions that require PAN are required to file Form 60.

How to fill out form 60 pdf?

To fill out Form 60, individuals must provide necessary details such as their name, address, and details of the transaction, along with a declaration stating that they do not have a PAN.

What is the purpose of form 60 pdf?

The purpose of Form 60 is to help financial institutions comply with legal requirements for identity verification when a PAN is not available.

What information must be reported on form 60 pdf?

Form 60 must report information such as the individual's name, address, date of birth, and details regarding the transaction for which it is being filled.

Fill out your form 60 pdf download online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 60 Pdf Download is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.